Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have an ans 1,2. Can you help me with 3,4,5,6? Question 6 The following accounts are the consolidated statement of financial position and parent

I have an ans 1,2. Can you help me with 3,4,5,6?

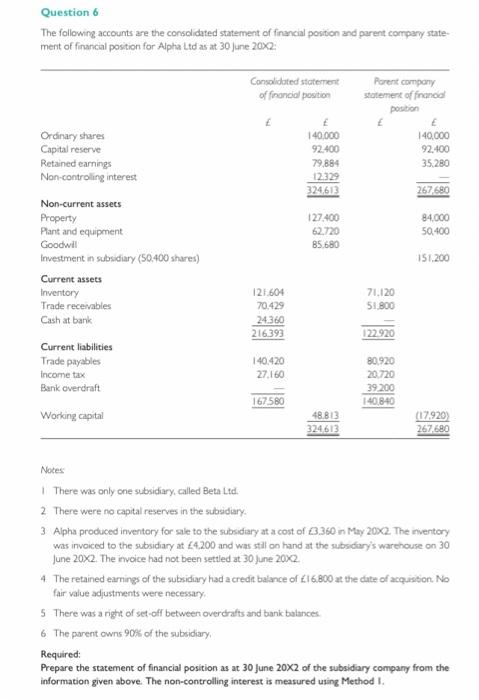

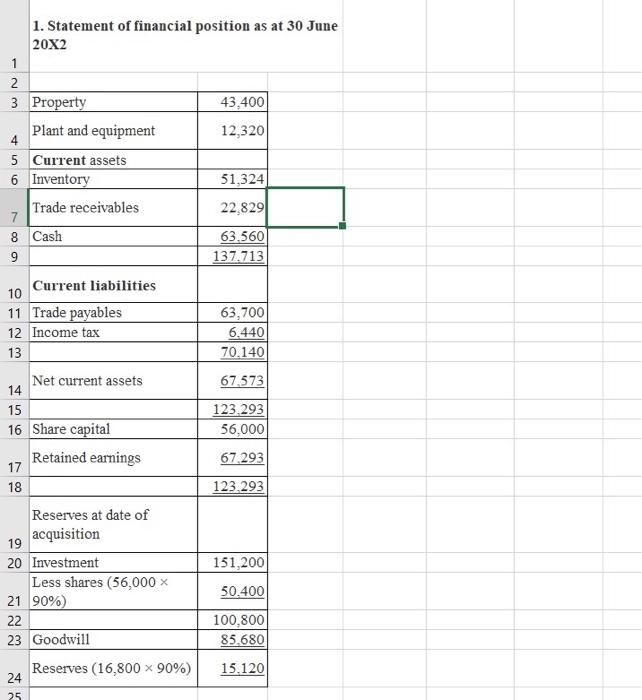

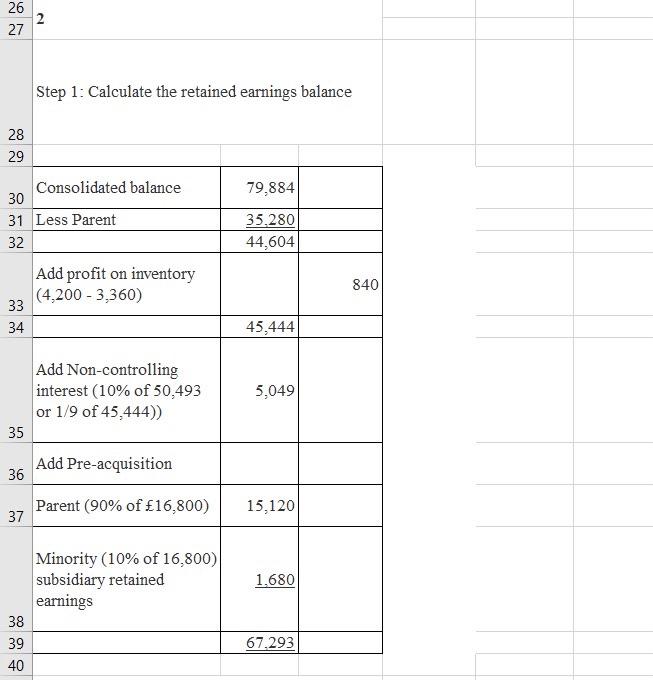

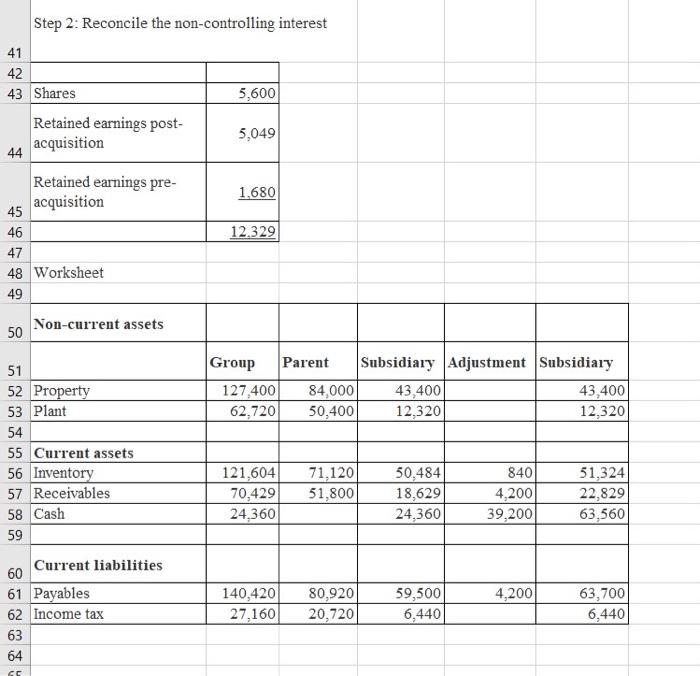

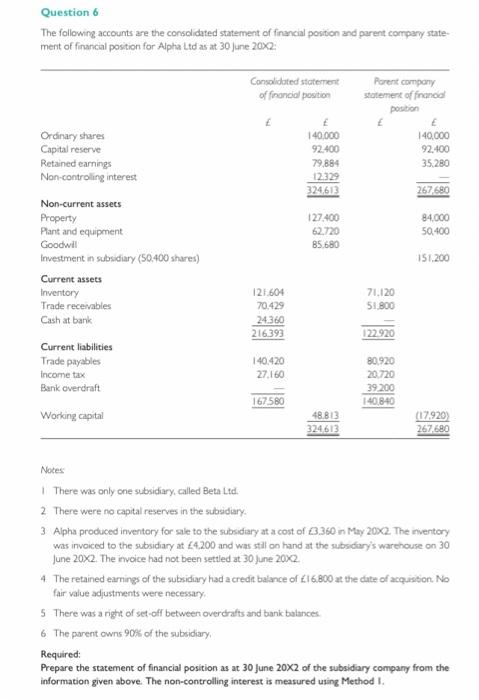

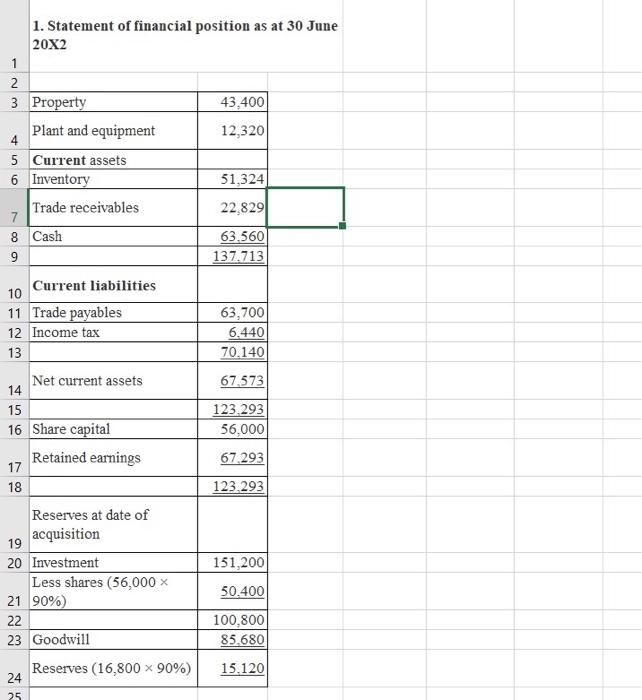

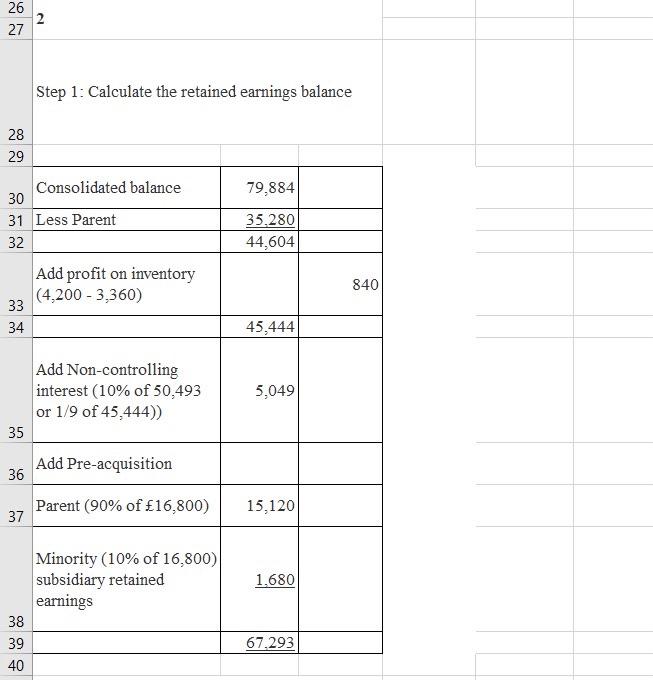

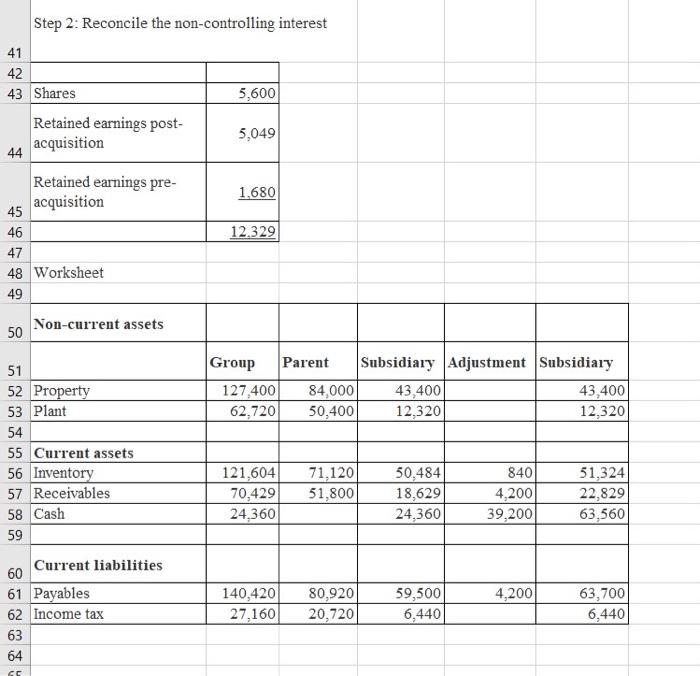

Question 6 The following accounts are the consolidated statement of financial position and parent company state- ment of financial position for Alpha Ltd as at 30 June 20X2: Consolidated statement of financial position Parent company statement of france position E 140,000 92.400 35.280 Ordinary shares Capital reserve Retained earnings Non-controlling interest 140,000 92.400 79,884 12329 324,613 267 680 127,400 62.720 85.680 84.000 50,400 151.200 Non-current assets Property Plant and equipment Goodwill Investment in subsidiary (50,400 shares) Current assets Inventory Trade receivables Cash at bank Current liabilities Trade payables Income tax Bank overdraft 121,604 70.429 