Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i APPENDIX A American Eagle Outfitters, Inc., 2020 Annual Report Financial information for American Eagle is presented in Appendix A at the end of the

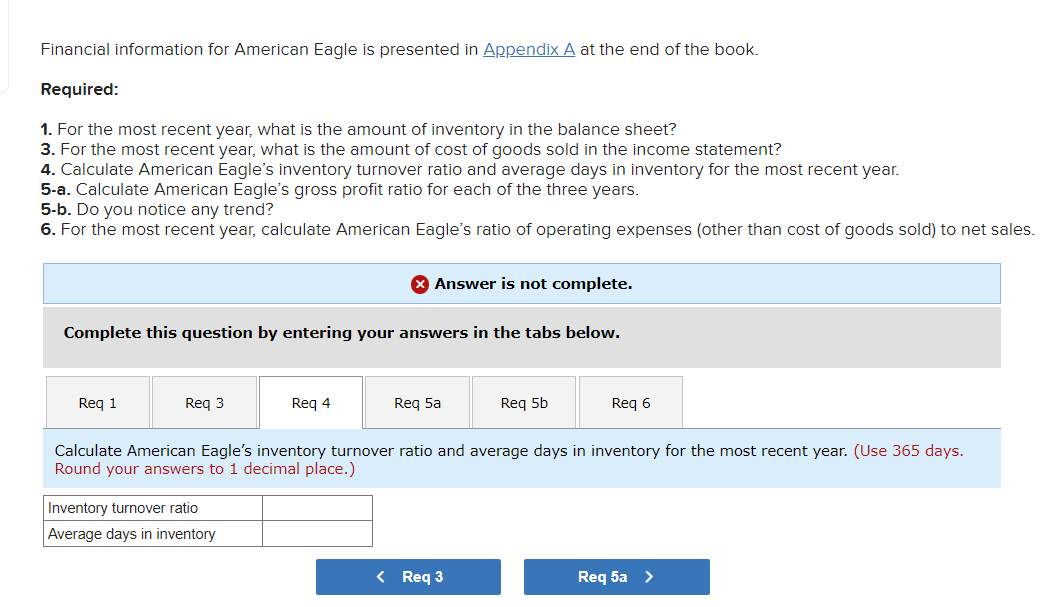

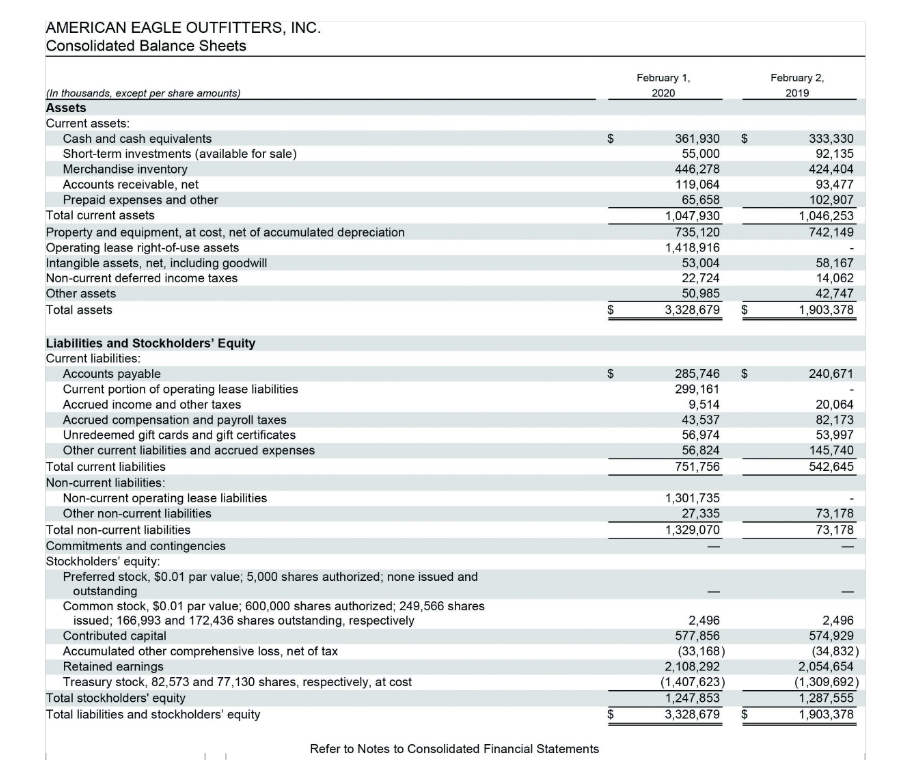

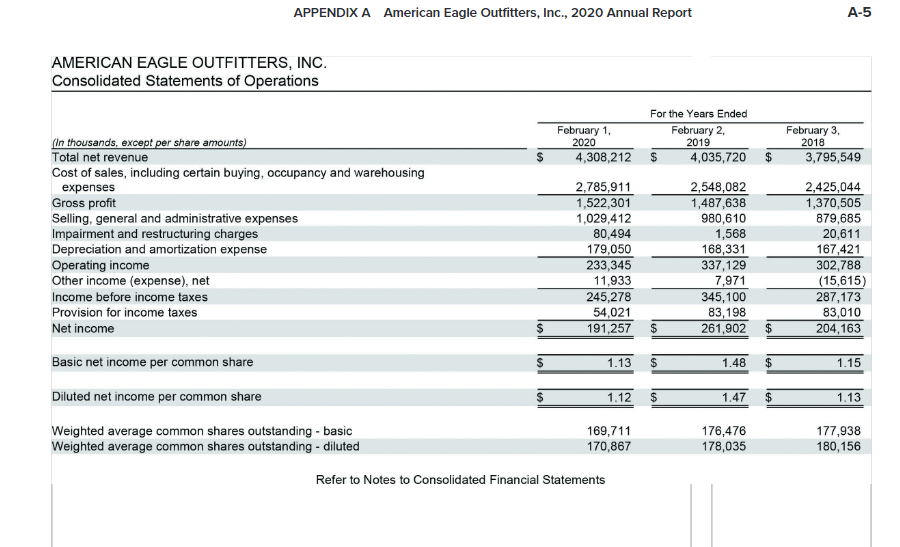

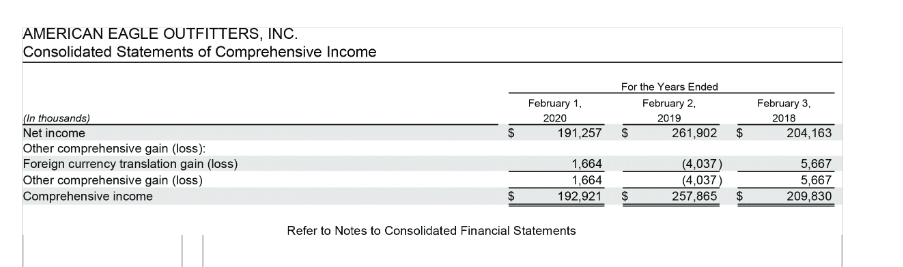

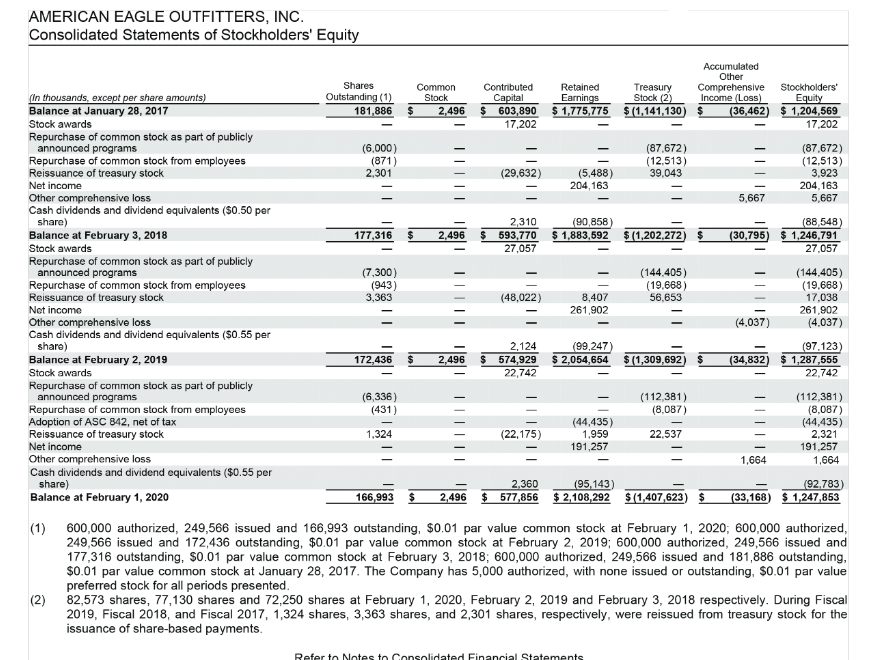

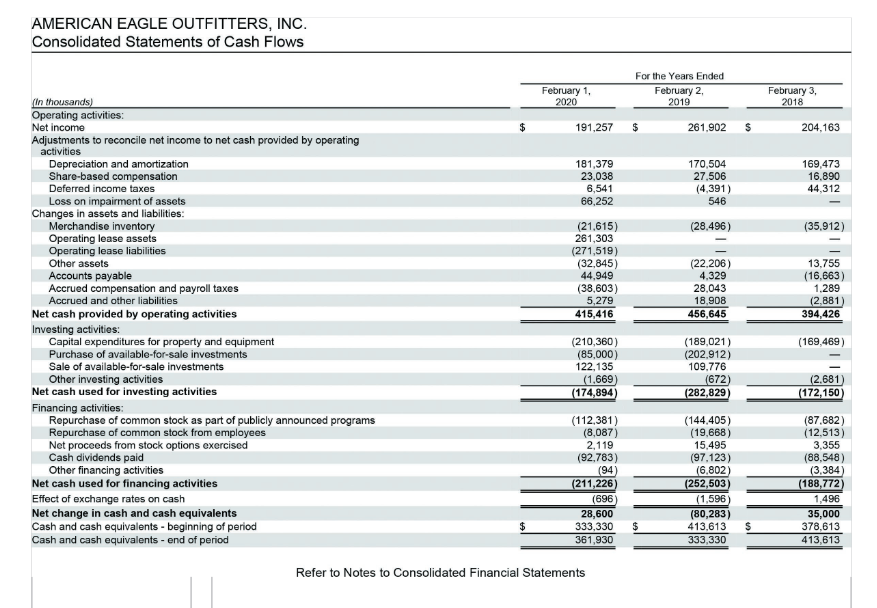

i APPENDIX A American Eagle Outfitters, Inc., 2020 Annual Report Financial information for American Eagle is presented in Appendix A at the end of the book. Required: 1. For the most recent year, what is the amount of inventory in the balance sheet? 3. For the most recent year, what is the amount of cost of goods sold in the income statement? 4. Calculate American Eagle's inventory turnover ratio and average days in inventory for the most recent year. 5-a. Calculate American Eagle's gross profit ratio for each of the three years. 5-b. Do you notice any trend? 6. For the most recent year, calculate American Eagle's ratio of operating expenses (other than cost of goods sold) to net s Answer is not complete. Complete this question by entering your answers in the tabs below. Calculate American Eagle's inventory turnover ratio and average days in inventory for the most recent year. (Use 365 days. Round your answers to 1 decimal place.) AMERICAN EAGLE OUTFITTERS, INC. Refer to Notes to Consolidated Financial Statements AMERICAN EAGLE