Answered step by step

Verified Expert Solution

Question

1 Approved Answer

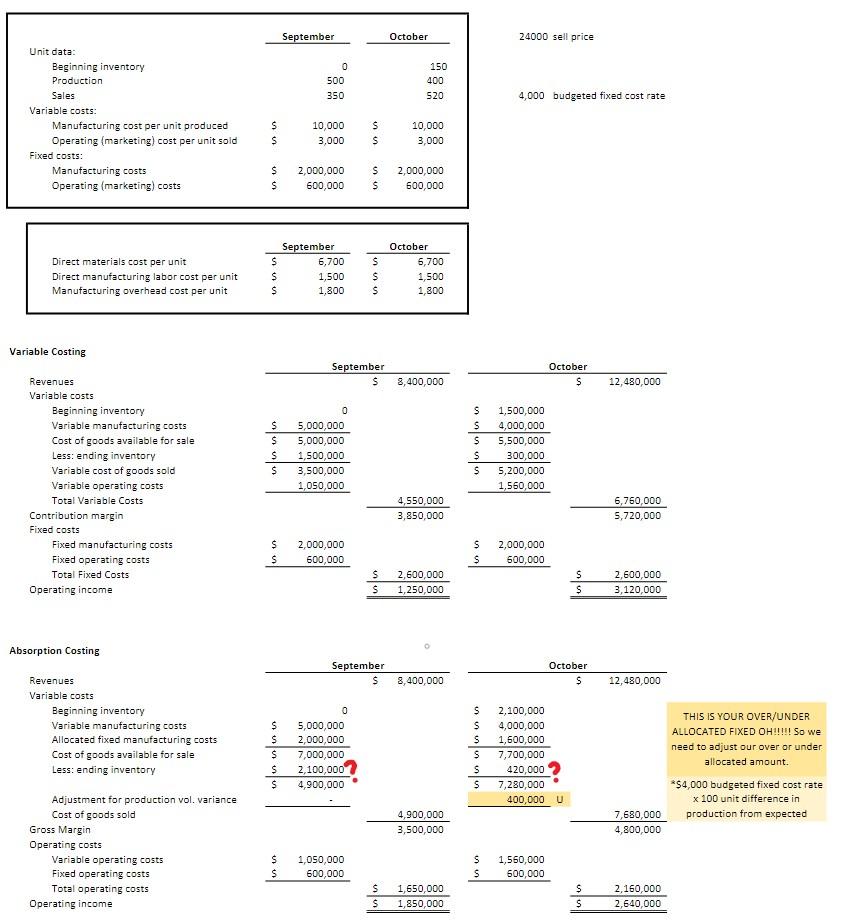

I just want to ask how to calculate the less: ending inventory as 2,100,000 and 420,000 in the picture (Mark with red question mark),

