Answered step by step

Verified Expert Solution

Question

1 Approved Answer

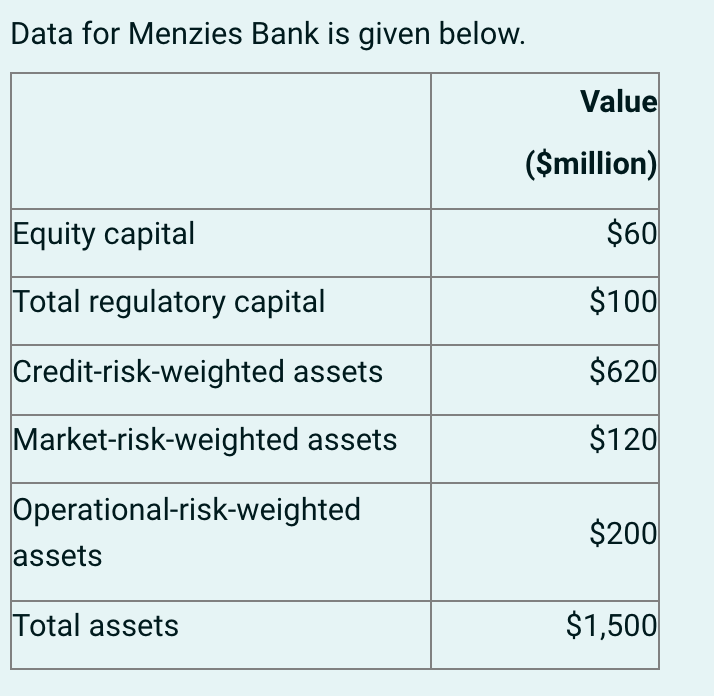

(i) Calculate Menzies Banks risk-based capital ratios for Common Equity Tier 1 and total regulatory capital (show all workings). (4 marks) (ii) Assess whether Menzies

(i) Calculate Menzies Banks risk-based capital ratios for Common Equity Tier 1 and total regulatory capital (show all workings). (4 marks)

(ii) Assess whether Menzies Bank has met the Basel III minimum requirements (including the capital conservation buffer) for each of the two (2) capital ratios calculated in part (i). (2 marks)

Data for Menzies Bank is given below. Value ($million) Equity capital $60 Total regulatory capital $100 Credit-risk-weighted assets $620 Market-risk-weighted assets $120 Operational-risk-weighted assets $200 Total assets $1,500 Data for Menzies Bank is given below. Value ($million) Equity capital $60 Total regulatory capital $100 Credit-risk-weighted assets $620 Market-risk-weighted assets $120 Operational-risk-weighted assets $200 Total assets $1,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started