Answered step by step

Verified Expert Solution

Question

1 Approved Answer

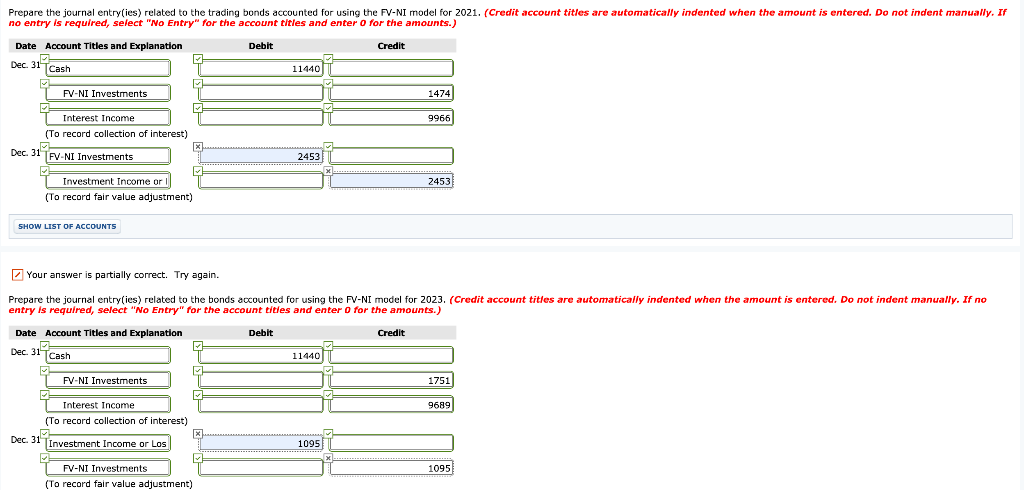

I do not know how to solve to record the fair value adjustment ( the answers shaded in blue are incorrect). 2397 and 1872 are

I do not know how to solve to record the fair value adjustment ( the answers shaded in blue are incorrect). 2397 and 1872 are also incorrect. Please help

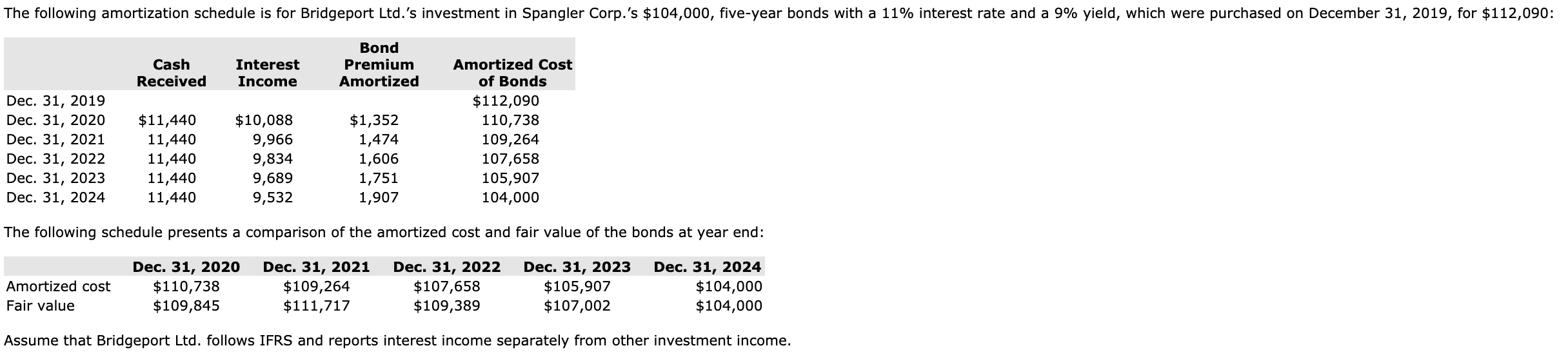

The following amortization schedule is for Bridgeport Ltd.'s investment in Spangler Corp.'s $104,000, five-year bonds with a 11% interest rate and a 9% yield, which were purchased on December 31, 2019, for $112,090: Cash Received Interest Income Bond Premium Amortized Dec. 31, 2019 Dec. 31, 2020 Dec. 31, 2021 Dec. 31, 2022 Dec. 31, 2023 Dec. 31, 2024 $11,440 11,440 11,440 11,440 11,440 $10,088 9,966 9,834 9,689 9,532 $1,352 1,474 1,606 1,751 1,907 Amortized Cost of Bonds $112,090 110,738 109,264 107,658 105,907 104,000 The following schedule presents a comparison of the amortized cost and fair value of the bonds at year end: Amortized cost Fair value Dec. 31, 2020 $110,738 $109,845 Dec. 31, 2021 $109,264 $111,717 Dec. 31, 2022 $107,658 $109,389 Dec. 31, 2023 $105,907 $107,002 Dec. 31, 2024 $104,000 $104,000 Assume that Bridgeport Ltd. follows IFRS and reports interest income separately from other investment income. Prepare the journal entry(ies) related to the trading bonds accounted for using the FV-NI model for 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Dec 31 TCash 11440 FV-NI Investments 1474 9966 Interest Income (To record collection of interest) Dec. 31 FV-NI Investments 2453 2453 Investment Income or (To record fair value adjustment) SHOW LIST OF ACCOUNTS Your answer is partially correct. Try again. Prepare the journal entry(ies) related to the bonds accounted for using the FV-NI model for 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Dec 31 Cash 11440 FV-NI Investments 1751 9689 Interest Income (To record collection of interest) Dec 31 Investment Income or Los 1095 1095 PV-NI Investments (To record fair value adjustment)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started