Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I did what I can, but for the rest I am a little lost and not sure what goes where. BGEN 210 Graded Exercise 1.

I did what I can, but for the rest I am a little lost and not sure what goes where.

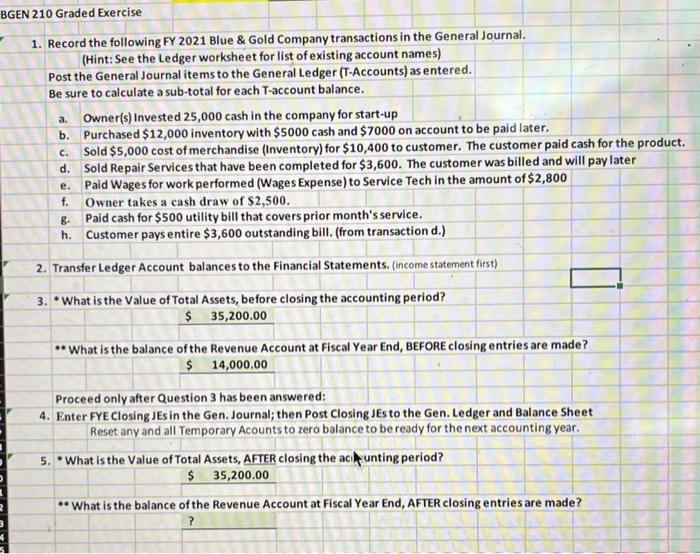

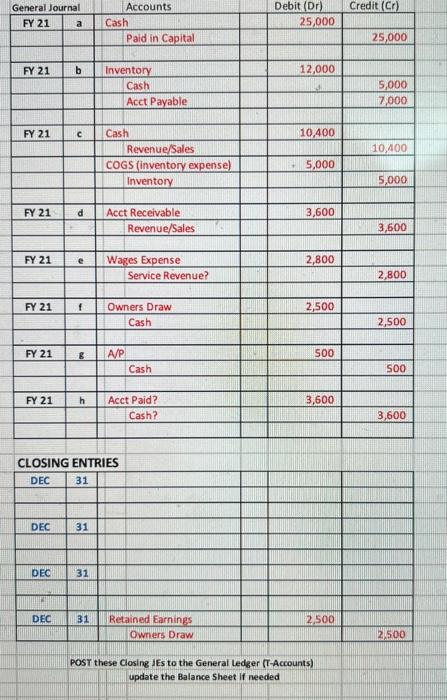

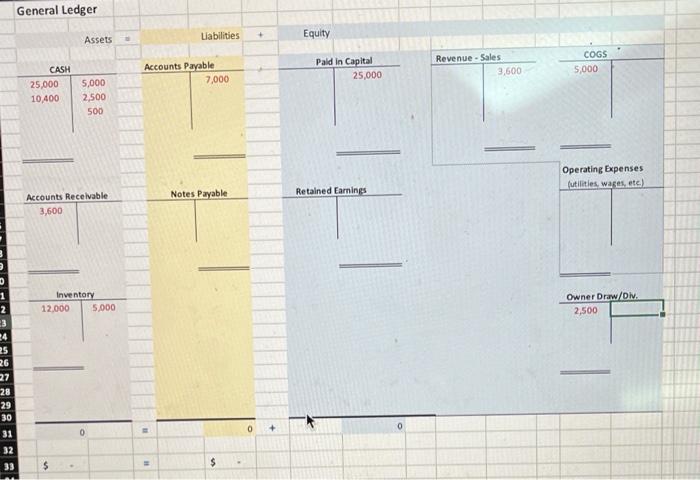

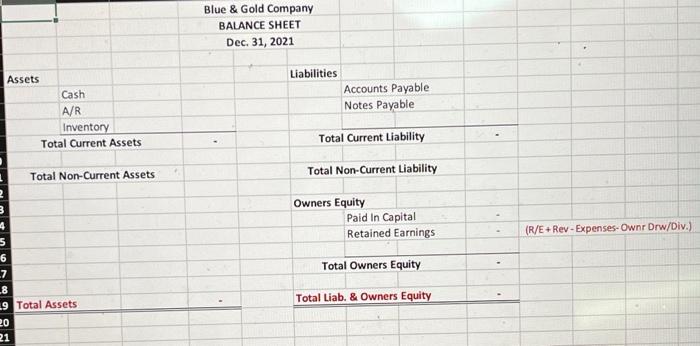

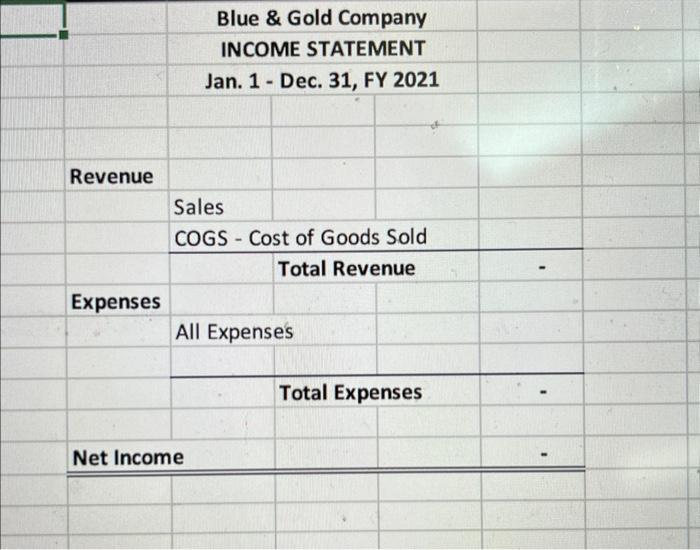

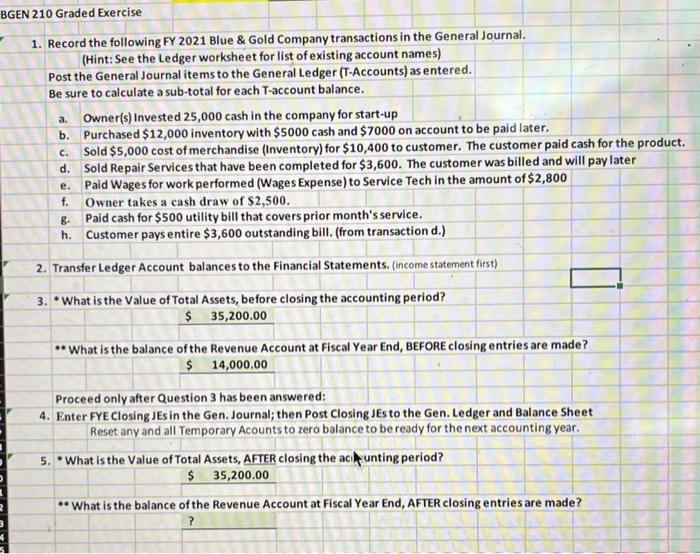

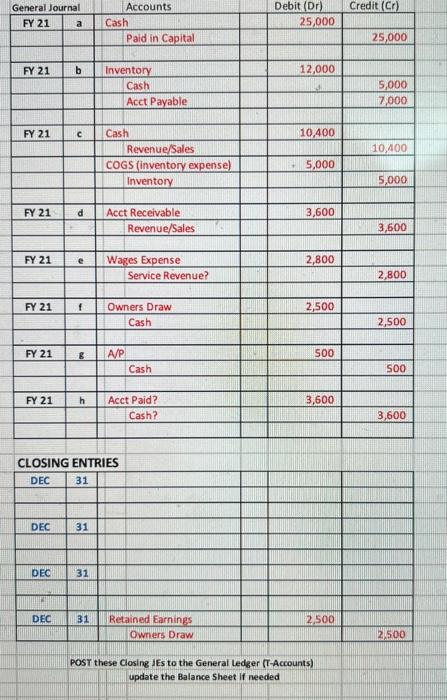

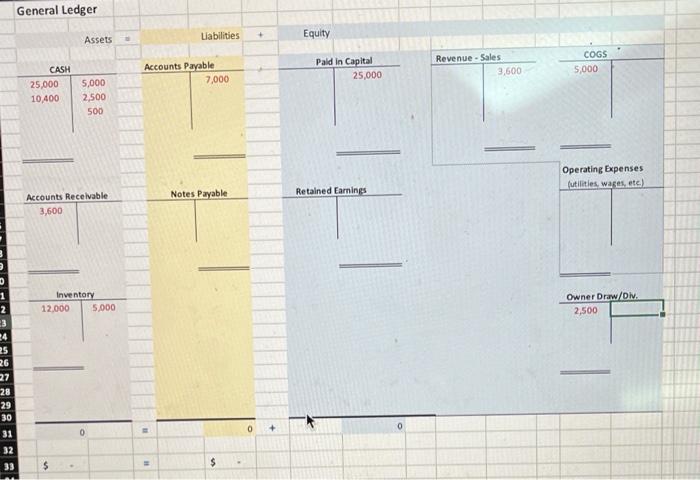

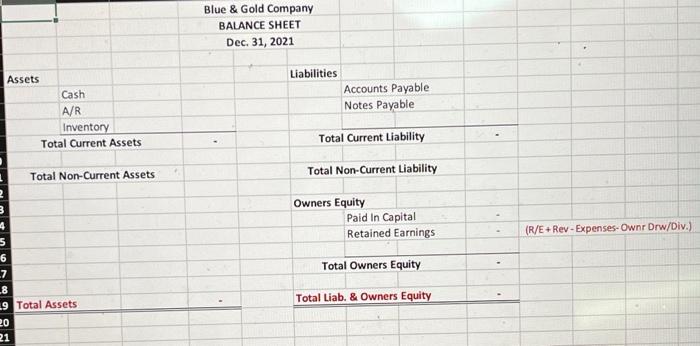

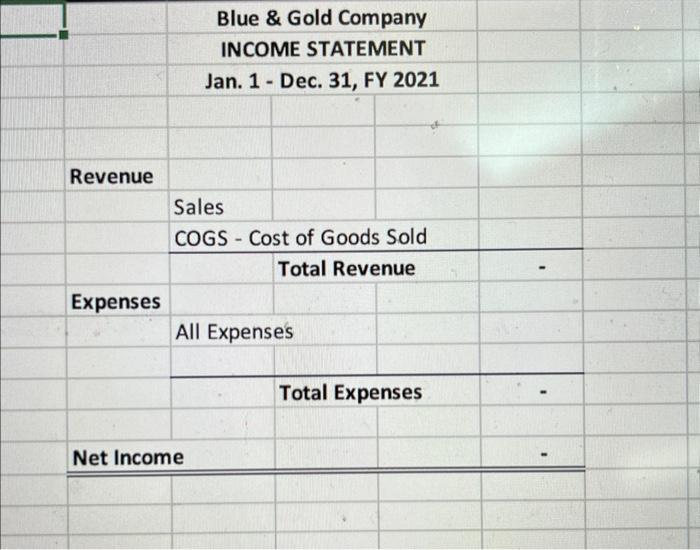

BGEN 210 Graded Exercise 1. Record the following FY 2021 Blue \& Gold Company transactions in the General Journal. (Hint: See the Ledger worksheet for list of existing account names) Post the General Journal items to the General Ledger (T-Accounts) as entered. Be sure to calculate a sub-total for each T-account balance. a. Owner(s) Invested 25,000 cash in the company for start-up b. Purchased $12,000 inventory with $5000 cash and $7000 on account to be paid later. c. Sold $5,000 cost of