i need help on D, E, F, and G.

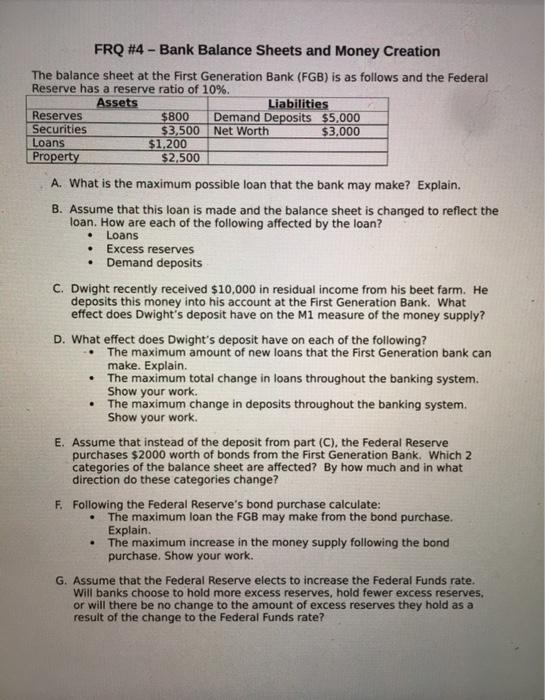

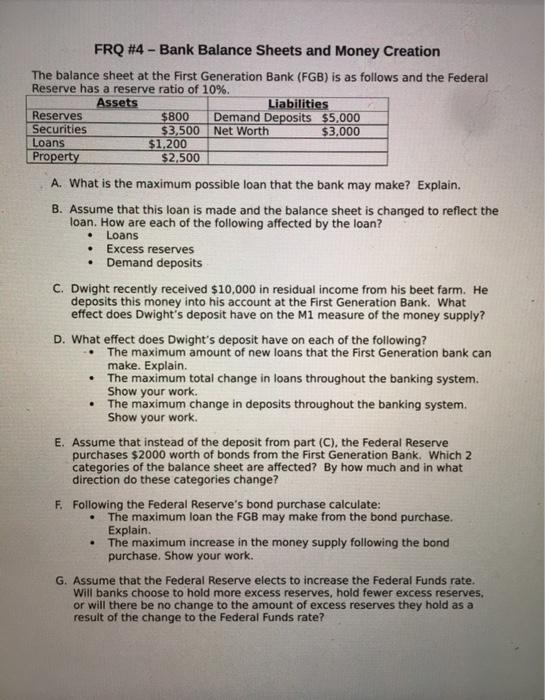

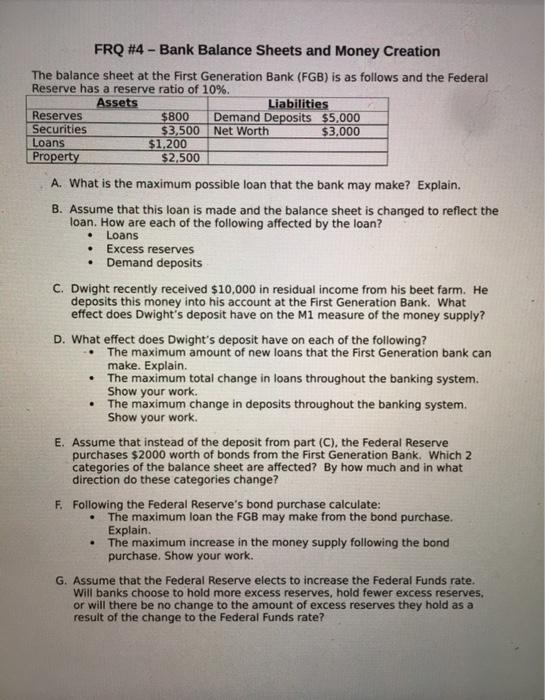

FRQ #4 - Bank Balance Sheets and Money Creation The balance sheet at the First Generation Bank (FGB) is as follows and the Federal Reserve has a reserve ratio of 10%. Assets Liabilities Reserves $800 Demand Deposits $5,000 Securities $3,500 Net Worth $3,000 Loans $1,200 Property $2,500 . . A. What is the maximum possible loan that the bank may make? Explain. B. Assume that this loan is made and the balance sheet is changed to reflect the loan. How are each of the following affected by the loan? Loans Excess reserves Demand deposits C. Dwight recently received $10,000 in residual income from his beet farm. He deposits this money into his account at the First Generation Bank. What effect does Dwight's deposit have on the M1 measure of the money supply? D. What effect does Dwight's deposit have on each of the following? The maximum amount of new loans that the First Generation bank can make. Explain. The maximum total change in loans throughout the banking system. Show your work. The maximum change in deposits throughout the banking system. Show your work E. Assume that instead of the deposit from part (C), the Federal Reserve purchases $2000 worth of bonds from the First Generation Bank. Which 2 categories of the balance sheet are affected? By how much and in what direction do these categories change? F. Following the Federal Reserve's bond purchase calculate: The maximum loan the FGB may make from the bond purchase. Explain The maximum increase in the money supply following the band purchase. Show your work. G. Assume that the Federal Reserve elects to increase the Federal Funds rate. Will banks choose to hold more excess reserves, hold fewer excess reserves, or will there be no change to the amount of excess reserves they hold as a result of the change to the Federal Funds rate? . FRQ #4 - Bank Balance Sheets and Money Creation The balance sheet at the First Generation Bank (FGB) is as follows and the Federal Reserve has a reserve ratio of 10%. Assets Liabilities Reserves $800 Demand Deposits $5,000 Securities $3,500 Net Worth $3,000 Loans $1,200 Property $2,500 . . A. What is the maximum possible loan that the bank may make? Explain. B. Assume that this loan is made and the balance sheet is changed to reflect the loan. How are each of the following affected by the loan? Loans Excess reserves Demand deposits C. Dwight recently received $10,000 in residual income from his beet farm. He deposits this money into his account at the First Generation Bank. What effect does Dwight's deposit have on the M1 measure of the money supply? D. What effect does Dwight's deposit have on each of the following? The maximum amount of new loans that the First Generation bank can make. Explain. The maximum total change in loans throughout the banking system. Show your work. The maximum change in deposits throughout the banking system. Show your work E. Assume that instead of the deposit from part (C), the Federal Reserve purchases $2000 worth of bonds from the First Generation Bank. Which 2 categories of the balance sheet are affected? By how much and in what direction do these categories change? F. Following the Federal Reserve's bond purchase calculate: The maximum loan the FGB may make from the bond purchase. Explain The maximum increase in the money supply following the band purchase. Show your work. G. Assume that the Federal Reserve elects to increase the Federal Funds rate. Will banks choose to hold more excess reserves, hold fewer excess reserves, or will there be no change to the amount of excess reserves they hold as a result of the change to the Federal Funds rate