\

\

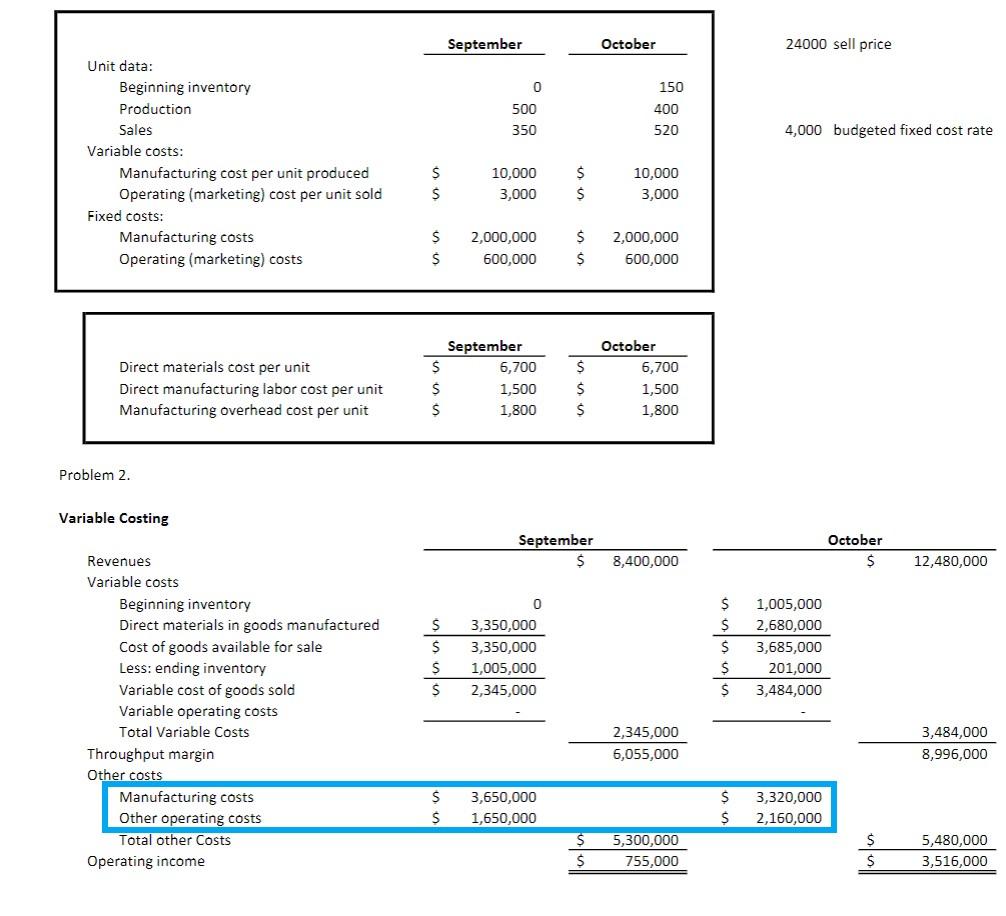

I just want to ask how to calculate the "less: ending inventory" as 2,100,000 and 420,000 in the picture (Mark with red question mark), and how to get "manufacturing costs"and "other operating costs"( marked with blue square).

Thank you!

