Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I DO NOT KNOW IF MY ANSWERS ARE CORRECT, PLEASE DOUBLE CHECK FOR ME. I NEED THE HIGHLIGHTED PARTS SOLVED. PLEASE SHOW ALL WORK SO

I DO NOT KNOW IF MY ANSWERS ARE CORRECT, PLEASE DOUBLE CHECK FOR ME. I NEED THE HIGHLIGHTED PARTS SOLVED. PLEASE SHOW ALL WORK SO I CAN FOLLOW ALONG. THANK YOU SO MUCH!

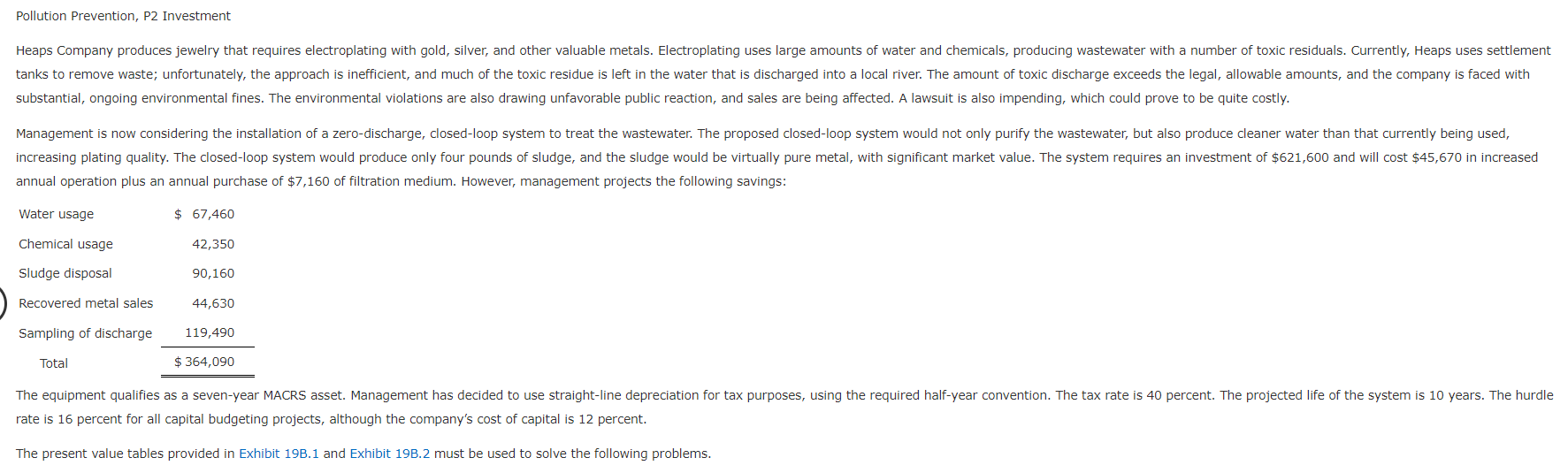

