i am lost help pls

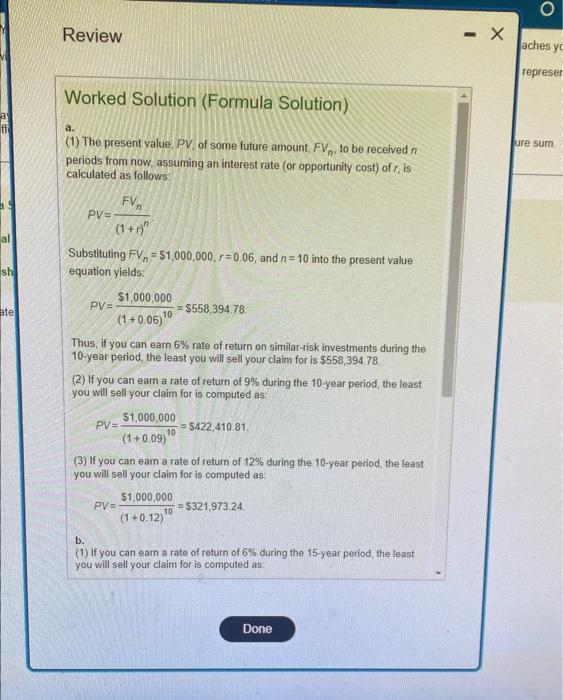

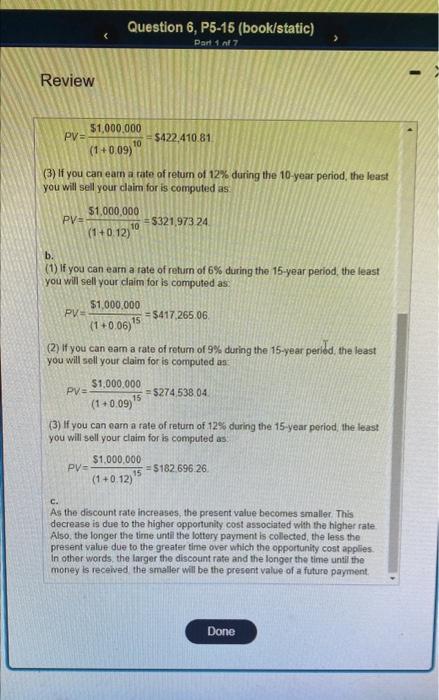

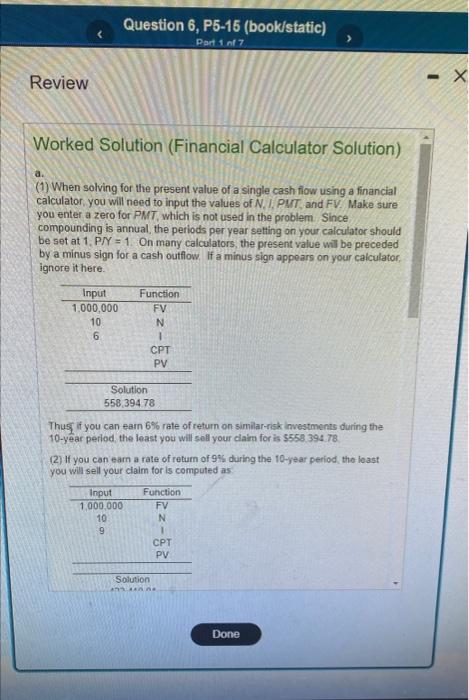

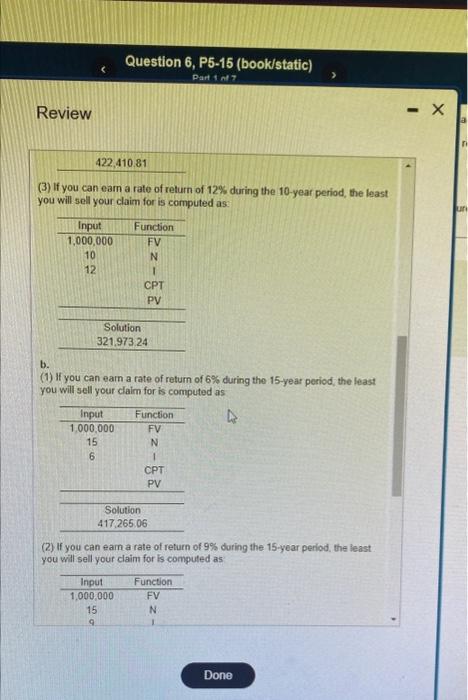

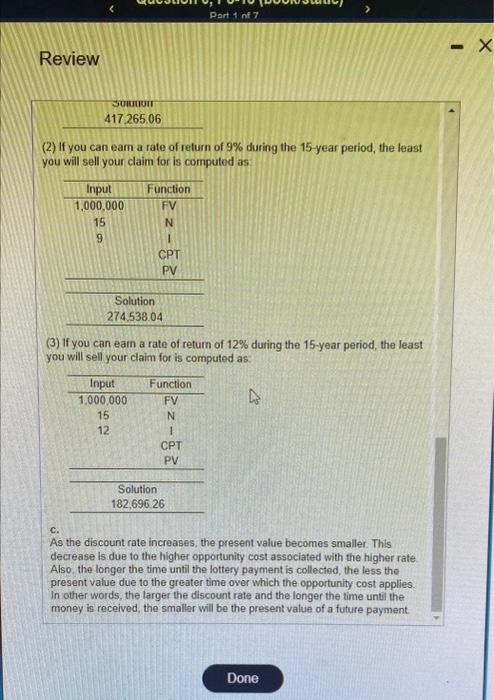

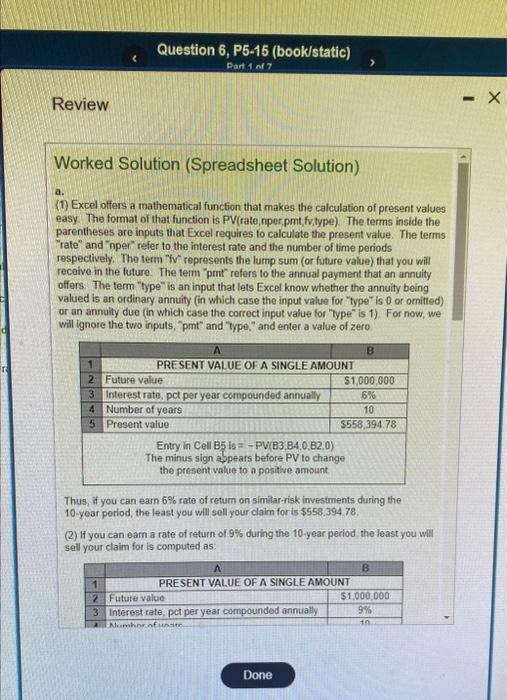

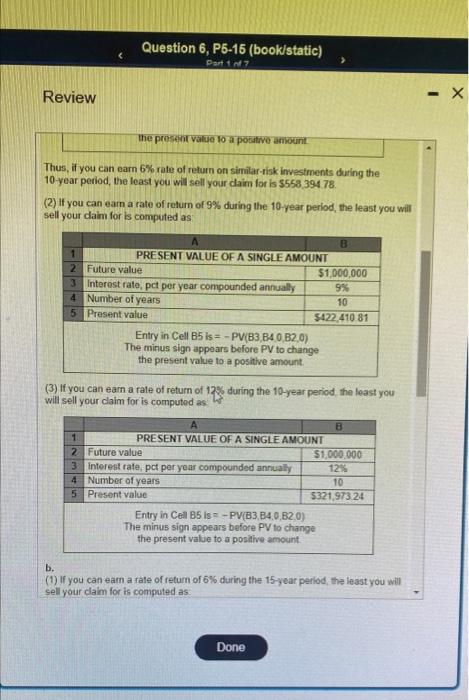

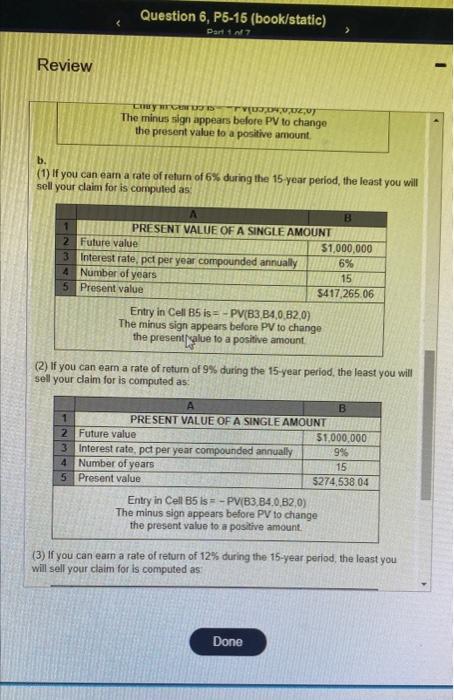

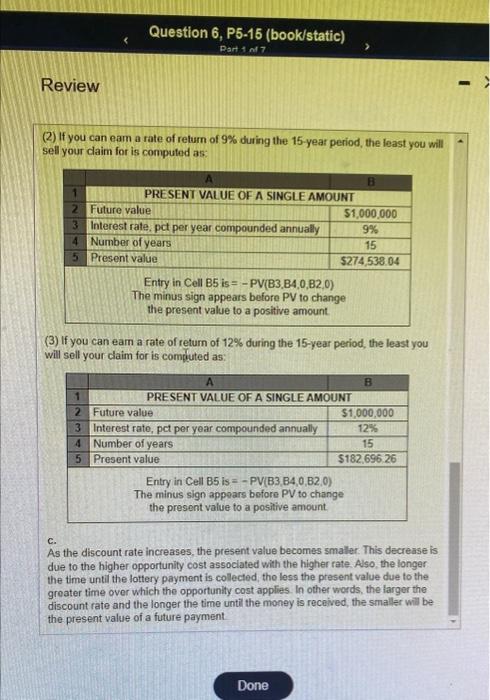

(d) ( (i) 4 a. (1) The present value, PV, of some future amount, FVn, to be received n periods from now, assuming an interest rate (or opportunity cost) of r, is calculated as follows PV=(1+t)nFVn Substituting FVn=$1,000,000,r=0.06, and n=10 into the present value equation yields: PV=(1+0.06)10$1,000,000=$558,394.78. Thus, if you can earn 6% rate of return on similar-risk investments during the 10 -year period, the least you will sell your claim for is $558,394.78. (2) If you can earn a rate of return of 9% during the 10 -year period, the least. you will sell your claim for is computed as: PV=(1+0,09)10$1,000,000=$422,410.81 (3) If you can earn a rate of return of 12% during the 10 -year period, the least you will sell your claim for is computed as: PV=(1+0.12)10$1,000,000=$321,973.24 b. (1) If you can earn a rate of return of 6% during the 15 -year period, the least you will sell your claim for is computed as: PV=(1+0.09)10$1,000.000=$422,410.81 (3) If you can eam a rate of retum of 12% during the 10 -year period, the least you will sell your claim for is computed as. PV=(1+0.12)10$1,000,000=$321,97324 b. (1) If you can earn a fate of rehurn of 6% during the 15 -year period, the least you will sell your claim for is computed as: PV=(1+0.06)15$1.000.000=$417,265.06 (2) If you can eam a rate of retum of 9% during the 15 -year peried, the least you will soll your claim for is computed as: PV=(1+0.09)15$1.000.000=$274.538.04 (3) If you can eam a rate of return of 12% during the 15 -year period, the least you will sell your claim for is computed as: PV=(1+0.12)15$1,000,000=$182.696.26 c. As the discount rate increases, the present value becomes smaller. This decrease is due to the higher opportunily cost associated with the higher rate Also, the longer the time until the lottery payment is collected, the less the present value due to the greater time over which the opportunity cost applies. In other werds, the larger the discount rate and the longer the time until the money is recewed the smaller wili be the present value of a future payment. Worked Solution (Financial Calculator Solution) a. (1) When solving for the present value of a single cash flow using a financial calculator, you will need to input the values of N. I, PIIT. and FV. Make sure you enter a zero for PNT. which is not used in the problem. Since compounding is annual, the periods per year setting on your calculator should be set at 1. PN = 1. On many calculators, the present value will be preceded by a minus sign for a cash outfiow. If a minus sign appoars on your calculator. ignore it here. Thus if you can easn 6% rate of return on similar-risk investments during the 10-year period, the least your will soll your claim for is 5558.394.78 (2) If you can eam a rate of retum of 99 during the 10 -year period, the least you will sell your claim for is computed as: (3) If you can eam a rate of return of 12% during the 10 -year period, the least you will sell your claim for is computed as: b. (1) If you can earn a rate of return of 6% during the 15 -year period, the least you will sell your claim for is computed as (2) If you can earn a rate of return of 9% during the 15 -year period, the least you will