merchandise (Inventory) for $10,400 to customer. The customer paid cash for the product. d. Sold Repair Services that have been completed for $3,600. The customer was billed and will pay later e. Paid Wages for work performed (Wages Expense) to Service Tech in the amount of $2,800 f. Owner takes a cash draw of $2,500. g. Paid cash for $500 utility bill that covers prior month's service. h. Customer pays entire $3,600 outstanding bill. (from transaction d.) 2. Transfer Ledger Account balances to the Financial Statements. (income statement first) 3. "What is the Value of Total Assets, before closing the accounting period? $35,200.00 * What is the balance of the Revenue Account at Fiscal Year End, BEFORE closing entries are made? $14,000.00 Proceed only after Question 3 has been answered: 4. Enter FYE Closing JEs in the Gen. Journal; then Post Closing JEs to the Gen. Ledger and Balance Sheet Reset any and all Temporary Acounts to zero balance to be ready for the next accounting year. 5. "What is the Value of Total Assets, AfTER closing the aci unting period? $35,200.00 What is the balance of the Revenue Account at Fiscal Year End, AFTER closing entries are made? ? CLOSING ENTRIES \begin{tabular}{|c|c|c|c|c|c|} \hline DEC & 31 & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline DEC & 31 & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline DEC & 31 & & & \\ \hline & & & & \\ \hline & & & & \\ \hline DEC & 31 & Retained Earnings & & 2,500 & \\ \hline & & Owners Draw & & & 2,500 \\ \hline \end{tabular} POST these Closing IEs to the General Ledger (T-Accounts) update the Balance Sheet if needed General Ledger Operating Expenses Blue \& Gold Company BALANCE SHEET Dec. 31, 2021 Assets Liabilities \begin{tabular}{|l|l|l|} \hline Cash & Accounts Payable \\ \hline A/R & Notes Payable \\ \hline Inventory & Total Current Liability \\ \hline Total Current Assets \end{tabular} Total Non-Current Assets Total Non-Current Liability Owners Equity Paid In Capital Retained Earnings (R/E+ Rev-Expenses- Ownr Drw/Div.) Total Owners Equity Total Assets Total Liab. \& Owners Equity Blue \& Gold Company INCOME STATEMENT Jan. 1 - Dec. 31, FY 2021 Revenue Sales COGS - Cost of Goods Sold Total Revenue Expenses All Expenses Total Expenses Net Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started