Question

Hui is currently considering investing in municipal bonds that earn 4.65 percent interest, or in taxable bonds issued by the Coca-Cola Company that pay

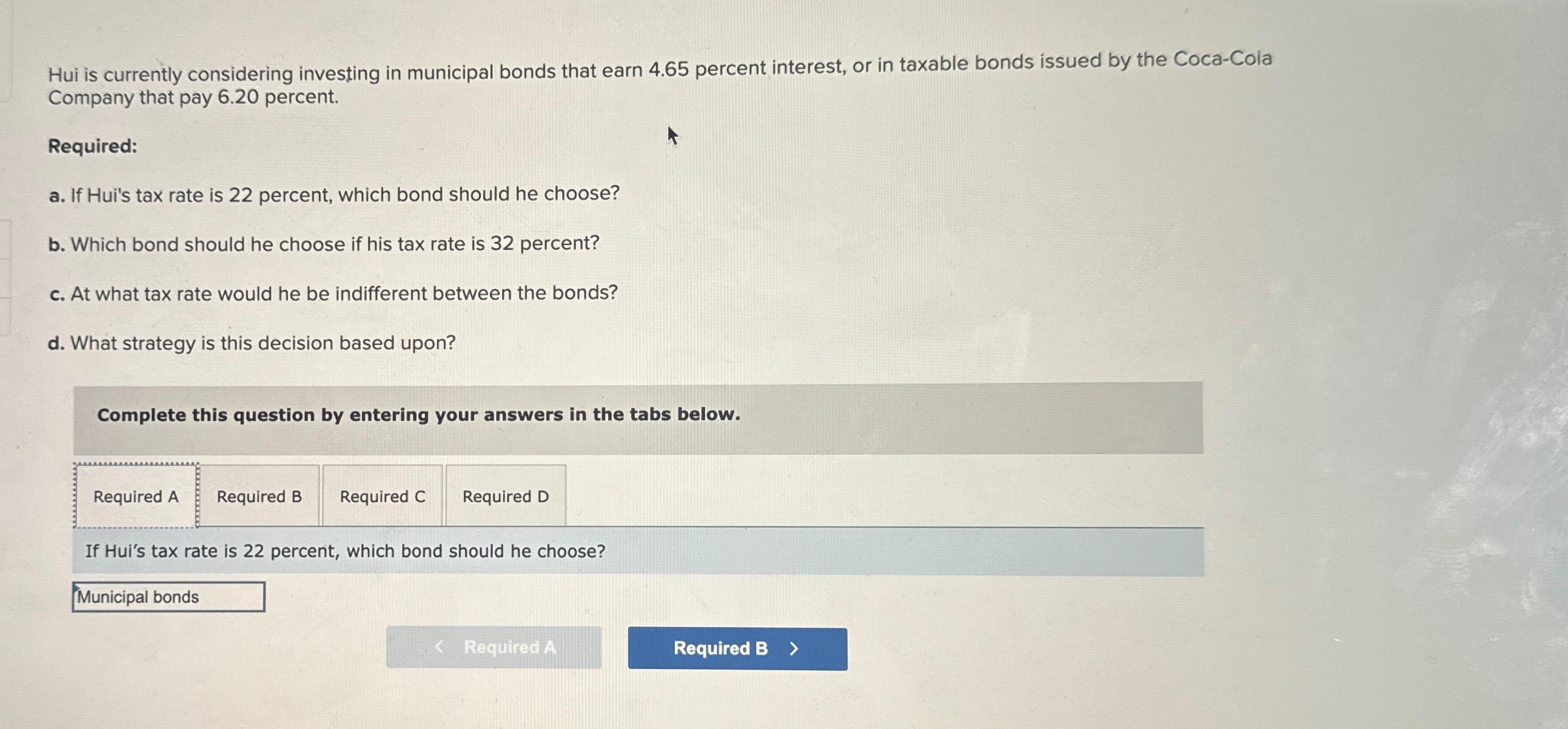

Hui is currently considering investing in municipal bonds that earn 4.65 percent interest, or in taxable bonds issued by the Coca-Cola Company that pay 6.20 percent. Required: a. If Hui's tax rate is 22 percent, which bond should he choose? b. Which bond should he choose if his tax rate is 32 percent? c. At what tax rate would he be indifferent between the bonds? d. What strategy is this decision based upon? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D If Hui's tax rate is 22 percent, which bond should he choose? Municipal bonds < Required A Required B >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Comparing the aftertax yields Municipal bonds 3627 Taxable bonds CocaCola 620 Since the aft...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxation Of Individuals And Business Entities 2015

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

6th Edition

978-1259206955, 1259206955, 77862368, 978-0077862367

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App