Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I Need All Work with steps in Word form, Not on page Thanks The Owen Corporation provided the following information for the month of September.

I Need All Work with steps in Word form, Not on page

Thanks

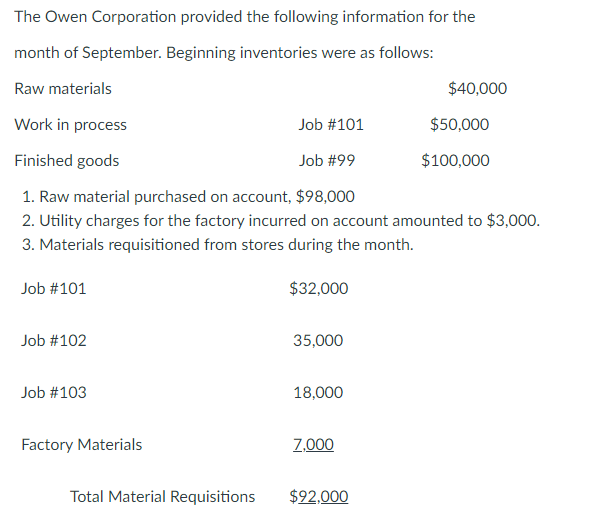

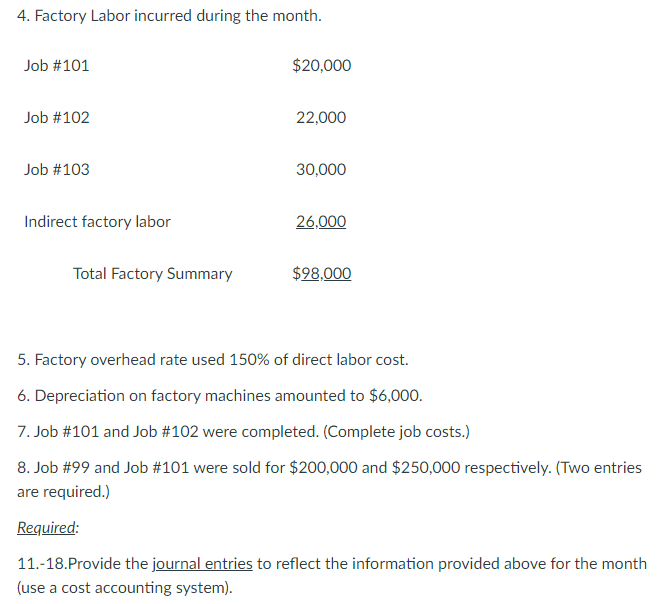

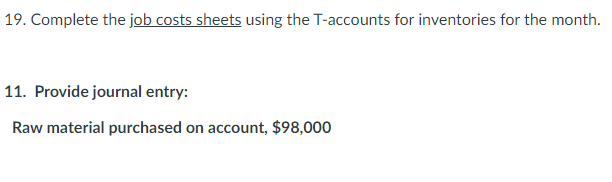

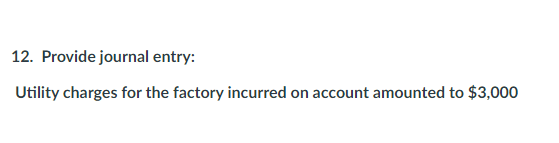

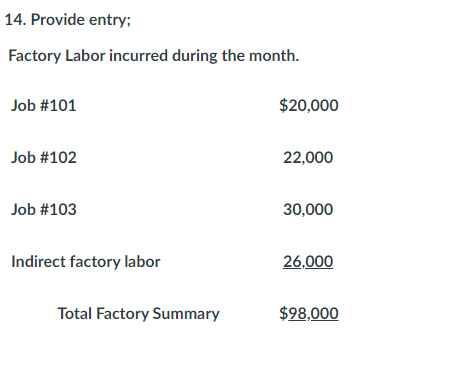

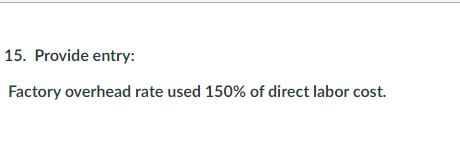

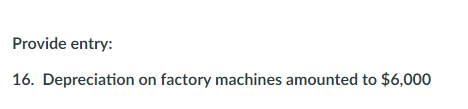

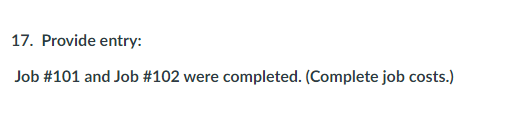

The Owen Corporation provided the following information for the month of September. Beginning inventories were as follows: $40,000 Raw materials Work in process Job #101 $50,000 Finished goods Job #99 $100,000 1. Raw material purchased on account, $98,000 2. Utility charges for the factory incurred on account amounted to $3,000. 3. Materials requisitioned from stores during the month. Job #101 $32,000 Job #102 35,000 Job #103 18,000 Factory Materials 7,000 Total Material Requisitions $92,000 4. Factory Labor incurred during the month. Job #101 $20,000 Job #102 22,000 Job #103 30,000 Indirect factory labor 26.000 Total Factory Summary $98.000 5. Factory overhead rate used 150% of direct labor cost. 6. Depreciation on factory machines amounted to $6,000. 7. Job #101 and Job #102 were completed. (Complete job costs.) 8. Job #99 and Job #101 were sold for $200,000 and $250,000 respectively. (Two entries are required.) Required: 11.-18.Provide the journal entries to reflect the information provided above for the month (use a cost accounting system). 19. Complete the job costs sheets using the T-accounts for inventories for the month. 11. Provide journal entry: Raw material purchased on account, $98,000 12. Provide journal entry: Utility charges for the factory incurred on account amounted to $3,000 13. Provide entry: Materials requisitioned from stores during the month. Job #101 $32,000 Job #102 35,000 Job #103 18,000 Factory Materials 7,000 Total Material Requisitions $92,000 14. Provide entry; Factory Labor incurred during the month. Job #101 $20,000 Job #102 22,000 Job #103 30,000 Indirect factory labor 26,000 Total Factory Summary $98,000 15. Provide entry: Factory overhead rate used 150% of direct labor cost. Provide entry: 16. Depreciation on factory machines amounted to $6,000 17. Provide entry: Job #101 and Job #102 were completed. (Complete job costs.) 18. Provide entry: Job #99 and Job #101 were sold for $200,000 and $250,000 respectively. (Two entries are required.) 19. Compute the ending RM, WIP anf FG: Raw materials $40,000+RM (BT)- RM (USED)= Work in process Job #101 $50,000+DM+DL+OH -FG mfg= Finished goods Job #99 $100,000+ FG mfg-FGsold=

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started