Answered step by step

Verified Expert Solution

Question

1 Approved Answer

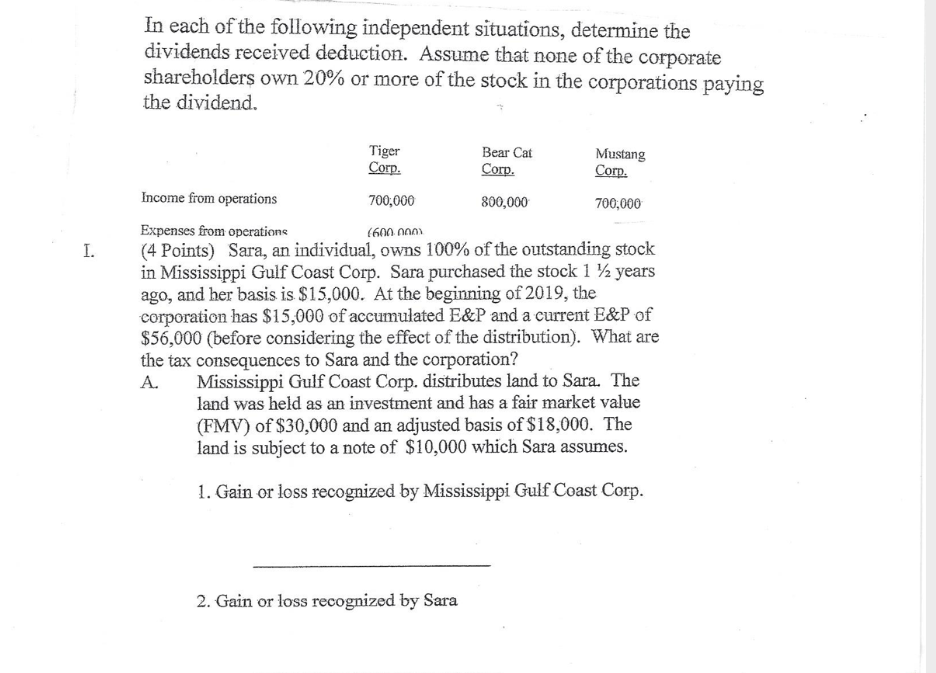

I. In each of the following independent situations, determine the dividends received deduction. Assume that none of the corporate shareholders own 20% or more