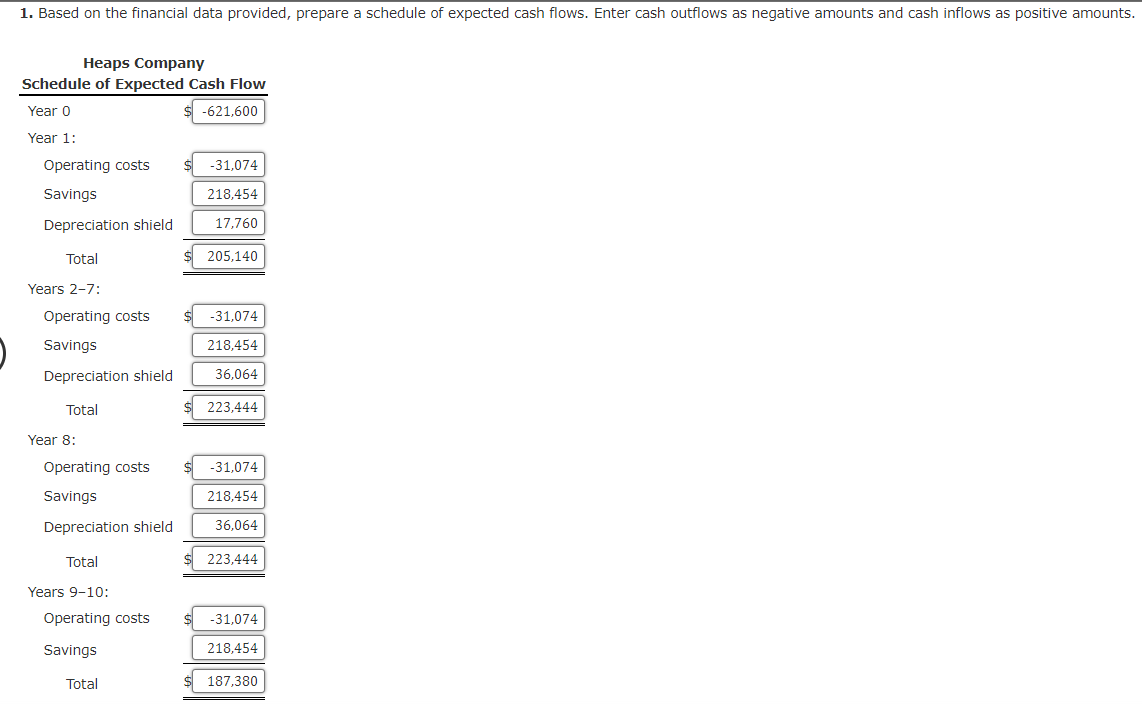

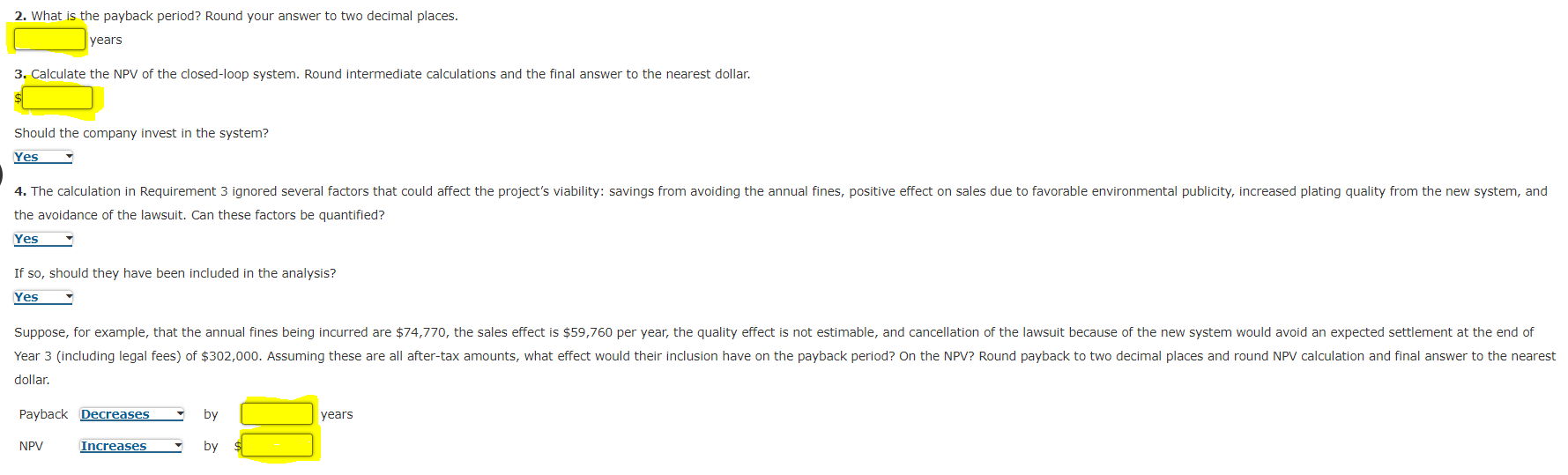

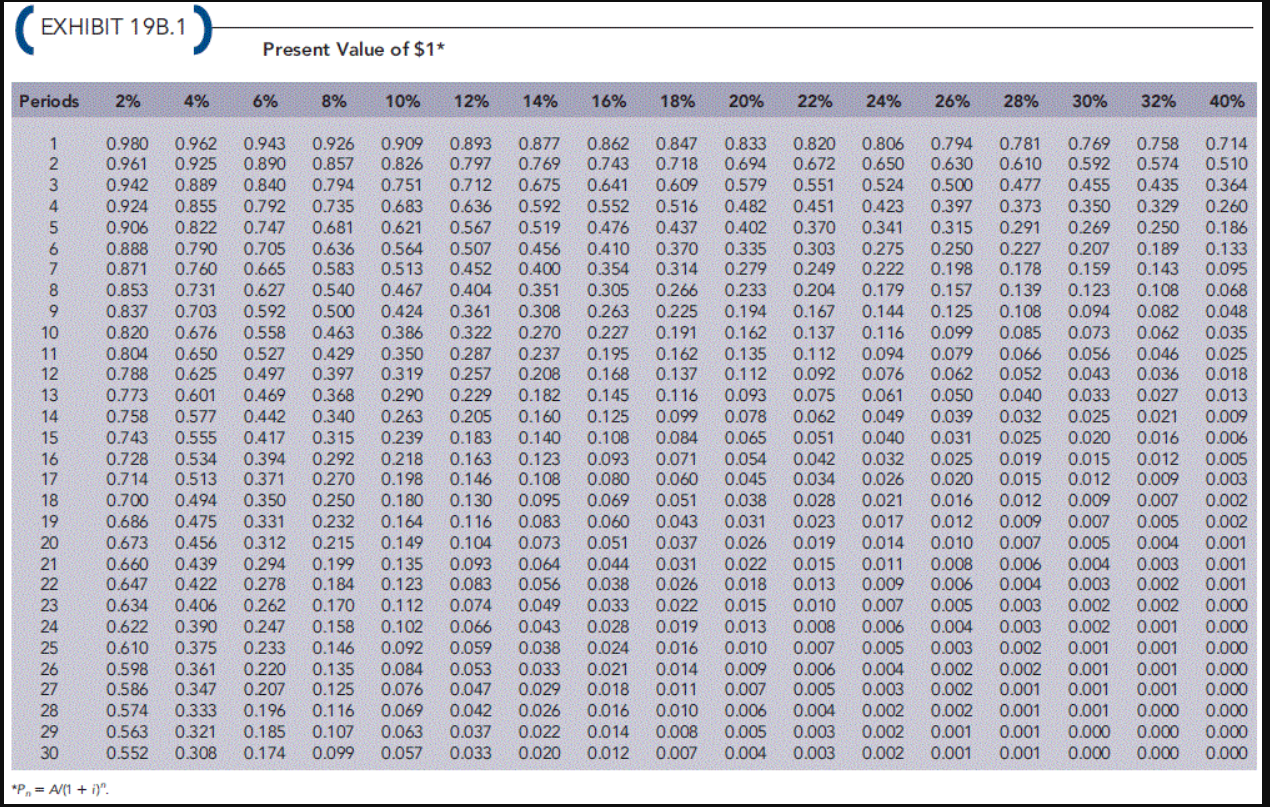

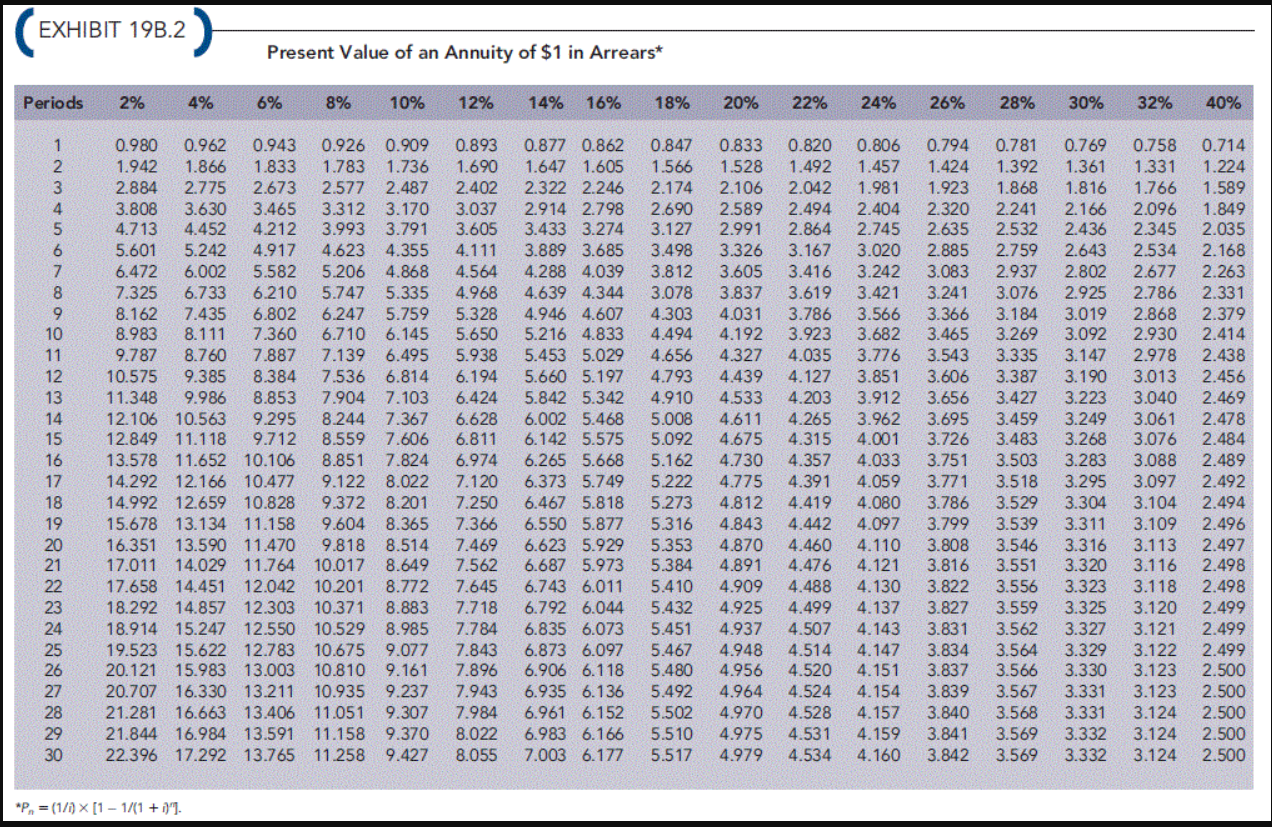

annual operation plus an annual purchase of $7,160 of filtration medium. However, management projects the following savings: rate is 16 percent for all capital budgeting projects, although the company's cost of capital is 12 percent. The present value tables provided in Exhibit 19B.1 and Exhibit 19B.2 must be used to solve the following problems. 1. Based on the financial data provided, prepare a schedule of expected cash flows. Enter cash outflows as negative amounts and cash inflows as positive amounts. 2. What is the payback period? Round your answer to two decimal places. years 3. Calculate the NPV of the closed-loop system. Round intermediate calculations and the final answer to the nearest dollar. Should the company invest in the system? the avoidance of the lawsuit. Can these factors be quantified? If so, should they have been included in the analysis? dollar. PaybackbyNPVbearsby: EXHIBIT 19B.1 Present Value of $1 * Pn=A/(1+i)n. +NrStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started