I am looking for the answers for the red parts . I use the chegg app so I don't know how to request antutor with it . thanks

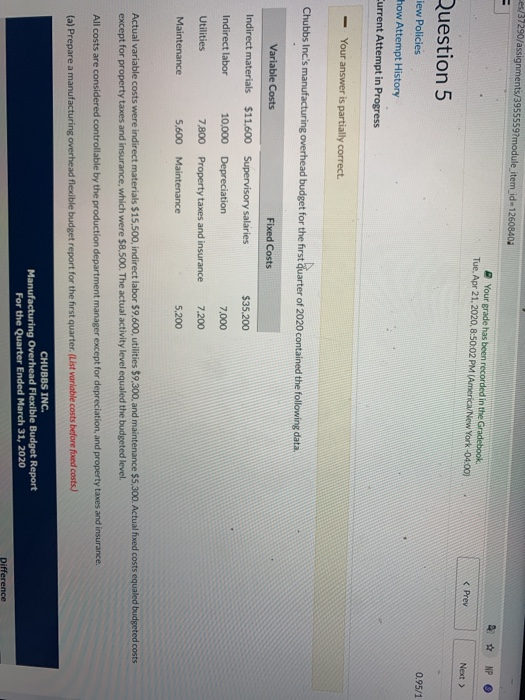

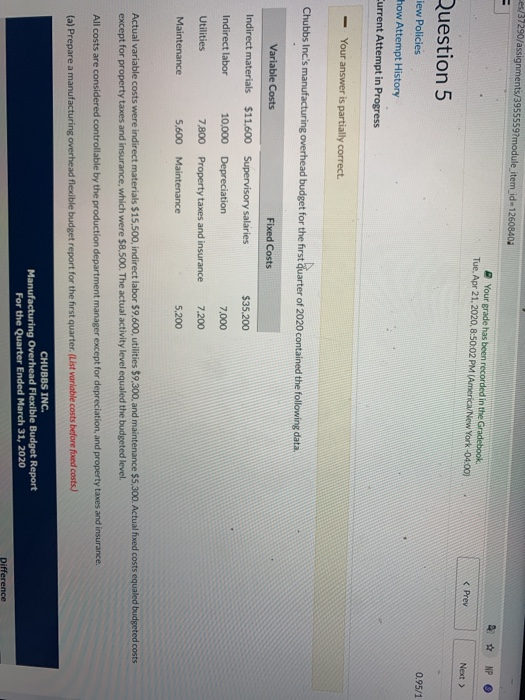

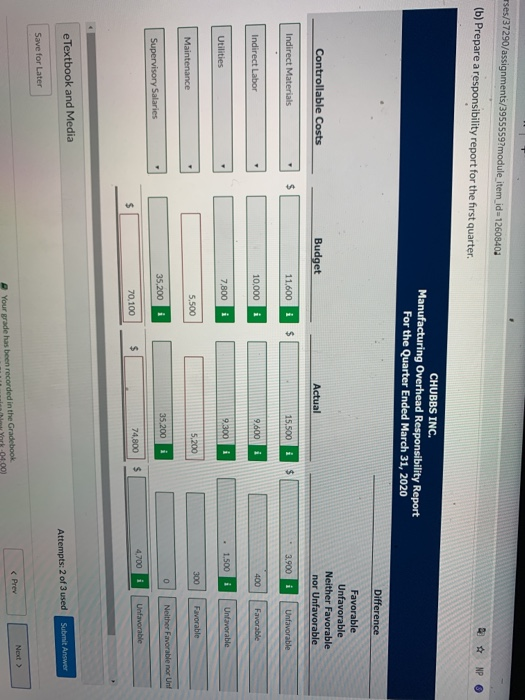

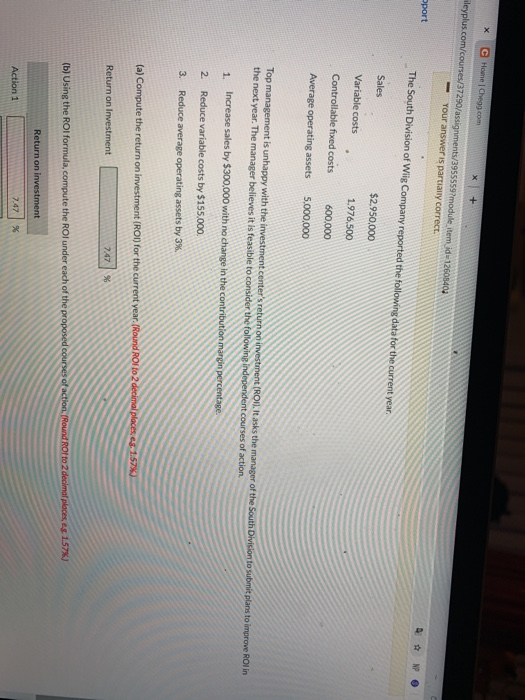

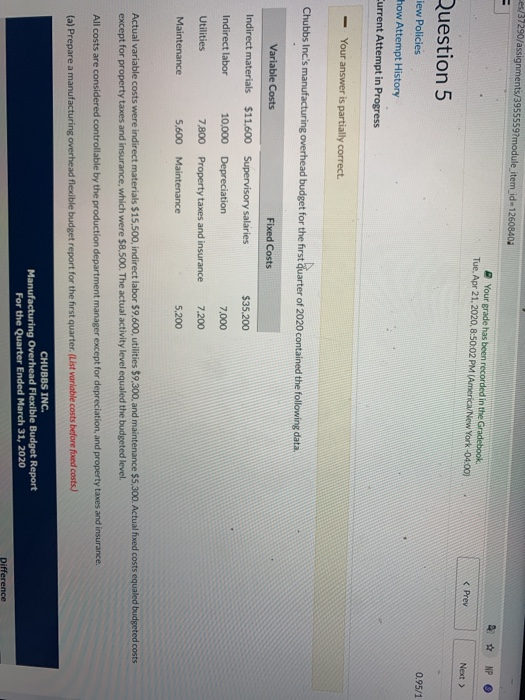

-es/37290/assignments/3955559?module item_id=12608403 4 # NP Your grade has been recorded in the Gradebook Tue Apr 21, 2020,8:50:02 PM (America/New York-04:00) Question 5 iew Policies how Attempt History Current Attempt in Progress 0.95/1 - Your answer is partially correct. Chubbs Inc.'s manufacturing overhead budget for the first quarter of 2020 contained the following data Variable Costs Fixed Costs $11.600 Supervisory salaries Indirect materials Indirect labor $35,200 7,000 10,000 Depreciation Utilities 7,800 5.600 Property taxes and insurance Maintenance 7,200 5,200 Maintenance Actual variable costs were indirect materials $15,500, indirect labor $9,600, utilities $9,300, and maintenance $5,300. Actual fixed costs equaled budgeted costs except for property taxes and insurance, which were $8,500. The actual activity level equaled the budgeted level. All costs are considered controllable by the production department manager except for depreciation, and property taxes and insurance. (a) Prepare a manufacturing overhead flexible budget report for the first quarter. (List variable costs before fixed costs CHUBBS INC. Manufacturing Overhead Flexible Budget Report For the Quarter Ended March 31, 2020 Difference rses/37290/assignments/3955559?module_item_id=12608403 (b) Prepare a responsibility report for the first quarter. 