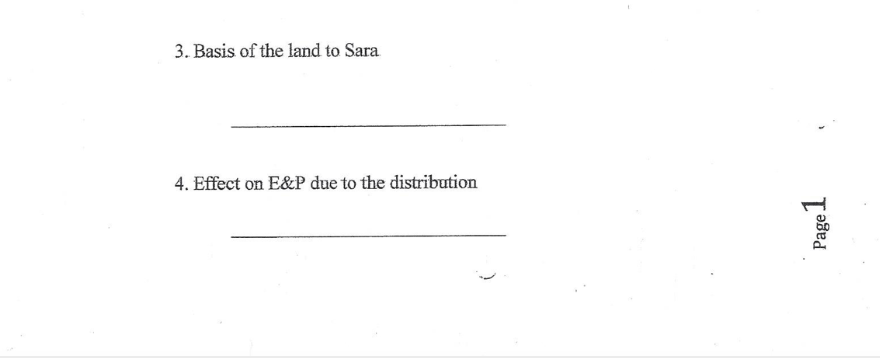

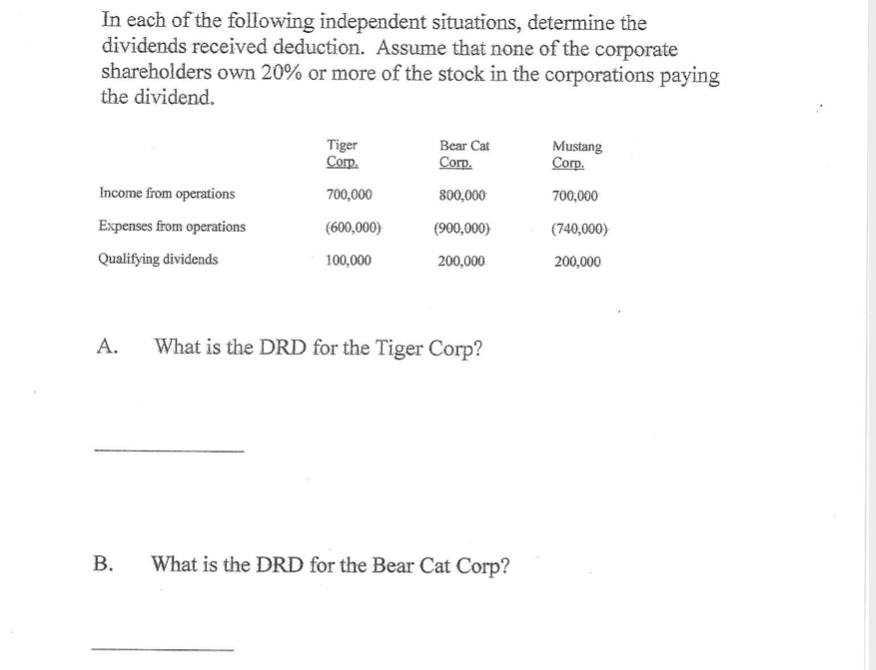

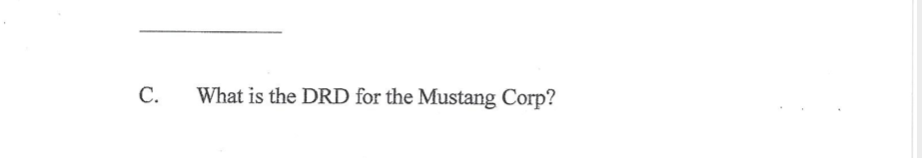

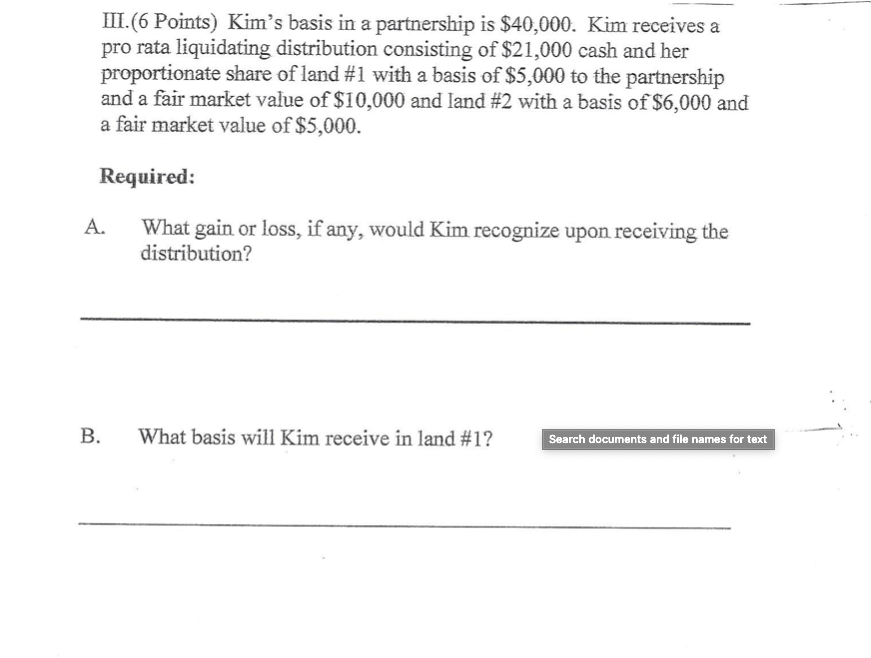

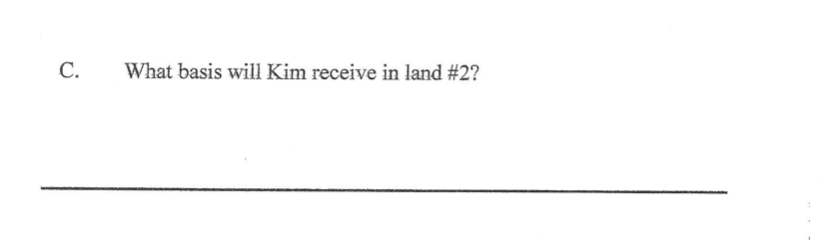

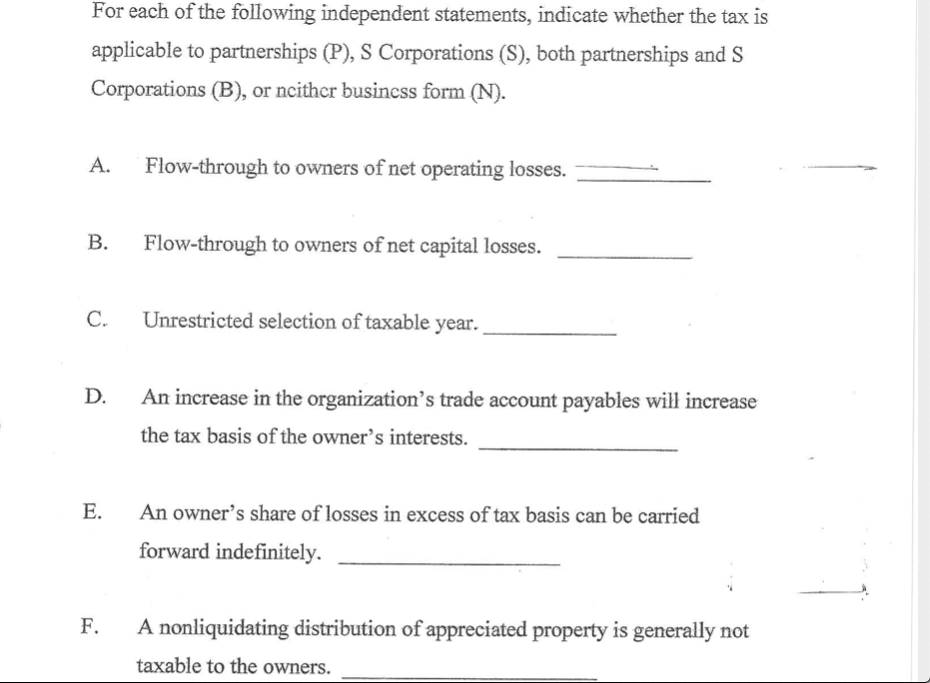

I. In each of the following independent situations, determine the dividends received deduction. Assume that none of the corporate shareholders own 20% or more of the stock in the corporations paying the dividend. Tiger Corp. 700,000 Bear Cat Corp. 800,000 Mustang Corp. Income from operations Expenses from operations (600.000) (4 Points) Sara, an individual, owns 100% of the outstanding stock in Mississippi Gulf Coast Corp. Sara purchased the stock 1 years ago, and her basis is $15,000. At the beginning of 2019, the corporation has $15,000 of accumulated E&P and a current E&P of $56,000 (before considering the effect of the distribution). What are the tax consequences to Sara and the corporation? A. 2. Gain or loss recognized by Sara 700,000 Mississippi Gulf Coast Corp. distributes land to Sara. The land was held as an investment and has a fair market value (FMV) of $30,000 and an adjusted basis of $18,000. The land is subject to a note of $10,000 which Sara assumes. 1. Gain or loss recognized by Mississippi Gulf Coast Corp. 3. Basis of the land to Sara 4. Effect on E&P due to the distribution Page 1 In each of the following independent situations, determine the dividends received deduction. Assume that none of the corporate shareholders own 20% or more of the stock in the corporations paying the dividend. Income from operations Expenses from operations Qualifying dividends A. B. Tiger Corp. 700,000 (600,000) 100,000 Bear Cat Corp. 800,000 (900,000) 