sell your claim for is computed as (2) If you can eam a rate of return of 9% during the 15 -year period, the least you will sell your claim for is computed as (3) If you can eam a rate of retum of 12% during the 15 -year period, the least you will sell your claim for is computed as. c. As the discount rate increases, the present value becomes smaller. This decrease is due to the higher opportunity cost associated with the higher rate Also, the longer the time until the lottery payment is collocted, the less the present value due to the greater time over which the opportunity cost applies. In other words, the larger the discount rate and the longer the time until the money is received, the smallor will be the present value of a future payment Worked Solution (Spreadsheet Solution) a. (1) Excel offers a mathematical function that makes the caiculation of present values easy. The format of that function is PV(rate.nper,pmt,fv,type). The terms inside the parentheses are inputs that Excel requires to calculate the present value. The terms "rate" and "nper" refer to the interest rate and the number of time periods respectively. The term "f" represents the lump sum (or future value) that you will recelve in the future. The term pmt refors to the annual payment that an annuity offers. The term "type" is an input that lets Excel know whether the annuity being valued is an ordinary annuity (in which case the input value for "type" is 0 or omitted) or an annulty due (in which case the correct input value for type" is.1). For now, we will ignore the two inputs, "pmt" and "type," and enter a value of zero Thus, if you can earn 6% rate of rcturn on similar-risk investments during the 10-year poriod, the least you will sell your claim for is $558.394.78. (2) If you can earn a rate of return of 