Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need expert answers using EXCEL or financial calculator. Thank you Your aunt is 70 years old and she has $1,976,056 saved for her retirement.

I need expert answers using EXCEL or financial calculator. Thank you

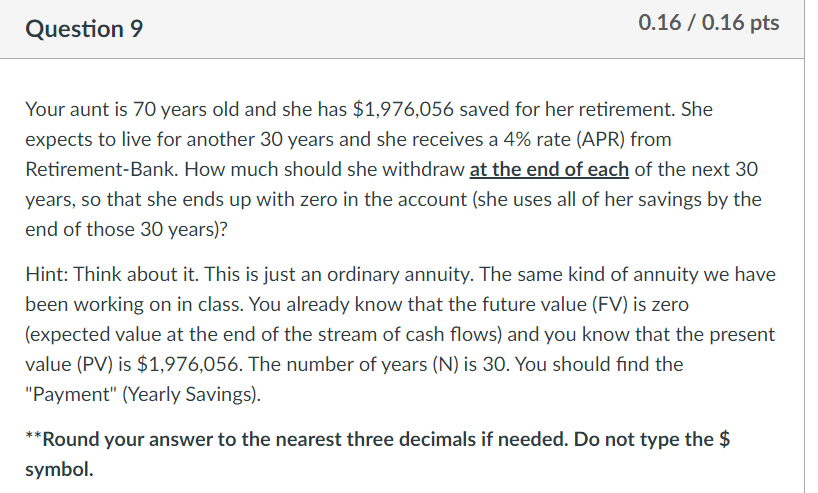

Your aunt is 70 years old and she has $1,976,056 saved for her retirement. She expects to live for another 30 years and she receives a 4% rate (APR) from Retirement-Bank. How much should she withdraw at the end of each of the next 30 years, so that she ends up with zero in the account (she uses all of her savings by the end of those 30 years)? Hint: Think about it. This is just an ordinary annuity. The same kind of annuity we have been working on in class. You already know that the future value (FV) is zero (expected value at the end of the stream of cash flows) and you know that the present value (PV) is $1,976,056. The number of years (N) is 30 . You should find the "Payment" (Yearly Savings). Round your answer to the nearest three decimals if needed. Do not type the $ symbolStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started