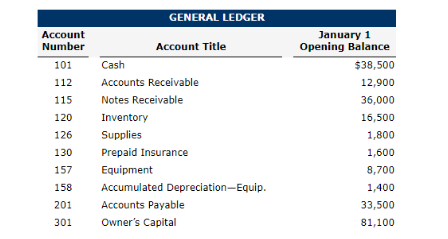

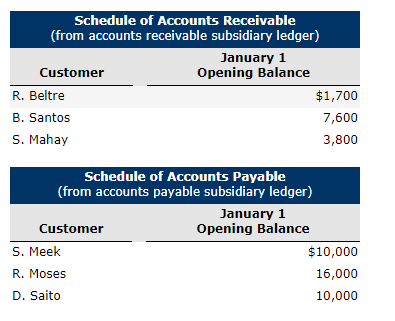

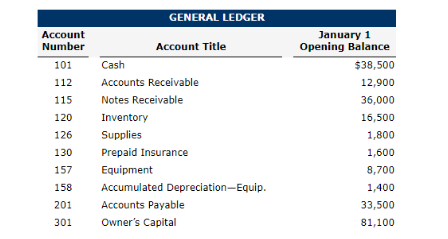

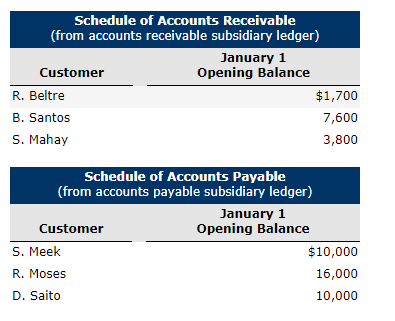

I need help posting to the general ledger. Accounting Cycle Review 7-01 a1-f2 Pharoah Co. uses a perpetual inventory system and both an accounts receivable and an accounts payable subsidiary ledger. Balances related to both the general ledger and the subsidiary ledger for Pharoah are indicated in the working papers. Presented below are a series of transactions for Pharoah Co. for the month of January. Credit sales terms are 2/10, n/30. The cost of all merchandise sold was 60% of the sales price.