24360 216393 71.120 51.800 122.920 140,420 27.160 80.920 20.720 39200 140,840 167580 Working capital 48.813 (17.920 267680 324613 Notes There was only one subsidiary called Beta Ltd. 2 There were no capital reserves in the subsidiary 3 Alpha produced inventory for sale to the subsidiary at a cost of 43.360 in May 20X2 The riventory was invoiced to the subsidiary at 4,200 and was still on hand at the subsidiary's warehouse on 30 June 20x2. The invoice had not been settled at 30 June 20x2. 4 The retained earnings of the subsidiary had a credit balance of 16.800 at the date of acquisition No fair value adjustments were necessary 5 There was a right of set-off between overdrafts and bank balances 6 The parent owns 90% of the subsidiary, Required: Prepare the statement of financial position as at 30 June 20X2 of the subsidiary company from the information given above. The non-controlling interest is measured using Method I. Nm 1. Statement of financial position as at 30 June 20X2 1 2 3 Property 43,400 Plant and equipment 12,320 4 5 Current assets 6 Inventory 51,324 7 Trade receivables 22.829 8 Cash 63.560 9 137.713 10 Current liabilities 11 Trade payables 63,700 12 Income tax 6.440 13 70.140 67.573 123.293 56,000 67.293 123.293 Net current assets 