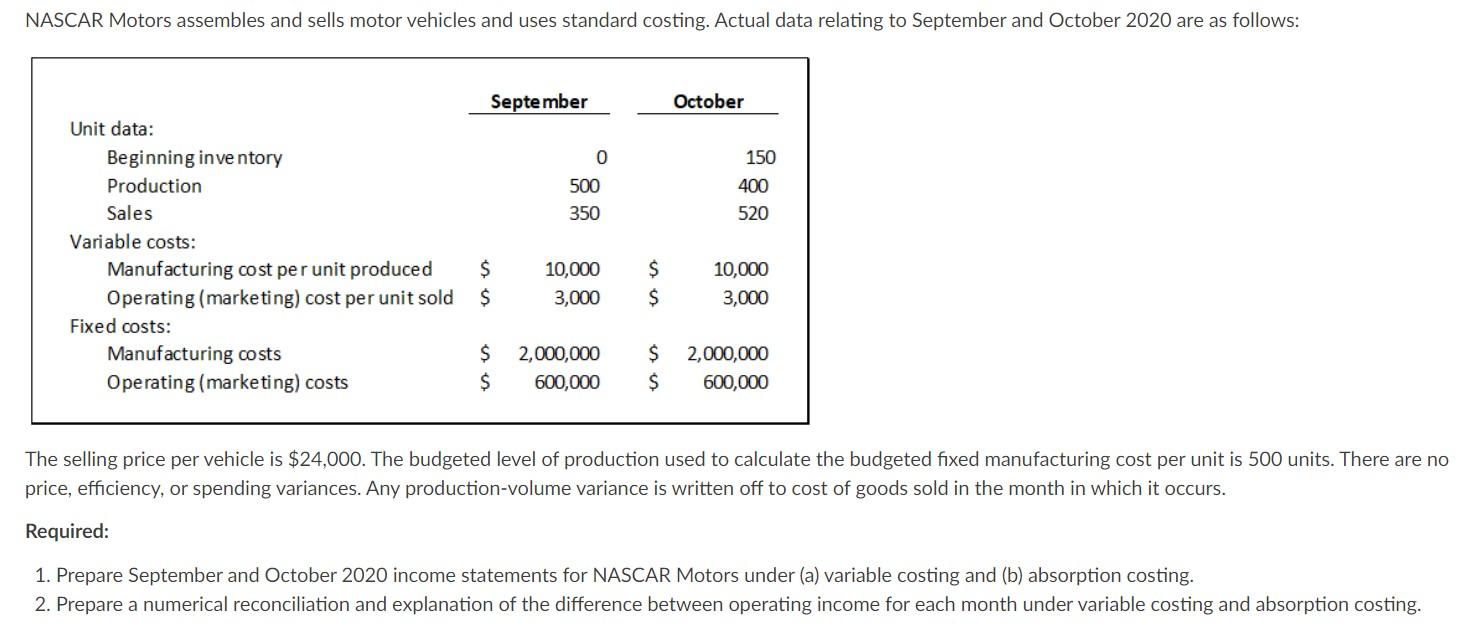

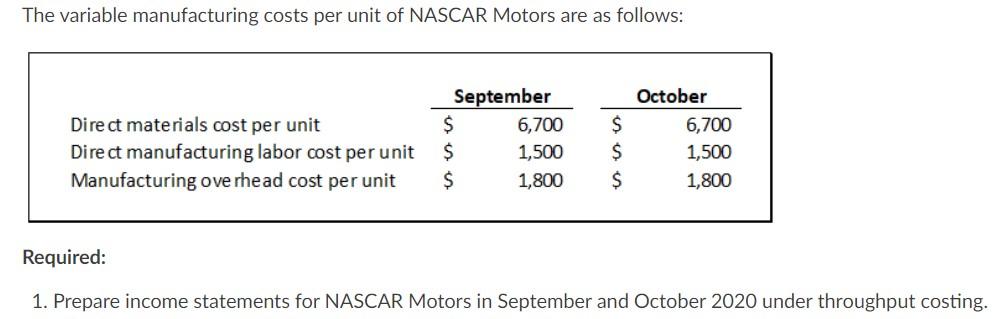

NASCAR Motors assembles and sells motor vehicles and uses standard costing. Actual data relating to September and October 2020 are as follows: September October 0 500 350 150 400 520 Unit data: Beginning inventory Production Sales Variable costs: Manufacturing cost per unit produced Operating (marketing) cost per unit sold Fixed costs: Manufacturing costs Operating (marketing) costs $ $ 10,000 3,000 $ $ 10,000 3,000 $ $ 2,000,000 600,000 $ $ 2,000,000 600,000 The selling price per vehicle is $24,000. The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 500 units. There are no price, efficiency, or spending variances. Any production-volume variance is written off to cost of goods sold in the month in which it occurs. Required: 1. Prepare September and October 2020 income statements for NASCAR Motors under (a) variable costing and (b) absorption costing. 2. Prepare a numerical reconciliation and explanation of the difference between operating income for each month under variable costing and absorption costing. September October 24000 sell price 0 500 350 150 400 520 4,000 budgeted fixed cost rate Unit data: Beginning inventory Production Sales Variable costs: Manufacturing cost per unit produced Operating (marketing) cost per unit sold Fixed costs: Manufacturing costs Operating (marketing) costs $ $ 10,000 3,000 S $ 10,000 3,000 $ $ 2,000,000 600,000 S S 2,000,000 600,000 Direct materials cost per unit Direct manufacturing labor cost per unit Manufacturing overhead cost per unit September $ 6,700 $ 1,500 $ 1,800 S S $ October 6,700 1,500 1,800 Variable Costing September $ October S 3,400,000 12,480,000 $ $ $ $ Revenues Variable costs Beginning inventory Variable manufacturing costs Cost of goods available for sale Less: ending inventory Variable cost of goods sold Variable operating costs Total Variable Costs Contribution margin Fixed costs Fixed manufacturing costs Fixed operating costs Total Fixed Costs Operating income 0 5,000,000 5,000,000 1,500,000 3,500,000 1,050,000 S S S S S 1,500,000 4,000,000 5,500,000 300,000 5,200,000 1,560,000 4,550,000 3,850,000 6,760,000 5,720,000 $ S 2,000,000 600,000 S $ 2,000,000 600,000 $ $ 2,600,000 1,250,000 $ $ 2,600,000 3,120,000 Absorption Costing September S October S 8,400,000 12,480,000 Revenues Variable costs Beginning inventory Variable manufacturing costs Allocated fixed manufacturing costs Cost of goods available for sale Less: ending inventory $ $ 0 5,000,000 2,000,000 7,000,000 2,100,000 4,900,000 S S S S S S 2,100,000 4,000,000 1,600,000 7,700,000 420,000 7,280,000 400,000 U $ $ THIS IS YOUR OVER/UNDER ALLOCATED FIXED OH!!!!! So we need to adjust our over or under allocated amount. *$4,000 budgeted fixed cost rate x 100 unit difference in production from expected 4,900,000 3,500,000 7,680,000 4,800,000 Adjustment for production vol. variance Cost of goods sold Gross Margin Operating costs Variable operating costs Fixed operating costs Total operating costs Operating income $ $ 1,050,000 600,000 S S 1,550,000 600,000 $ S 1,650,000 1,850,000 $ S 2,160,000 2,640,000 The variable manufacturing costs per unit of NASCAR Motors are as follows: Direct materials cost per unit Direct manufacturing labor cost per unit Manufacturing overhead cost per unit September $ 6,700 $ 1,500 $ 1,800 S $ $ October 6,700 1,500 1,800 Required: 1. Prepare income statements for NASCAR Motors in September and October 2020 under throughput costing. September October 24000 sell price 0 500 350 150 400 520 4,000 budgeted fixed cost rate Unit data: Beginning inventory Production Sales Variable costs: Manufacturing cost per unit produced Operating (marketing) cost per unit sold Fixed costs: Manufacturing costs Operating (marketing) costs $ S 10,000 3,000 $ $ 10,000 3,000 $ S 2,000,000 600,000 $ $ 2,000,000 600,000 Direct materials cost per unit Direct manufacturing labor cost per unit Manufacturing overhead cost per unit September S 6,700 S 1,500 S 1,800 $ $ $ October 6,700 1,500 1,800 Problem 2. Variable Costing September October $ 8,400,000 12,480,000 0 $ $ $ $ 3,350,000 3,350,000 1,005,000 2,345,000 S $ $ $ $ 1,005,000 2,680,000 3,685,000 201,000 3,484,000 Revenues Variable costs Beginning inventory Direct materials in goods manufactured Cost of goods available for sale Less: ending inventory Variable cost of goods sold Variable operating costs Total Variable Costs Throughput margin Other costs Manufacturing costs Other operating costs Total other Costs Operating income 2,345,000 6,055,000 3,484,000 8,996,000 $ S 3,650,000 1,650,000 $ $ 3,320,000 2,160,000 $ $ 5,300,000 755,000 $ $ 5,480,000 3,516,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started