Answered step by step

Verified Expert Solution

Question

1 Approved Answer

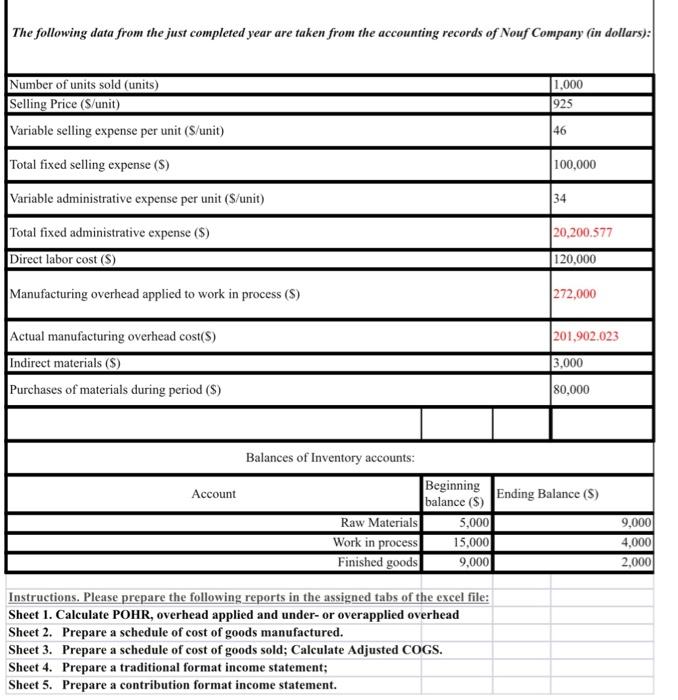

I NEED 1- schedule of COGS 2- TRADITIONAL income statment 3- CONRTribution income statment The following data from the just completed year are taken from

