Question

I HOPE u can help me. Thank You in advance 1 HOUR GIVEN TIME TO FINISH THE TASK Giving UPVOTE and GOOD comment I HOPE

I HOPE u can help me. Thank You in advance

1 HOUR GIVEN TIME TO FINISH THE TASK

Giving UPVOTE and GOOD comment

I HOPE u can help me. Thank You in advance

1 HOUR GIVEN TIME TO FINISH THE TASK

Giving UPVOTE and GOOD comment

PLEASE HELP ME IT WILL BE VERY MUCH APPRECIATED

PLEASE ANSWER ALL GIVEN QUESTIONS FOR THE GOOD MARKS.

FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE

FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE

FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE >> FINANCE

/////QUESTION

|

|

----------EDITTED QUESTION-------------

THE QUESTION IS : Question: What measures should the US Government undertake to UNFREEZE CREDIT and limit the economic downturn experience by the country?

---------------

Question: What measures should the US Government undertake to UNFREEZE CREDIT and limit the economic downturn experience by the country?

-----------------

Question: What measures should the US Government undertake to UNFREEZE CREDIT and limit the economic downturn experience by the country?

---------------------

HOPE THIS EDITTED VERSION CLEAR TO YOU TUETOR // sorry for the capslock. HOPE U ANSWER IT CLEARLY.

|

|

/////QUESTION

PLEASE ANSWER ALL GIVEN QUESTION, WILL GIVE UPVOTE AND GOOD COMMENT....

PLEASE ANSWER ALL GIVEN QUESTION, WILL GIVE UPVOTE AND GOOD COMMENT....

PLEASE ANSWER ALL GIVEN QUESTION, WILL GIVE UPVOTE AND GOOD COMMENT....

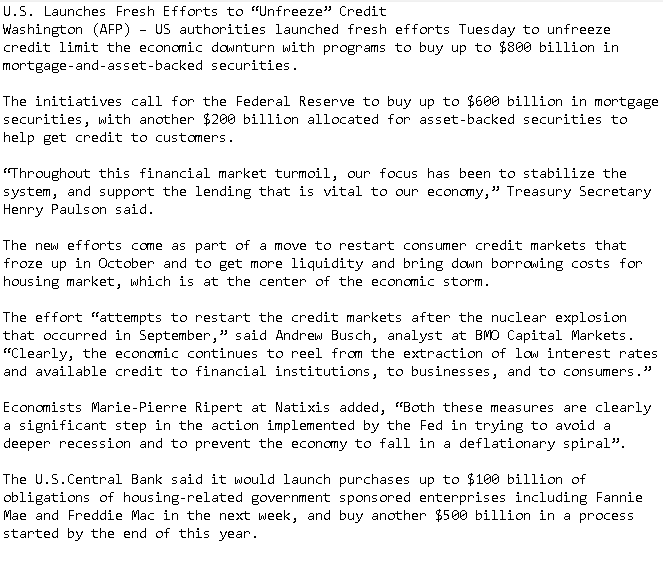

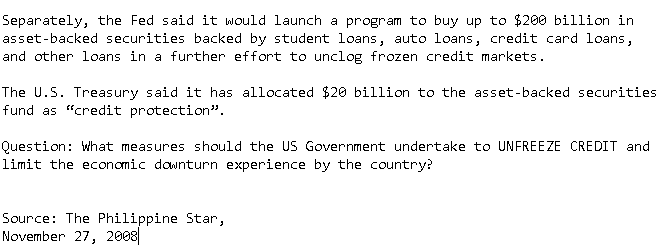

U.S. Launches Fresh Efforts to "Unfreeze" Credit Washington (AFP) - US authorities launched fresh efforts Tuesday to unfreeze credit limit the economic downturn with programs to buy up to $800 billion in mortgage-and-asset-backed securities. The initiatives call for the Federal Reserve to buy up to $600 billion in mortgage securities, with another $200 billion allocated for asset-backed securities to help get credit to customers. "Throughout this financial market turmoil, our focus has been to stabilize the system, and support the lending that is vital to our economy," Treasury Secretary Henry Paulson said. The new efforts come as part of a move to restart consumer credit markets that froze up in October and to get more liquidity and bring down borrowing costs for housing market, which is at the center of the economic storm. 3) The effort "attempts to restart the credit markets after the nuclear explosion that occurred in September," said Andrew Busch, analyst at BMO Capital Markets. "Clearly, the economic continues to reel from the extraction of low interest rates and available credit to financial institutions, to businesses, and to consumers." Economists Marie-Pierre Ripert at Natixis added, "Both these measures are clearly a significant step in the action implemented by the Fed in trying to avoid a deeper recession and to prevent the economy to fall in a deflationary spiral. The U.S. Central Bank said it would launch purchases up to $100 billion of obligations of housing-related government sponsored enterprises including Fannie Mae and Freddie Mac in the next week, and buy another $500 billion in a process started by the end of this year. Separately, the Fed said it would launch a program to buy up to $200 billion in asset-backed securities backed by student loans, auto loans, credit card loans, and other loans in a further effort to unclog frozen credit markets. The U.S. Treasury said it has allocated $20 billion to the asset-backed securities fund as "credit protection". Question: What measures should the US Government undertake to UNFREEZE CREDIT and limit the economic downturn experience by the country? Source: The Philippine Star, November 27, 2008 U.S. Launches Fresh Efforts to "Unfreeze" Credit Washington (AFP) - US authorities launched fresh efforts Tuesday to unfreeze credit limit the economic downturn with programs to buy up to $800 billion in mortgage-and-asset-backed securities. The initiatives call for the Federal Reserve to buy up to $600 billion in mortgage securities, with another $200 billion allocated for asset-backed securities to help get credit to customers. "Throughout this financial market turmoil, our focus has been to stabilize the system, and support the lending that is vital to our economy," Treasury Secretary Henry Paulson said. The new efforts come as part of a move to restart consumer credit markets that froze up in October and to get more liquidity and bring down borrowing costs for housing market, which is at the center of the economic storm. 3) The effort "attempts to restart the credit markets after the nuclear explosion that occurred in September," said Andrew Busch, analyst at BMO Capital Markets. "Clearly, the economic continues to reel from the extraction of low interest rates and available credit to financial institutions, to businesses, and to consumers." Economists Marie-Pierre Ripert at Natixis added, "Both these measures are clearly a significant step in the action implemented by the Fed in trying to avoid a deeper recession and to prevent the economy to fall in a deflationary spiral. The U.S. Central Bank said it would launch purchases up to $100 billion of obligations of housing-related government sponsored enterprises including Fannie Mae and Freddie Mac in the next week, and buy another $500 billion in a process started by the end of this year. Separately, the Fed said it would launch a program to buy up to $200 billion in asset-backed securities backed by student loans, auto loans, credit card loans, and other loans in a further effort to unclog frozen credit markets. The U.S. Treasury said it has allocated $20 billion to the asset-backed securities fund as "credit protection". Question: What measures should the US Government undertake to UNFREEZE CREDIT and limit the economic downturn experience by the country? Source: The Philippine Star, November 27, 2008Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started