Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I have posted this question previously , the answer provided was wrong as per checking with my lecturer , kindly provide correct answer with working

I have posted this question previously , the answer provided was wrong as per checking with my lecturer , kindly provide correct answer with working for each figure.

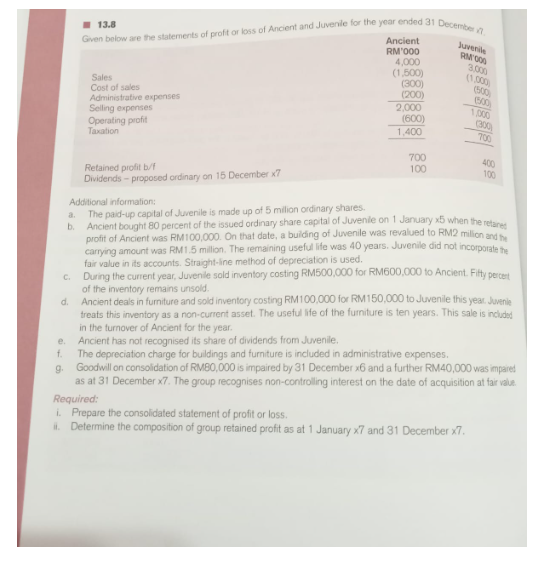

13.8 Additional information: a. The paid-up capital of Juvenile is made up of 5 milion ordinary shares. b. Ancient boughi 80 percent of the issued ordinary share capital of Juvenile on 1 Jaruary 5 when the retares profit of Ancient was RM100,000. On that date, a builing of Juvenile was revalued to RM2 milion and hi carrying amount was RM1.5 milion. The remaining useful life was 40 years. Juvenile did not incorparate the fair value in its accounts. Straight-ine method of depreciation is used. of the inventory remains unsold. d. Ancient deals in furniture and sold inventory costing RM100,000 for RM150,000 to Juvenile this year. Juvenie treats this inventory as a non-current asset. The useful life of the furniture is ten years. This sale is includst in the furnover of Ancient for the year. e. Ancient has not recognised its share of dividends from Juvenle. f. The depreciation charge for buldings and turniture is included in administrative expenses. 9. Goodwill on consolidation of RMB0,000 is impaired by 31 December x6 and a further RM40,000 was mpared as at 31 December x7. The group recognises non-controlling interest on the date of acquistion at far value Required: i. Prepare the consolidated statement of profit or loss. ii. Determine the composition of group retained profit as at 1 January 7 and 31 December 7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started