OUTFITTERS, INC. AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Stockholders' Equity (1) 600,000 authorized, 249,566 issued and 166,993 outstanding, $0.01 par value common stock at February 1, 2020; 600,000 authorized, 249,566 issued and 172,436 outstanding, $0.01 par value common stock at February 2, 2019; 600,000 authorized, 249,566 issued and 177,316 outstanding, $0.01 par value common stock at February 3,2018;600,000 authorized, 249,566 issued and 181,886 outstanding, $0.01 par value common stock at January 28, 2017. The Company has 5,000 authorized, with none issued or outstanding, $0.01 par value preferred stock for all periods presented. (2) 82,573 shares, 77,130 shares and 72,250 shares at February 1, 2020, February 2, 2019 and February 3, 2018 respectively. During Fiscal 2019 , Fiscal 2018, and Fiscal 2017, 1,324 shares, 3,363 shares, and 2,301 shares, respectively, were reissued from treasury stock for the issuance of share-based payments

i APPENDIX A American Eagle Outfitters, Inc., 2020 Annual Report Financial information for American Eagle is presented in Appendix A at the end of the book. Required: 1. For the most recent year, what is the amount of inventory in the balance sheet? 3. For the most recent year, what is the amount of cost of goods sold in the income statement? 4. Calculate American Eagle's inventory turnover ratio and average days in inventory for the most recent year. 5-a. Calculate American Eagle's gross profit ratio for each of the three years. 5-b. Do you notice any trend? 