Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It is early in February 2017 and you are conducting the audit of Blast Off Airline's 2016 financial statements. Through discussion with Blast Off's Chief

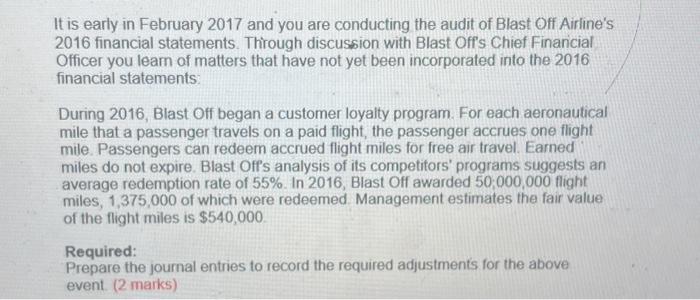

It is early in February 2017 and you are conducting the audit of Blast Off Airline's 2016 financial statements. Through discussion with Blast Off's Chief Financial Officer you learn of matters that have not yet been incorporated into the 2016 financial statements: During 2016, Blast Off began a customer loyalty program. For each aeronautical mile that a passenger travels on a paid flight, the passenger accrues one flight mile. Passengers can redeem accrued flight miles for free air travel. Earned miles do not expire. Blast Offs analysis of its competitors' programs suggests an average redemption rate of 55%. In 2016, Blast Off awarded 50,000,000 flight miles, 1,375,000 of which were redeemed. Management estimates the fair value of the flight miles is $540,000. Required: Prepare the journal entries to record the required adjustments for the above event. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started