Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hui is currently considering investing in municipal bonds that earn 9 . 3 0 ?percent interest, or in taxable bonds issued by the Coca -

Hui is currently considering investing in municipal bonds that earn ?percent interest, or in taxable bonds issued by the CocaCola Company that pay ?percent.

Required:

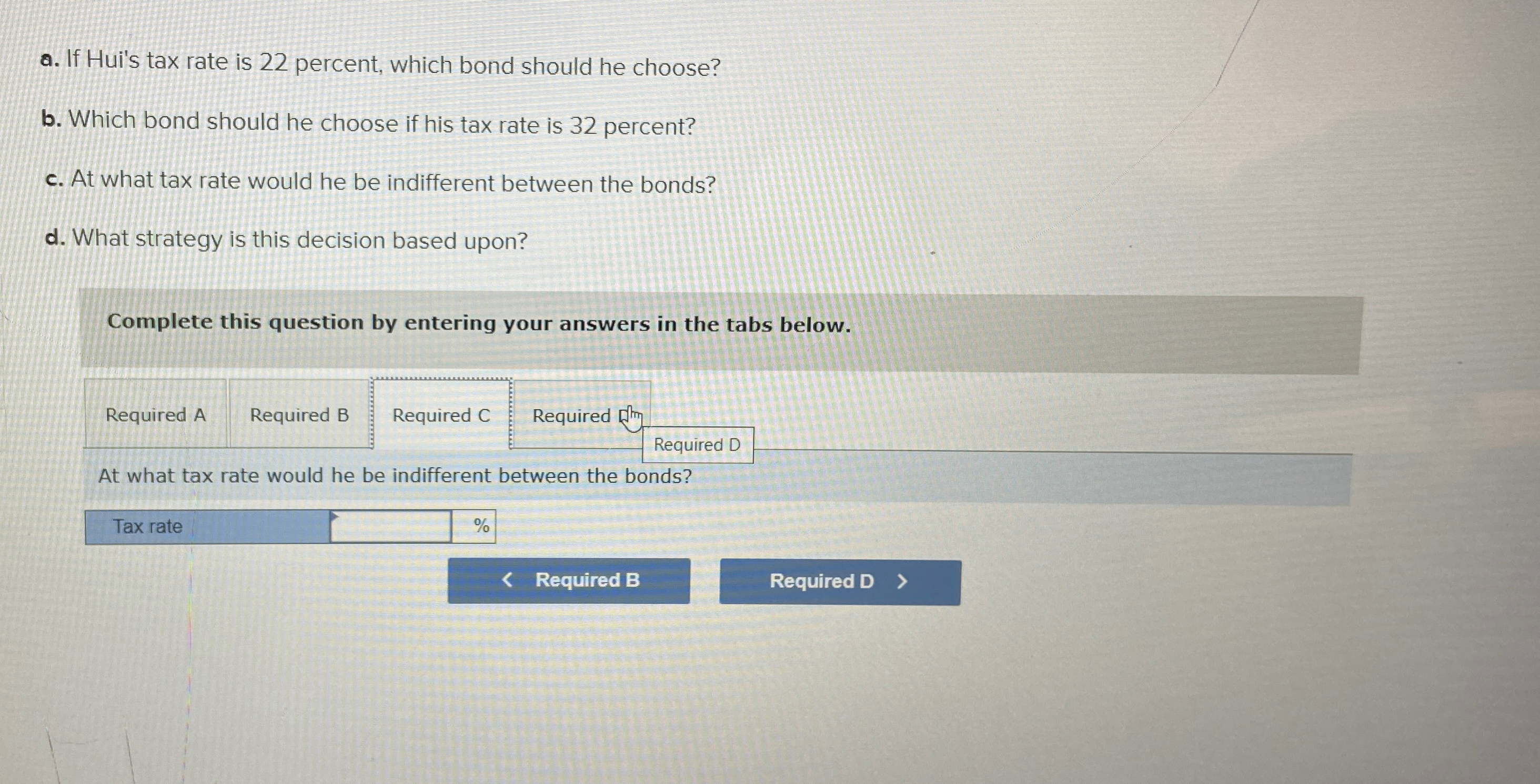

a. If Hui's tax rate is 22 percent, which bond should he choose? b. Which bond should he choose if his tax rate is 32 percent? c. At what tax rate would he be indifferent between the bonds? d. What strategy is this decision based upon? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required Required D At what tax rate would he be indifferent between the bonds? Tax rate % < Required B Required D >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine which bond Hui should choose based on his tax rate we need to compare the aftertax yiel...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dccbd92457_962029.pdf

180 KBs PDF File

663dccbd92457_962029.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started