14 15 16 Share capital Retained earnings 17 18 Reserves at date of acquisition 19 20 Investment Less shares (56,000 X 21 90%) 22 23 Goodwill Reserves (16,800 x 90%) 24 151,200 50,400 100.800 85.680 15.120 25 26 27 2 Step 1: Calculate the retained earnings balance 28 29 79,884 35.280 44,604 Consolidated balance 30 31 Less Parent 32 Add profit on inventory (4,200 - 3,360) 33 34 840 45,444 5,049 Add Non-controlling interest (10% of 50,493 or 1/9 of 45,444)) 35 Add Pre-acquisition 36 Parent (90% of 16,800) 37 15,120 1.680 Minority (10% of 16,800) subsidiary retained earnings 38 39 40 67.293 Step 2: Reconcile the non-controlling interest 41 42 43 Shares 5,600 Retained earnings post- 5,049 44 acquisition Retained earnings pre- 1.680 acquisition 45 46 12.329 47 48 Worksheet 49 Non-current assets 50 Group Parent Subsidiary Adjustment Subsidiary 127,400 84,000 43,400 43,400 62,720 50,400 12,320 12,320 51 52 Property 53 Plant 54 55 Current assets 56 Inventory 57 Receivables 58 Cash 59 121,604 70,429 24,360 71,120 51,800 50,484 18,629 24,360 840 4,200 39,200 51,324 22,829 63,560 4,200 Current liabilities 60 61 Payables 62 Income tax 63 64 140,420 27,160 80,920 20,720 59,500 6,440 63,700 6,440 9 GS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started