9% during the 10 -year period. the least you will sell your claim for is computed as: Thus, if you can earn 6% rate of return on similar-risk investments during the 10 -year period, the least you will sell your daim for is $558,39478. (2) If you can earn a rate of roturn of 9% during the 10 -year period, the least you will sell your daim for is computed as (3) If you can earn a rate of return of 12% during the 10-year period, the least you will sell your claim for is computed as. b. (1) If you can eam a rate of return of 6% during the 15 -year period, the least you will sell your daim for is computed as: Review The minus sign appears before PV to change the present value to a positive arnount. b. (1) If you can earn a rate of return of 6% during the 15 year period, the least you will sell your claim for is cornpuled as (2) If you can eam a rate of return of 9% during the 15-year period, the least you will sell your claim for is computed as. (3) If you can earn a rate of return of 12% during the 15 -year period, the least you will sell your claim for is computed as Review (2) If you can eam a rate of relum of 9% during the 15 -year period, the least you will sell your claim for is computed as. (3) If you can eam a rate of return of 12% during the 15 -year period, the least you will sell your claim for is compluted as: c. As the discount rate increases, the present value becomes smaller. This decrease is due to the higher opportunity cost associated with the higher rate. Also, the longer the time untif the lottery payment is collected, tho less the present value due to the greater time over which the opportunity cost applies. In other words, the larger the discount rate and the longer the time until the money is received, the smaller will be the present value of a future payment