2 NP CHUBBS INC. Manufacturing Overhead Responsibility Report For the Quarter Ended March 31, 2020 Difference Favorable Unfavorable Neither Favorable nor Unfavorable Controllable Costs Budget Actual Indirect Materials 11,600 i $ 15.500 is 3.900 1 otavorare Indirect Labor 10,000 i 9.600 i 400 Favorable Utilities 7,800 i 9.300 i . 1.500 i Unfavorable 5,500 5,200 300 Maintenance Favorable 35,200 35.200 i Neither Favorable nor Unt Supervisory Salaries 4.700 74.800 i 70,100 Unfavorable e Textbook and Media Attempts: 2 of 3 used Submit Answer Save for Later Your grade has been recorded in the Gradebook York-04.001 * C Home Chegg.com leyplus.com/courses/37290/assignments/39555597moduleItem_id 12603404 - your answer is partially correct. port The South Division of Wiig Company reported the following data for the current year Sales $2.950,000 Variable costs Controllable fixed costs 1.976,500 600,000 5,000,000 Average operating assets Top management is unhappy with the investment center's return on investment (ROI. It asks the manager of the South Division to submit plans to improve ROI in the next year. The manager believes it is feasible to consider the following independent courses of action 1. Increase sales by $300,000 with no change in the contribution margin percentage. 2. Reduce variable costs by $155.000 3. Reduce average operating assets by 3% (a) Compute the return on investment (ROI) for the current year. (Round ROI o 2 decimal places 1.57% Return on Investment 7.47 (b) Using the ROI formula, compute the Rol under each of the proposed courses of action (Round Rolto 2 decimal places es. 1572 Return on investment Action 1 7.47