Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I am writing a brief paper analyzing a comapny's DuPont ROE and ROA and just want a second-pair of eyes to see if my analysis

I am writing a brief paper analyzing a comapny's DuPont ROE and ROA and just want a second-pair of eyes to see if my analysis is sound. Below is what I've written:

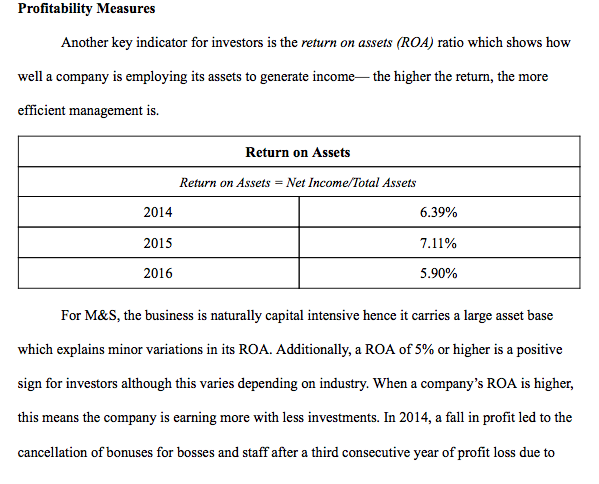

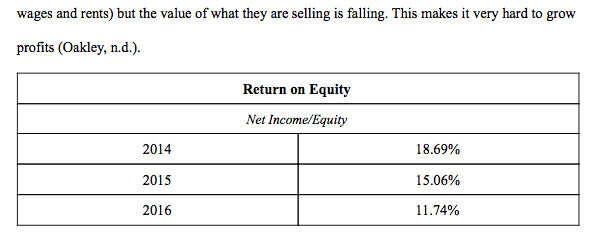

Profitability Measures Another key indicator for investors is the return on assets (ROA) ratio which shows how well a company is employing its assets to generate income-the higher the return, the more efficient management is Return on Assets Return on Assets Net Income/Total Assets 2014 6.39% 2015 7.11% 2016 5.90% For M&S, the business is naturally capital intensive hence it carries a large asset base which explains minor variations in its ROA. Additionally, a ROA of 5% or higher is a positive sign for investors although this varies depending on industry. When a company's ROA is higher, this means the company is earning more with less investments. In 2014, a fall in profit led to the cancellation of bonuses for bosses and staff after a third consecutive year of profit loss due to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started