Question

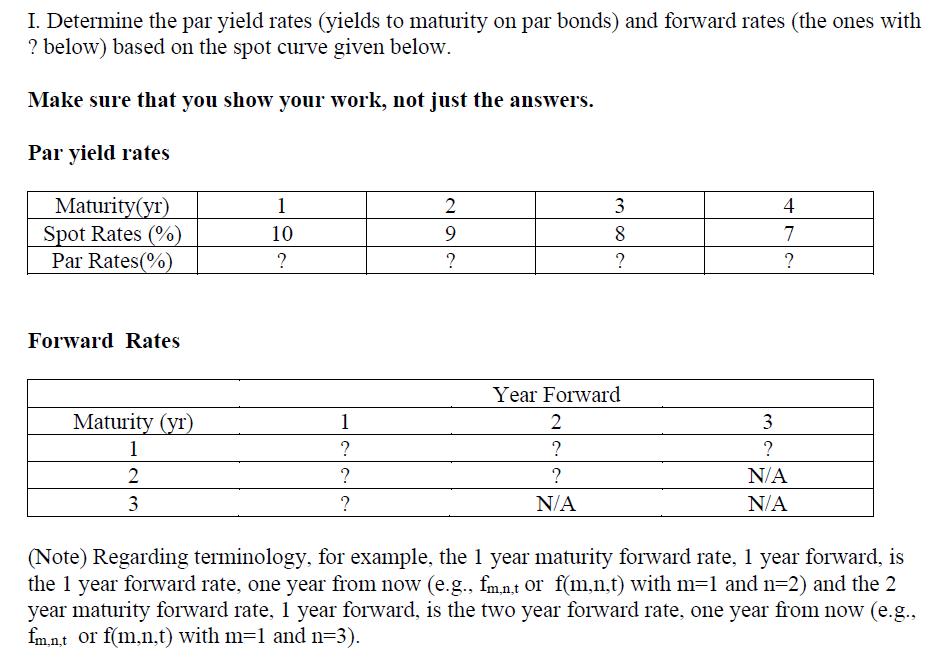

I. Determine the par yield rates (yields to maturity on par bonds) and forward rates (the ones with ? below) based on the spot

I. Determine the par yield rates (yields to maturity on par bonds) and forward rates (the ones with ? below) based on the spot curve given below. Make sure that you show your work, not just the answers. Par yield rates Maturity(yr) Spot Rates (%) 1 2 3 4 10 9 8 7 Par Rates(%) ? ? ? ? Forward Rates Maturity (yr) 1 1 ? 2 ? 3 ? Year Forward 2 ? ? N/A 3 ? N/A N/A (Note) Regarding terminology, for example, the 1 year maturity forward rate, 1 year forward, is the 1 year forward rate, one year from now (e.g., fm,nt or f(m,n,t) with m=1 and n=2) and the 2 year maturity forward rate, 1 year forward, is the two year forward rate, one year from now (e.g., fm.nt or f(m,n.t) with m=1 and n=3).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Transportation A Global Supply Chain Perspective

Authors: Robert A. Novack, Brian Gibson, Yoshinori Suzuki, John J. Coyle

9th Edition

1337406643, 9781337406642

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App