200,000 What is the DRD for the Tiger Corp? What is the DRD for the Bear Cat Corp? Mustang Corp. 700,000 (740,000) 200,000 C. What is the DRD for the Mustang Corp? III. (6 Points) Kim's basis in a partnership is $40,000. Kim receives a pro rata liquidating distribution consisting of $21,000 cash and her proportionate share of land #1 with a basis of $5,000 to the partnership and a fair market value of $10,000 and land #2 with a basis of $6,000 and a fair market value of $5,000. Required: What gain or loss, if any, would Kim recognize upon receiving the distribution? A. B. What basis will Kim receive in land #1? Search documents and file names for text C. What basis will Kim receive in land #2? For each of the following independent statements, indicate whether the tax is applicable to partnerships (P), S Corporations (S), both partnerships and S Corporations (B), or neither business form (N). A. Flow-through to owners of net operating losses. B. C. D. E. F. Flow-through to owners of net capital losses. Unrestricted selection of taxable year. An increase in the organization's trade account payables will increase the tax basis of the owner's interests. An owner's share of losses in excess of tax basis can be carried forward indefinitely. A nonliquidating distribution of appreciated property is generally not taxable to the owners. G. H. Income retained in the business will not be taxed to the owners until distributed to them. Organizational costs can be amortized over a 180-month period. Page 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

I Dividends Received Deduction DRD is a provision in the tax code that allows certain corporate shar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started