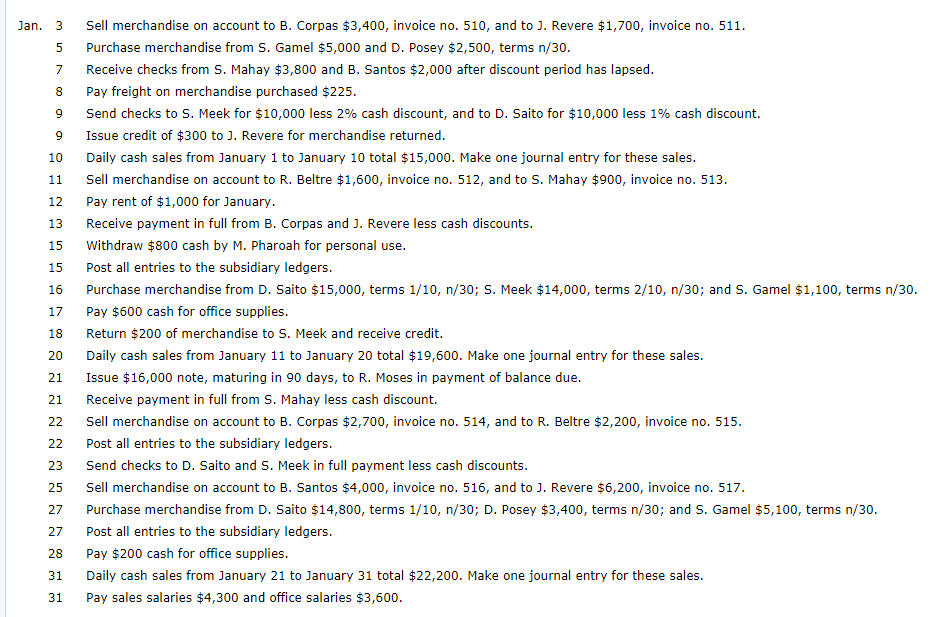

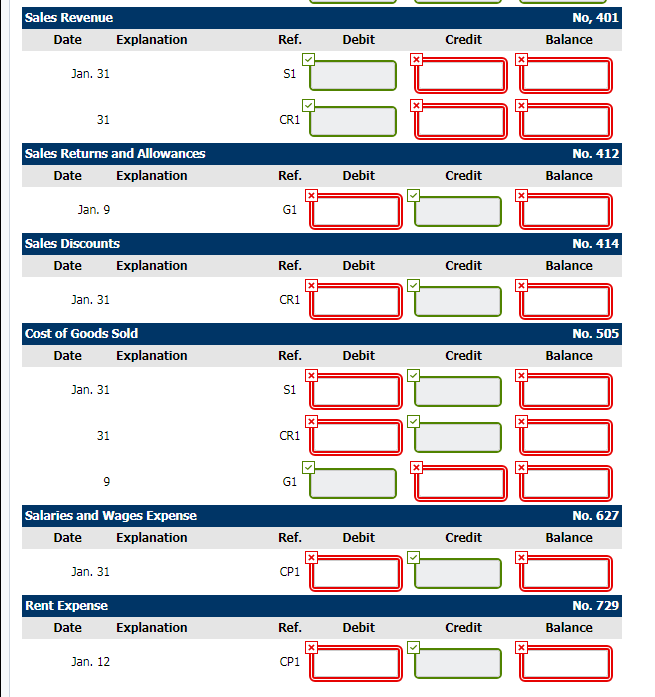

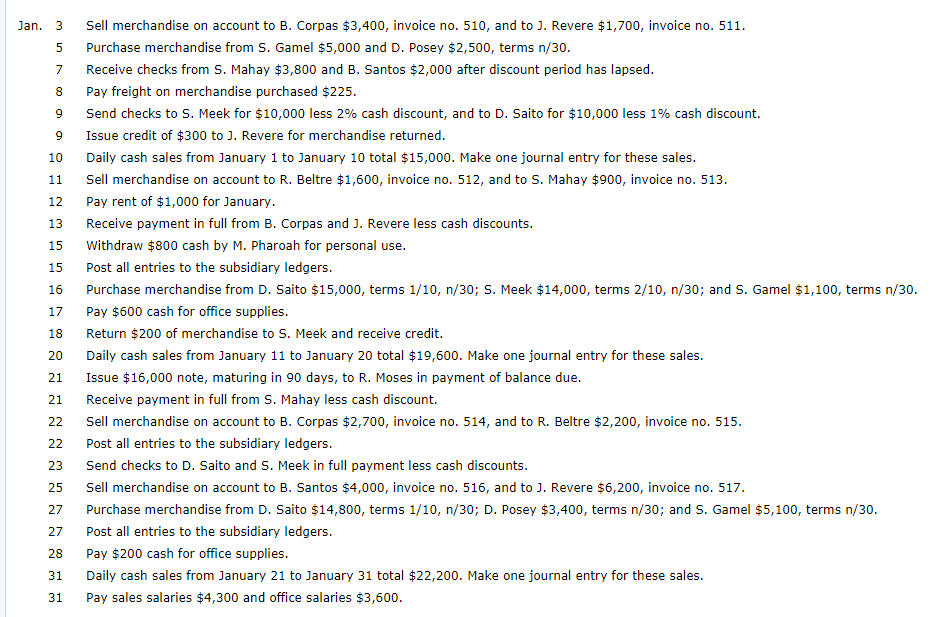

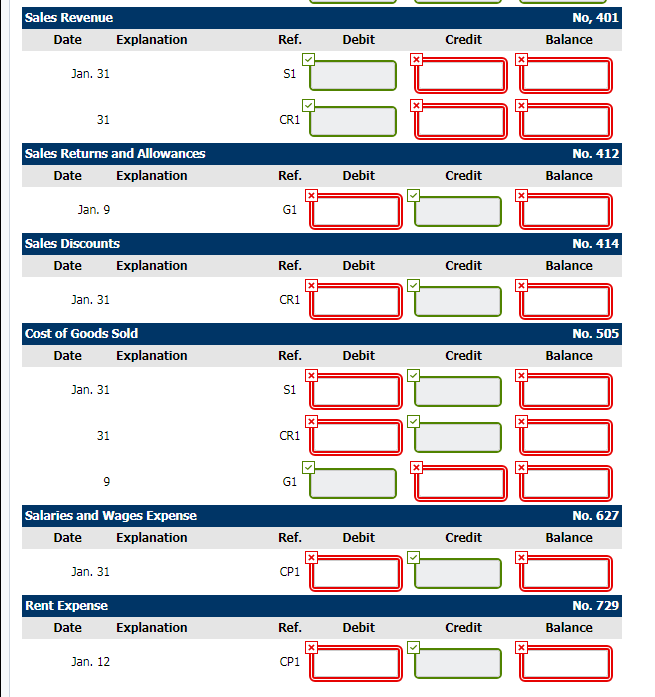

GENERAL LEDGER Account Number 101 112 115 120 126 130 157 158 201 301 Account Title Cash Accounts Receivable Notes Receivable Inventory Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equip. Accounts Payable Owner's Capital January 1 Opening Balance $38,500 12,900 36,000 16,500 1,800 1,600 8,700 1,400 33,500 81,100 Schedule of Accounts Receivable (from accounts receivable subsidiary ledger) January 1 Customer Opening Balance R. Beltre $1,700 B. Santos 7,600 S. Mahay 3,800 Schedule of Accounts Payable (from accounts payable subsidiary ledger) January 1 Customer Opening Balance S. Meek $10,000 R. Moses 16,000 D. Saito 10,000 Jan. 3 5 7 8 9 9 10 11 12 13 15 15 16 17 18 20 21 21 22 22 23 25 27 27 28 31 31 Sell merchandise on account to B. Corpas $3,400, invoice no. 510, and to J. Revere $1,700, invoice no. 511. Purchase merchandise from S. Gamel $5,000 and D. Posey $2,500, terms n/30. Receive checks from S. Mahay $3,800 and B. Santos $2,000 after discount period has lapsed. Pay freight on merchandise purchased $225. Send checks to S. Meek for $10,000 less 2% cash discount, and to D. Saito for $10,000 less 1% cash discount. Issue credit of $300 to ). Revere for merchandise returned. Daily cash sales from January 1 to January 10 total $15,000. Make one journal entry for these sales. Sell merchandise on account to R. Beltre $1,600, invoice no. 512, and to S. Mahay $900, invoice no. 513. Pay rent of $1,000 for January. Receive payment in full from B. Corpas and ). Revere less cash discounts. Withdraw $800 cash by M. Pharoah for personal use. Post all entries to the subsidiary ledgers. Purchase merchandise from D. Saito $15,000, terms 1/10, n/30; S. Meek $14,000, terms 2/10, n/30; and S. Gamel $1,100, terms n/30. Pay $600 cash for office supplies. Return $200 of merchandise to S. Meek and receive credit. Daily cash sales from January 11 to January 20 total $19,600. Make one journal entry for these sales. Issue $16,000 note, maturing in 90 days, to R. Moses in payment of balance due. Receive payment in full from S. Mahay less cash discount. Sell merchandise on account to B. Corpas $2,700, invoice no. 514, and to R. Beltre $2,200, invoice no. 515. Post all entries to the subsidiary ledgers. Send checks to D. Saito and S. Meek in full payment less cash discounts. Sell merchandise on account to B. Santos $4,000, invoice no. 516, and to J. Revere $6,200, invoice no. 517. Purchase merchandise from D. Saito $14,800, terms 1/10, n/30; D. Posey $3,400, terms n/30; and S. Gamel $5,100, terms n/30. Post all entries to the subsidiary ledgers. Pay $200 cash for office supplies. Daily cash sales from January 21 to January 31 total $22,200. Make one journal entry for these sales. Pay sales salaries $4,300 and office salaries $3,600. Inventory Date No. 120 Balance Explanation Ref. Debit Credit Jan. 1 Balance 20000 200 Supplies Date No. 125 Balance Explanation Ref. Debit Credit Jan. 1 Balance 1700 31 Supplies Date No. 125 Balance Explanation Ref. Debit Credit Jan. 1 Balance 1700 Prepaid Insurance Date Explanation No. 130 Balance Ref. Debit Credit Jan. 1 Balance Equipment Date 2100 No. 157 Balance Explanation Ref. Debit Credit Jan. 1 Balance V Accumulated Depreciation Equipment Date Explanation No. 158 Balance Ref. Debit Credit Jan. 1 Balance Notes Payable Date 1600 No. 200 Balance Explanation Ref. Debit Credit Jan. 21 G1 16000 16000 Accounts Payable Date Explanation No. 201 Balance Ref. Debit Credit Jan. 1 Balance Sales Revenue Date Explanation No, 401 Balance Ref. Debit Credit Jan. 31 Sales Returns and Allowances Date Explanation No. 412 Balance Ref. Debit Credit Jan. 9 Sales Discounts Date Explanation No. 414 Balance Ref. Debit Credit Jan. 31 Cost of Goods Sold Date Explanation No. 505 Balance Ref. Debit Credit Jan. 31 Salaries and Wages Expense Date Explanation No. 627 Balance Ref. Debit Credit Jan. 31 Rent Expense Date Explanation No. 729 Balance Ref. Debit Credit Jan. 12 GENERAL LEDGER Account Number 101 112 115 120 126 130 157 158 201 301 Account Title Cash Accounts Receivable Notes Receivable Inventory Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equip. Accounts Payable Owner's Capital January 1 Opening Balance $38,500 12,900 36,000 16,500 1,800 1,600 8,700 1,400 33,500 81,100 Schedule of Accounts Receivable (from accounts receivable subsidiary ledger) January 1 Customer Opening Balance R. Beltre $1,700 B. Santos 7,600 S. Mahay 3,800 Schedule of Accounts Payable (from accounts payable subsidiary ledger) January 1 Customer Opening Balance S. Meek $10,000 R. Moses 16,000 D. Saito 10,000 Jan. 3 5 7 8 9 9 10 11 12 13 15 15 16 17 18 20 21 21 22 22 23 25 27 27 28 31 31 Sell merchandise on account to B. Corpas $3,400, invoice no. 510, and to J. Revere $1,700, invoice no. 511. Purchase merchandise from S. Gamel $5,000 and D. Posey $2,500, terms n/30. Receive checks from S. Mahay $3,800 and B. Santos $2,000 after discount period has lapsed. Pay freight on merchandise purchased $225. Send checks to S. Meek for $10,000 less 2% cash discount, and to D. Saito for $10,000 less 1% cash discount. Issue credit of $300 to ). Revere for merchandise returned. Daily cash sales from January 1 to January 10 total $15,000. Make one journal entry for these sales. Sell merchandise on account to R. Beltre $1,600, invoice no. 512, and to S. Mahay $900, invoice no. 513. Pay rent of $1,000 for January. Receive payment in full from B. Corpas and ). Revere less cash discounts. Withdraw $800 cash by M. Pharoah for personal use. Post all entries to the subsidiary ledgers. Purchase merchandise from D. Saito $15,000, terms 1/10, n/30; S. Meek $14,000, terms 2/10, n/30; and S. Gamel $1,100, terms n/30. Pay $600 cash for office supplies. Return $200 of merchandise to S. Meek and receive credit. Daily cash sales from January 11 to January 20 total $19,600. Make one journal entry for these sales. Issue $16,000 note, maturing in 90 days, to R. Moses in payment of balance due. Receive payment in full from S. Mahay less cash discount. Sell merchandise on account to B. Corpas $2,700, invoice no. 514, and to R. Beltre $2,200, invoice no. 515. Post all entries to the subsidiary ledgers. Send checks to D. Saito and S. Meek in full payment less cash discounts. Sell merchandise on account to B. Santos $4,000, invoice no. 516, and to J. Revere $6,200, invoice no. 517. Purchase merchandise from D. Saito $14,800, terms 1/10, n/30; D. Posey $3,400, terms n/30; and S. Gamel $5,100, terms n/30. Post all entries to the subsidiary ledgers. Pay $200 cash for office supplies. Daily cash sales from January 21 to January 31 total $22,200. Make one journal entry for these sales. Pay sales salaries $4,300 and office salaries $3,600. Inventory Date No. 120 Balance Explanation Ref. Debit Credit Jan. 1 Balance 20000 200 Supplies Date No. 125 Balance Explanation Ref. Debit Credit Jan. 1 Balance 1700 31 Supplies Date No. 125 Balance Explanation Ref. Debit Credit Jan. 1 Balance 1700 Prepaid Insurance Date Explanation No. 130 Balance Ref. Debit Credit Jan. 1 Balance Equipment Date 2100 No. 157 Balance Explanation Ref. Debit Credit Jan. 1 Balance V Accumulated Depreciation Equipment Date Explanation No. 158 Balance Ref. Debit Credit Jan. 1 Balance Notes Payable Date 1600 No. 200 Balance Explanation Ref. Debit Credit Jan. 21 G1 16000 16000 Accounts Payable Date Explanation No. 201 Balance Ref. Debit Credit Jan. 1 Balance Sales Revenue Date Explanation No, 401 Balance Ref. Debit Credit Jan. 31 Sales Returns and Allowances Date Explanation No. 412 Balance Ref. Debit Credit Jan. 9 Sales Discounts Date Explanation No. 414 Balance Ref. Debit Credit Jan. 31 Cost of Goods Sold Date Explanation No. 505 Balance Ref. Debit Credit Jan. 31 Salaries and Wages Expense Date Explanation No. 627 Balance Ref. Debit Credit Jan. 31 Rent Expense Date Explanation No. 729 Balance Ref. Debit Credit Jan. 12