Question: I am stuck trying to solve both questions The current price of a stock is $50.02 and the annual effective risk-free rate is 2.4 percent.

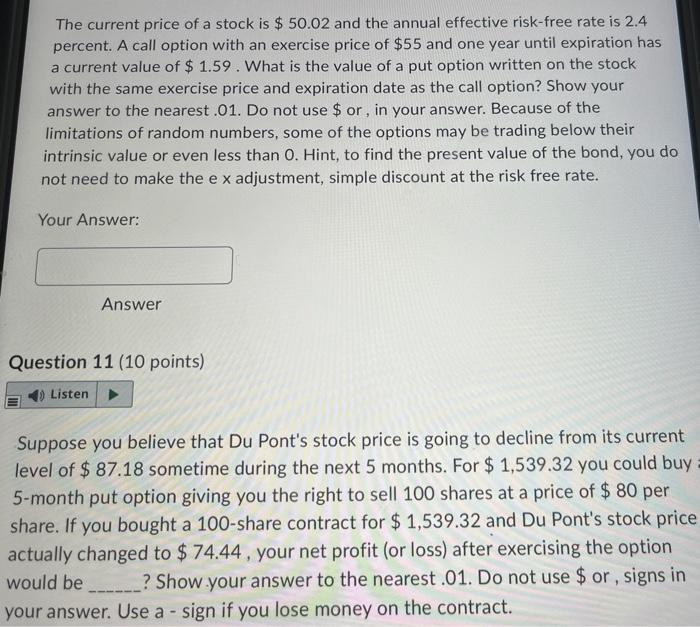

The current price of a stock is $50.02 and the annual effective risk-free rate is 2.4 percent. A call option with an exercise price of $55 and one year until expiration has a current value of $1.59. What is the value of a put option written on the stock with the same exercise price and expiration date as the call option? Show your answer to the nearest .01. Do not use $ or, in your answer. Because of the limitations of random numbers, some of the options may be trading belou intrinsic value or even less than 0 . Hint, to find the present value of the bond, you do not need to make the ex adjustment, simple discount at the risk free rate. Your Answer: Answer Question 11 (10 points) Suppose you believe that Du Pont's stock price is going to decline from its current level of $87.18 sometime during the next 5 months. For $1,539.32 you could buy 5-month put option giving you the right to sell 100 shares at a price of $80 per share. If you bought a 100-share contract for $1,539.32 and Du Pont's stock price actually changed to $74.44, your net profit (or loss) after exercising the option would be _._. Show. your answer to the nearest .01. Do not use $ or, signs in your answer. Use a - sign if you lose money on the contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts