I need assistance.

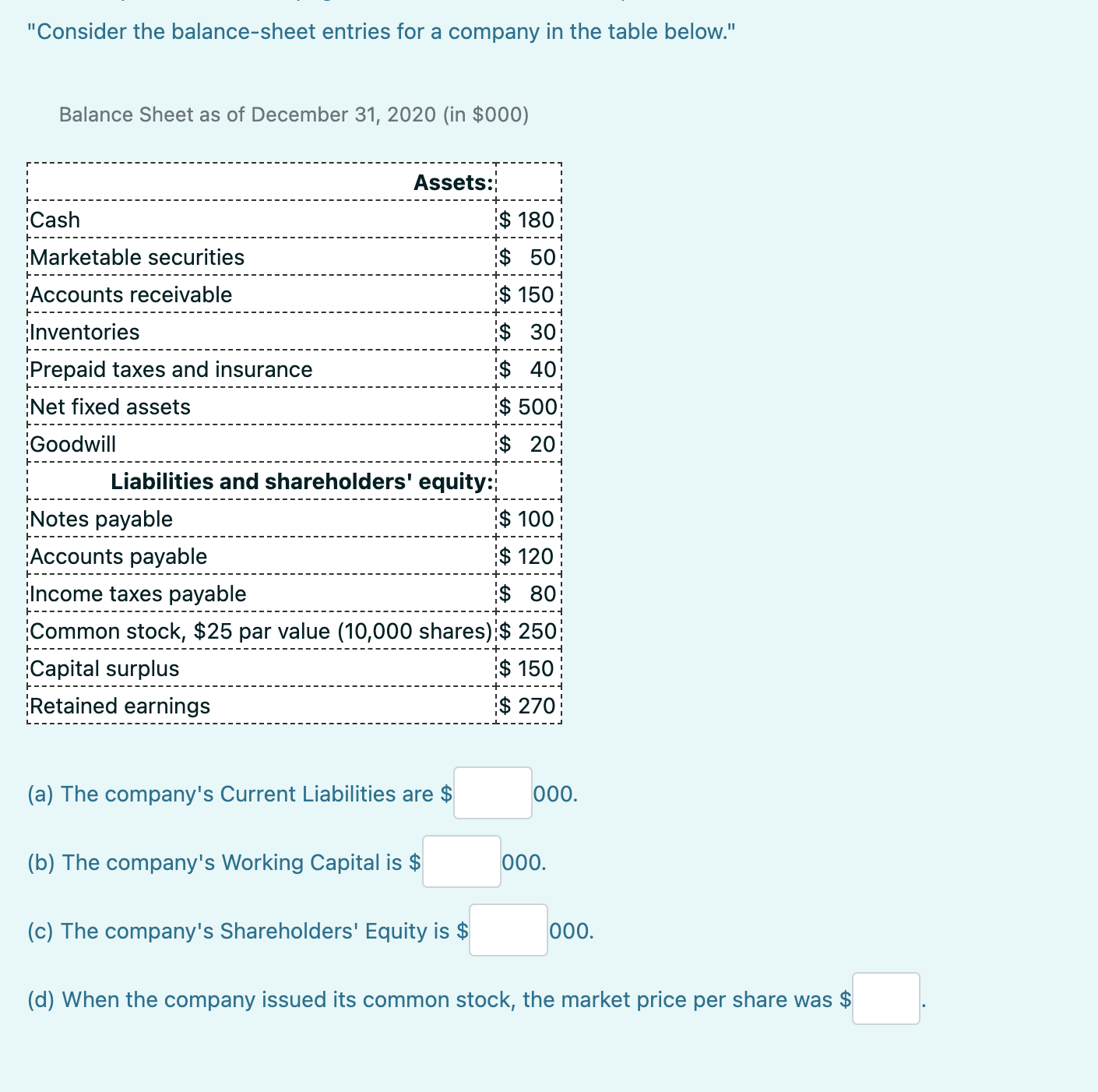

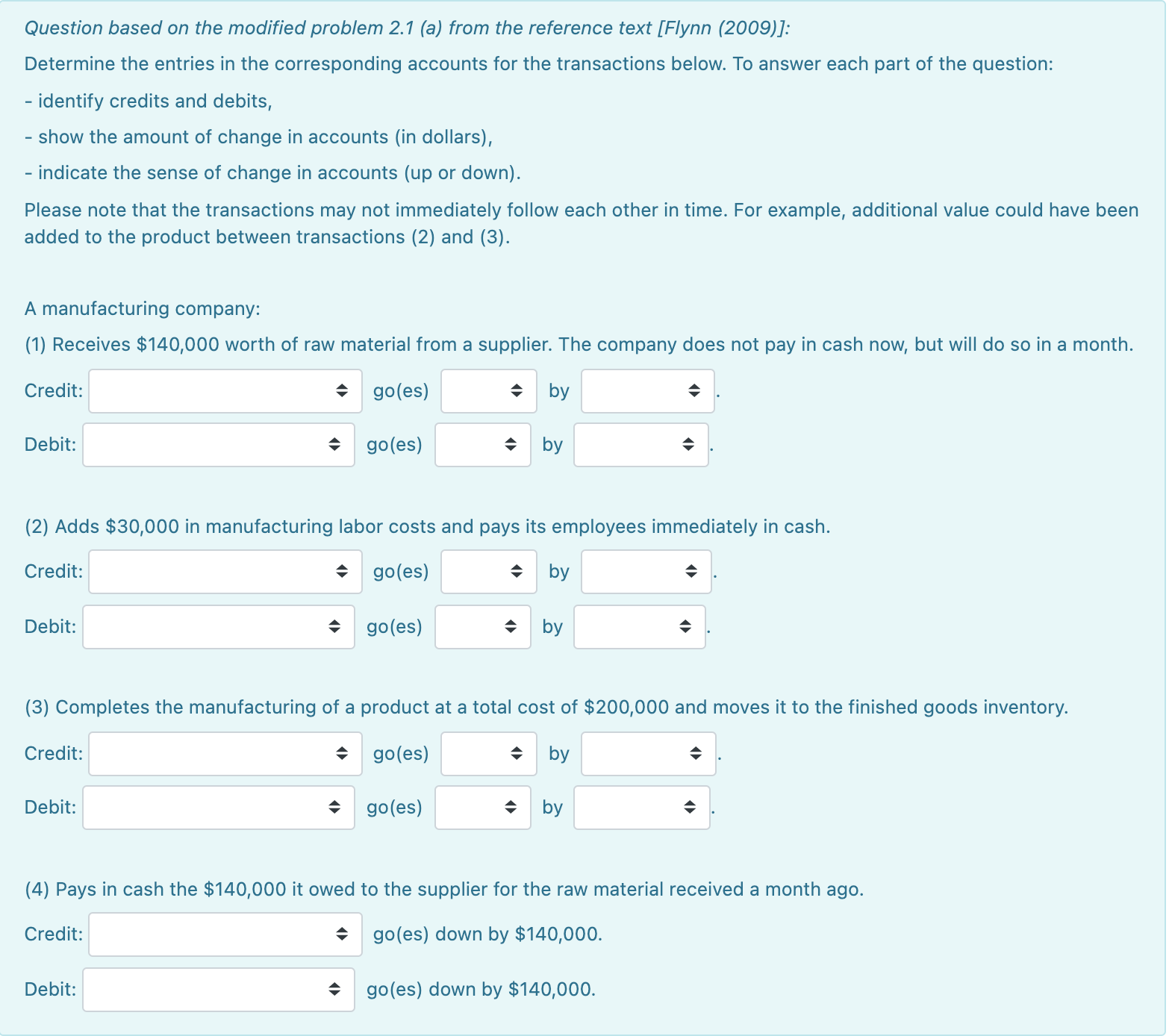

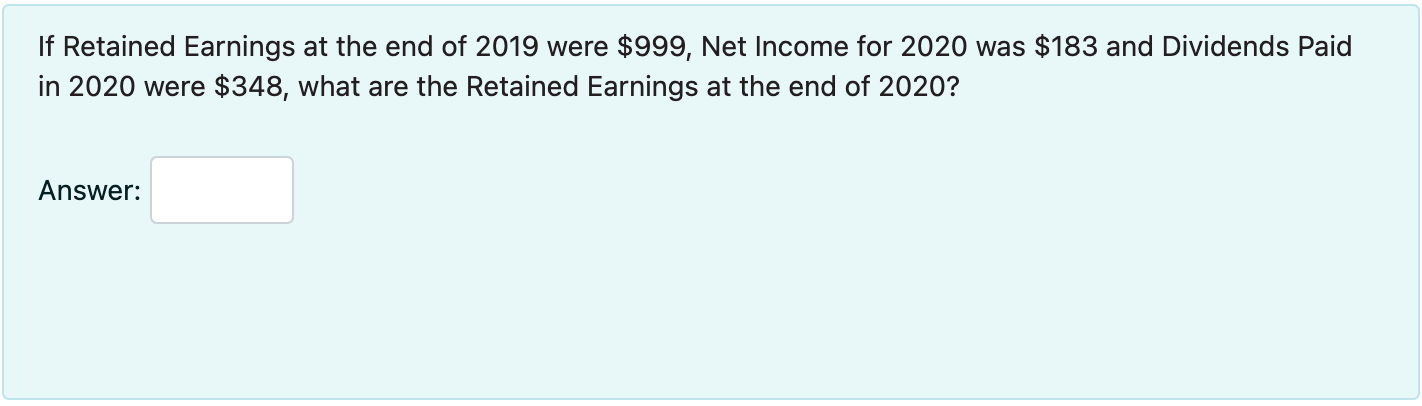

"Consider the balance-sheet entries for a company in the table below." Balance Sheet as of December 31, 2020 (in $000) Assets:; ---+ - Cash $ 180 P- --- + - - -----4 :Marketable securities $ 50: F-- + - - -- Accounts receivable $ 150 + - - :Inventories $ Prepaid taxes and insurance $ 40 + - - :Net fixed assets $ 500; + - - Goodwill $ 20 Liabilities and shareholders' equity:; :Notes payable $ 100 Accounts payable $ 120 + - - income taxes payable $ 80 - ---- --+ - ------4 Common stock, $25 par value (10,000 shares);$ 250 -+ - --- Capital surplus $ 150 + - - Retained earnings $ 270 (a) The company's Current Liabilities are $ 000. (b) The company's Working Capital is $ 000. (c) The company's Shareholders' Equity is $ 000. (d) When the company issued its common stock, the market price per share was $Question based on the modified problem 2.1 (a) from the reference text [Flynn (2009)]: Determine the entries in the corresponding accounts for the transactions below. To answer each part of the question: identify credits and debits, show the amount of change in accounts (in dollars), - indicate the sense of change in accounts (up or down). Please note that the transactions may not immediately follow each other in time. For example, additional value could have been added to the product between transactions (2) and (3). A manufacturing company: (1) Receives $140,000 worth of raw material from a supplier. The company does not pay in cash now, but will do so in a month. Credit: : go(es) c by :. Debit: c goles) t by c. (2) Adds $30,000 in manufacturing labor costs and pays its employees immediately in cash. Credit: go(es) by $. Debit: goles) : by $. (3) Completes the manufacturing of a product at a total cost of $200,000 and moves it to the finished goods inventory. Credit: c go(es) t by :. Debit: c goles) : by t. (4) Pays in cash the $140,000 it owed to the supplier for the raw material received a month ago. Credit: : go(es) down by $140,000. Debit: goles) down by $140,000. If Retained Earnings at the end of 2019 were $999, Net Income for 2020 was $183 and Dividends Paid in 2020 were $348, what are the Retained Earnings at the end of 2020