6. For the most recent year, calculate American Eagle's ratio of operating expenses (other than cost of goods sold) to net s Answer is not complete. Complete this question by entering your answers in the tabs below. Calculate American Eagle's inventory turnover ratio and average days in inventory for the most recent year. (Use 365 days. Round your answers to 1 decimal place.) AMERICAN EAGLE OUTFITTERS, INC. Refer to Notes to Consolidated Financial Statements AMERICAN EAGLE OUTFITTERS, INC. AMERICAN EAGLE OUTFITTERS, INC. Consolidated Statements of Stockholders' Equity (1) 600,000 authorized, 249,566 issued and 166,993 outstanding, $0.01 par value common stock at February 1, 2020; 600,000 authorized, 249,566 issued and 172,436 outstanding, $0.01 par value common stock at February 2, 2019; 600,000 authorized, 249,566 issued and 177,316 outstanding, $0.01 par value common stock at February 3,2018;600,000 authorized, 249,566 issued and 181,886 outstanding, $0.01 par value common stock at January 28, 2017. The Company has 5,000 authorized, with none issued or outstanding, $0.01 par value preferred stock for all periods presented. (2) 82,573 shares, 77,130 shares and 72,250 shares at February 1, 2020, February 2, 2019 and February 3, 2018 respectively. During Fiscal 2019 , Fiscal 2018, and Fiscal 2017, 1,324 shares, 3,363 shares, and 2,301 shares, respectively, were reissued from treasury stock for the issuance of share-based payments Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started