Answered step by step

Verified Expert Solution

Question

1 Approved Answer

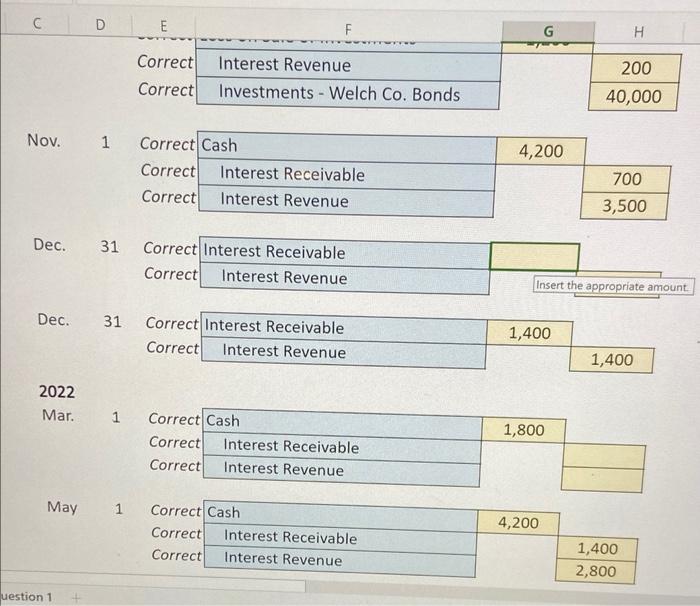

I cannot get the blank ones.. Dec 31 is not 1200 PR 15-3A Stock investment transactions, equity method and available-for-sale securities Soto Industries, Inc. is

I cannot get the blank ones.. Dec 31 is not 1200

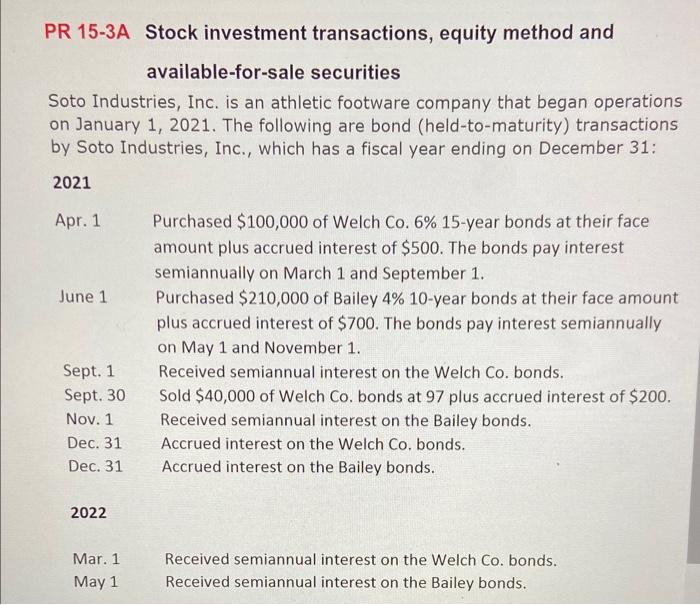

PR 15-3A Stock investment transactions, equity method and available-for-sale securities Soto Industries, Inc. is an athletic footware company that began operations on January 1, 2021. The following are bond (held-to-maturity) transactions by Soto Industries, Inc., which has a fiscal year ending on December 31: 2021 Apr. 1 Purchased $100,000 of Welch Co. 6\% 15-year bonds at their face amount plus accrued interest of $500. The bonds pay interest semiannually on March 1 and September 1. June 1 Purchased $210,000 of Bailey 4%10-year bonds at their face amount plus accrued interest of $700. The bonds pay interest semiannually on May 1 and November 1. Sept. 1 Received semiannual interest on the Welch Co. bonds. Sept. 30 Sold $40,000 of Welch Co. bonds at 97 plus accrued interest of $200. Nov. 1 Received semiannual interest on the Bailey bonds. Dec. 31 Accrued interest on the Welch Co, bonds. Dec. 31 Accrued interest on the Bailey bonds. 2022 Mar. 1 Received semiannual interest on the Welch Co. bonds. \begin{tabular}{|c|c|} \hline 4,200 & \\ & 700 \\ \hline 3,500 \\ \hline \end{tabular} \begin{tabular}{lll|l|} Dec. 31 & Correct & Interest Receivable & \\ \hline & correct & Interest Revenue & \\ \cline { 3 - 4 } & & & \end{tabular} 2022 \begin{tabular}{ll|l|l|} Mar. 1 & Correct & Cash \\ & & Correct & Interest Receivable \\ & Correct & Interest Revenue \\ \cline { 3 - 4 } & & & \end{tabular} \begin{tabular}{lll|l|} May & 1 & Correct & Cash \\ & & correct & Interest Receivable \\ & Correct & Interest Revenue \\ \cline { 3 - 4 } & & & \end{tabular} \begin{tabular}{|l|l|} \hline 4,200 & \\ \hline & 1,400 \\ \cline { 2 } & 2,800 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started