I NEED

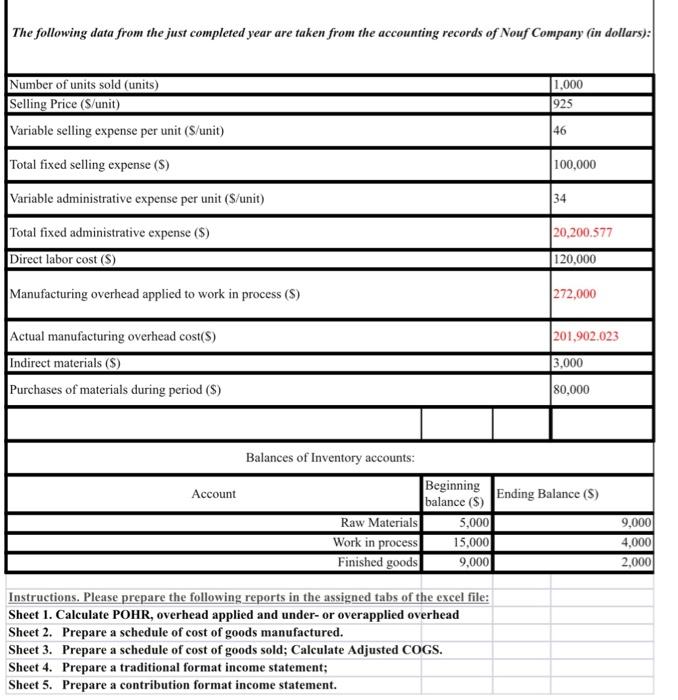

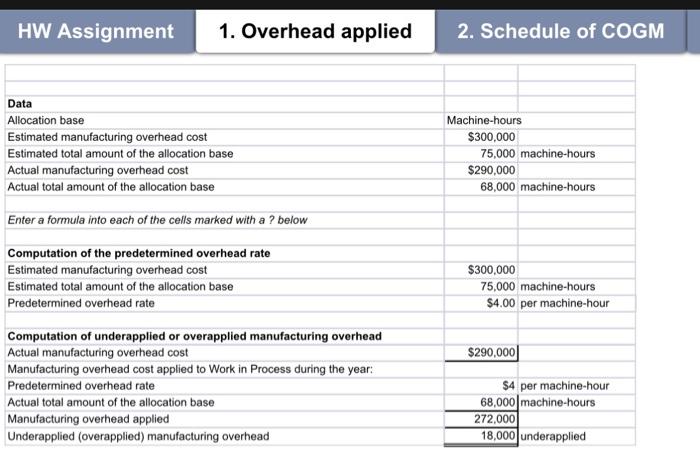

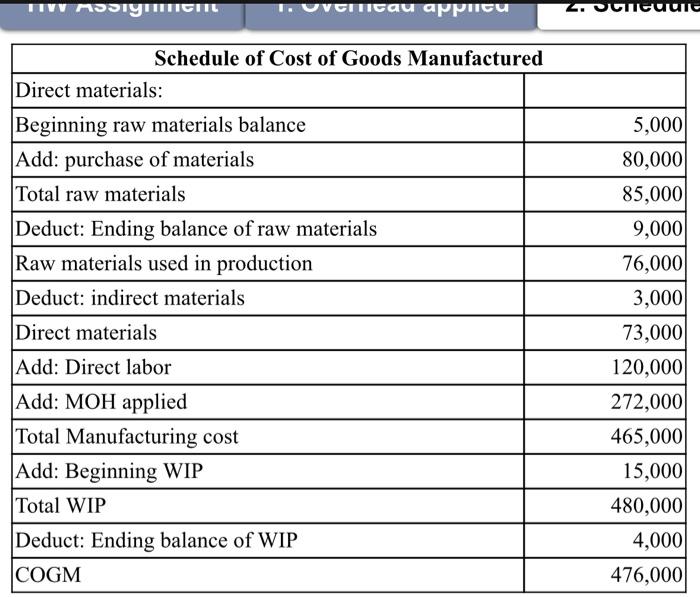

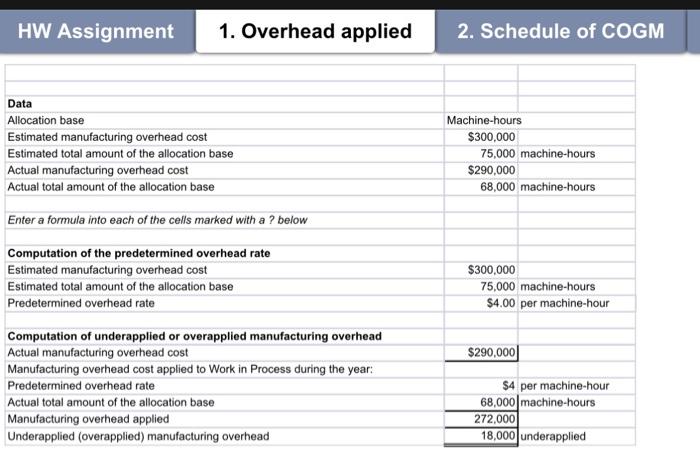

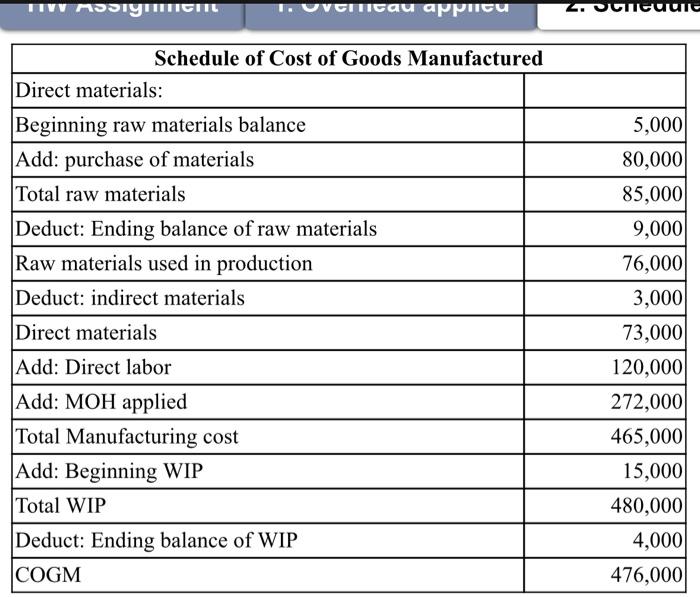

The following data from the just completed year are taken from the accounting records of Nouf Company (in dollars): Number of units sold (units) Selling Price (S/unit) Variable selling expense per unit ( $/ unit) Total fixed selling expense ($) 100,000 Variable administrative expense per unit (\$/unit) 34 Total fixed administrative expense ($) 20,200.577 Direct labor cost (S) 120,000 Manufacturing overhead applied to work in process (\$) 272,000 Actual manufacturing overhead cost($) 201,902.023 Indirect materials ($) 3,000 Purchases of materials during period ($) 80,000 Instructions. Please prepare the following reports in the assigned tabs of the excel file: Sheet 1. Calculate POHR, overhead applied and under- or overapplied overhead Sheet 2. Prepare a schedule of cost of goods manufactured. Sheet 3. Prepare a schedule of cost of goods sold; Calculate Adjusted COGS. Sheet 4. Prepare a traditional format income statement; Sheet 5. Prepare a contribution format income statement. HW Assignment 1. Overhead applied 2. Schedule of COGM Data Allocation base Machine-hours Estimated manufacturing overhead cost $300,000 Estimated total amount of the allocation base 75,000 machine-hours Actual manufacturing overhead cost $290,000 Actual total amount of the allocation base 68,000 machine-hours Enter a formula into each of the cells marked with a ? below Computation of the predetermined overhead rate Estimated manufacturing overhead cost $300,000 Estimated total amount of the allocation base 75,000 machine-hours Predetermined