Answered step by step

Verified Expert Solution

Question

1 Approved Answer

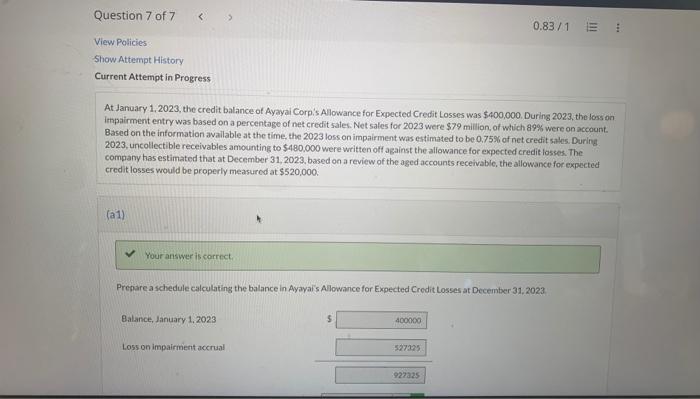

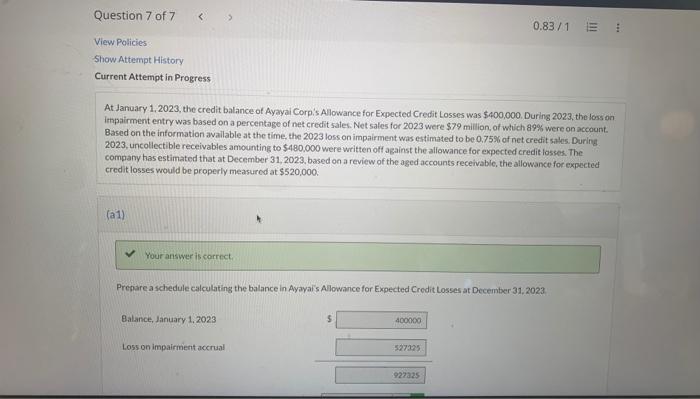

I just need help with (a2) thank you!! At Jamuary 1.2023, the credit balance of Ayayai Corpis Allowance for Expected Credit Losses was $400,000. During

I just need help with (a2)

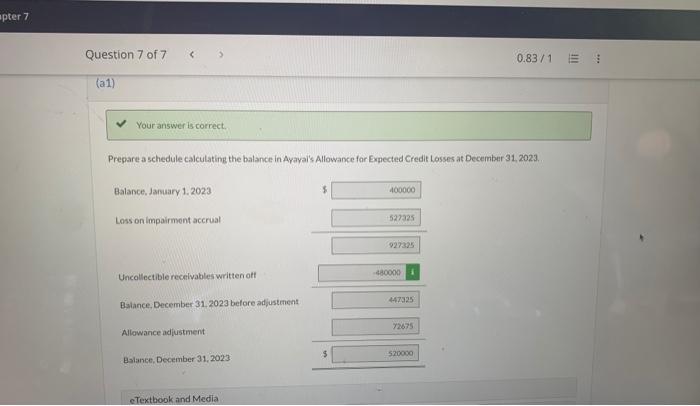

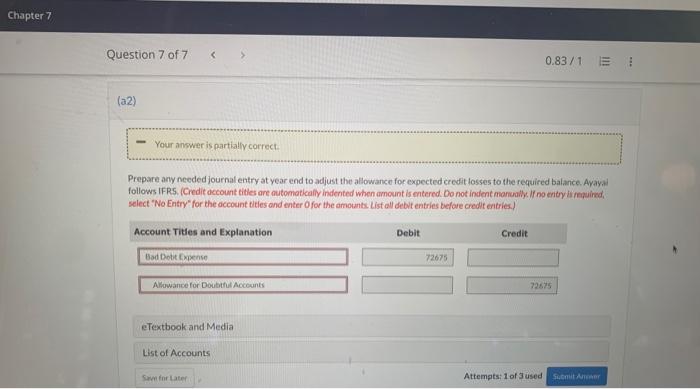

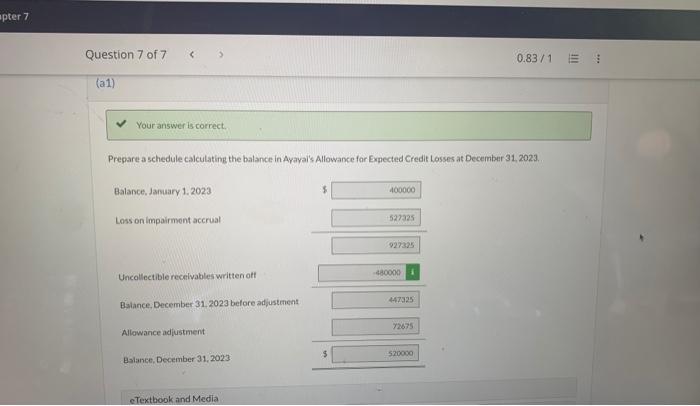

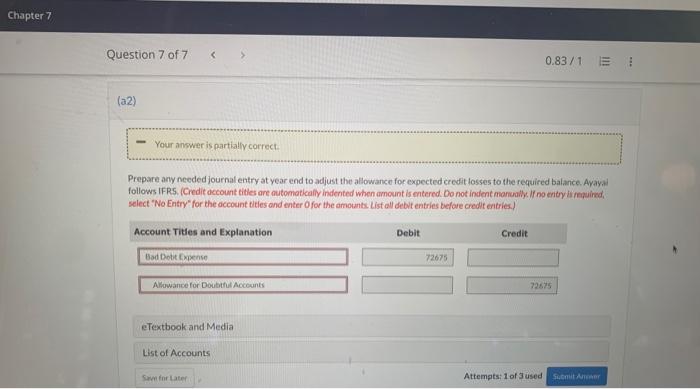

At Jamuary 1.2023, the credit balance of Ayayai Corpis Allowance for Expected Credit Losses was $400,000. During 2023, the loss on impairment entry was based on a percentage of net credit sales. Net sales for 2023 were $79 million, of which 899 were on account. Based on the information awallable at the time, the 2023 loss on impairment was estimated to be 0.75% of net credit sales. During 2023, uncollectible receivables amounting to $480.000 were written off against the allowance for expected credit losses. The company has estimated that at December 31,2023 , based on a review of the aged accounts receivable, the allowance for expected credit losses would be properly measurod at $520,000. (a1) Your answer is correct. Prepare a schedule calculating the balance in Ayayal's Allowance for Expected Credit Losses at December 31. 2023. Prepart a sehedule calculating the balance in Ayayai's Allowance for Expected Credit Losses at December 31,2023. Prepare any needed journal entry at year end to adjust the allowance for expected credit losses to the required balance. Ayay, follows IFRS. (Credit account titles are outomatkaliy indented when amount is entered. Do not indent manually. If no entey li mewind, select 'No Entry" for the account tities ond enter of for the amounts. List oll debit entries before credit entries.) thank you!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started