overhead rate Computation of underapplied or overapplied manufacturing overhead Actual manufacturing overhead cost Manufacturing overhead cost applied to Work in Process during the year: Predetermined overhead rate Actual total amount of the allocation base Manufacturing overhead applied Underapplied (overapplied) manufacturing overhead \begin{tabular}{|r|r|} \hline$290,000 & \\ \hline$4 & per machine-hour \\ \hline 68,000 & machine-hours \\ \hline 272,000 & \\ \hline 18,000 & underapplied \\ \hline \hline \end{tabular} \begin{tabular}{|l|r|} \hline \multicolumn{2}{|c|}{ Schedule of Cost of Goods Manufactured } \\ \hline Direct materials: & \\ \hline Beginning raw materials balance & 5,000 \\ \hline Add: purchase of materials & 80,000 \\ \hline Total raw materials & 85,000 \\ \hline Deduct: Ending balance of raw materials & 9,000 \\ \hline Raw materials used in production & 76,000 \\ \hline Deduct: indirect materials & 3,000 \\ \hline Direct materials & 73,000 \\ \hline Add: Direct labor & 120,000 \\ \hline Add: MOH applied & 272,000 \\ \hline Total Manufacturing cost & 465,000 \\ \hline Add: Beginning WIP & 15,000 \\ \hline Total WIP & 480,000 \\ \hline Deduct: Ending balance of WIP & 4,000 \\ \hline COGM & 476,000 \\ \hline \end{tabular} HW Assignment 1. Overhead applied 2. Schedule of COGM Schedule of Cost of Goods Sold HW Assignment 1. Overhead applied 2. Schedule of COGM 3. Schedule of COGS 4. Traditional IS Traditional Format Income Statement HW Assignment 1. Overhead applied 2. Schedule of COGM 3. Schedule of COGS 4. Traditional IS Contribution Format Income Statement 1- schedule of COGS

2- TRADITIONAL income statment

3- CONRTribution income statment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started