I need help with part A, I got part B

I need help with part A, I got part B

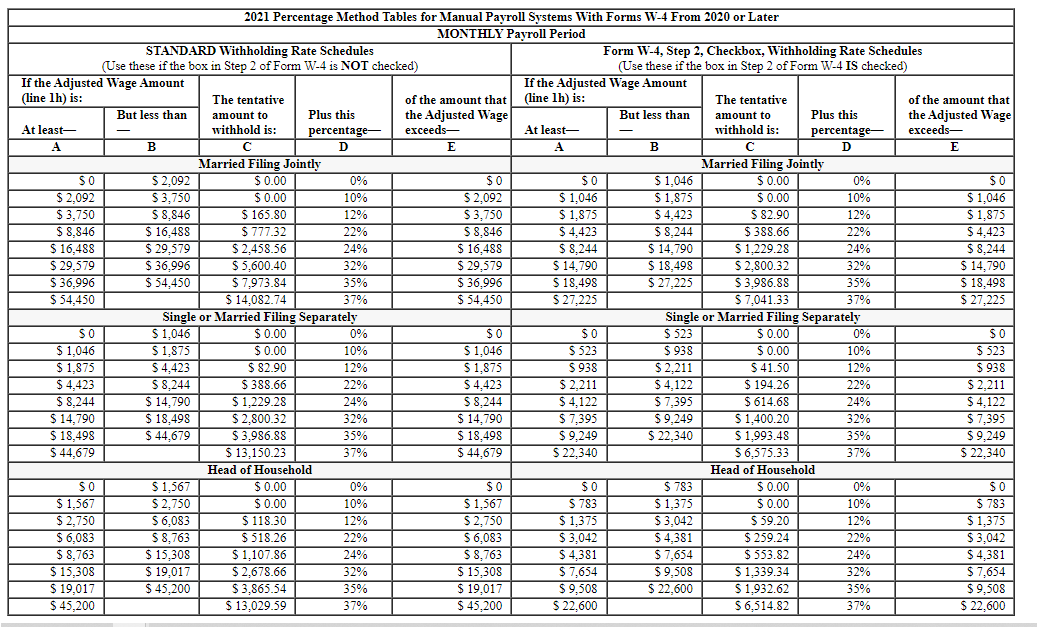

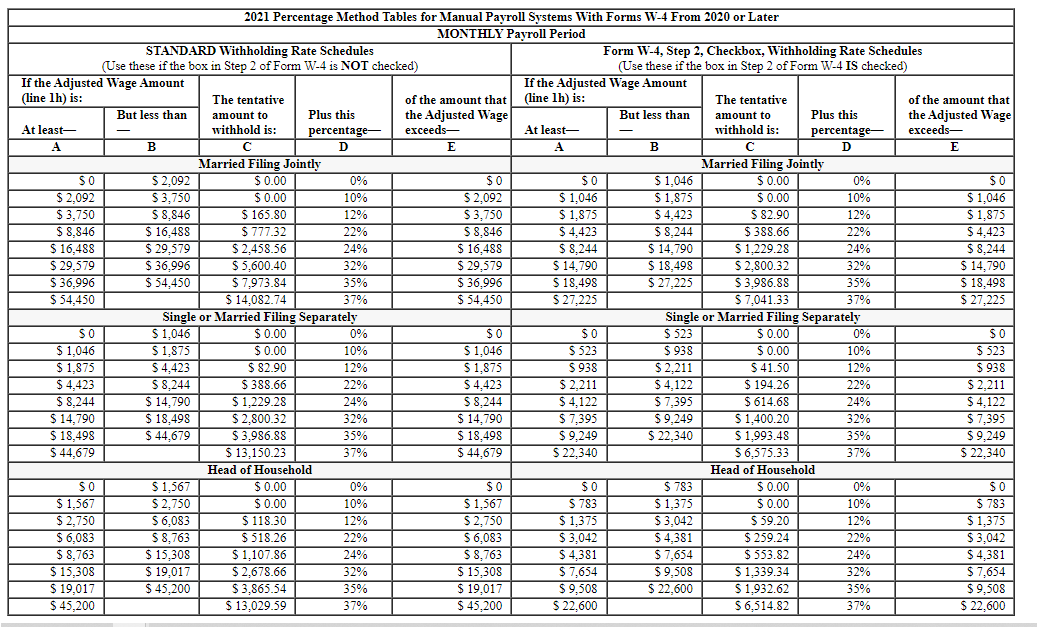

N Kendall, who earned $130.800 during 2021, is paid on a monthly basis, is married, (spouse does not work) and claims two dependents who are under the age of 17. Use the Percentage Method Tables for Automated Payroll Systems. Use percentage method tables for automated systems eBook Requlred: .. What is Kendall's federal tax withholding for each pay period? b. What is Kendall's FICA withholding for each pay period? Note: For all requlrements, round your Intermediate computations and final answers to 2 decimal places. Amount a. Federal tax withholdings b. Total FICA withholding 2021 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later MONTHLY Payroll Period STANDARD Withholding Rate Schedules Form W-4, Step 2, Checkbox, Withholding Rate Schedules (Use these if the box in Step 2 of Form W-4 is NOT checked) (Use these if the box in Step 2 of Form W-4 IS checked) If the Adjusted Wage Amount If the Adjusted Wage Amount (line 1h) is: The tentative of the amount that (line 1h) is: The tentative of the amount that But less than amount to Plus this the Adjusted Wage But less than amount to Plus this the Adjusted Wage At least- withhold is: percentage- exceeds- At least- withhold is: percentage- exceeds- A B D E A B D E Married Filing Jointly Married Filing Jointly So $ 2,092 $ 0.00 0% SO $0 $ 1,046 $ 0.00 0% $0 $ 2,092 $ 3,750 $ 0.00 10% $ 2,092 $ 1,046 $ 1,875 $ 0.00 10% $ 1,046 $3,750 $ 8,846 $ 165.80 12% $3,750 $ 1,875 $ 4,423 $ 82.90 12% $ 1,875 $ 8,846 $ 16,488 $777.32 22% $ 8,846 $ 4,423 $ 8,244 $ 388.66 22% $ 4,423 $ 16,488 $ 29,579 $ 2.458.56 24% $ 16,488 $ 8,244 $ 14,790 S 1.229.28 24% $ 8.244 $ 29,579 $ 36,996 $ 5,600.40 32% $ 29,579 $ 14,790 $ 18,498 $ 2.800.32 32% $ 14,790 $ 36,996 $ 54,450 $ 7,973.84 35% $36.996 S 18.498 $ 27,225 $ 3,986.88 35% $ 18,498 $ 54,450 $ 14,082.74 37% $ 54.450 $ 27,225 $ 7,041.33 37% $ 27,225 Single or Married Filing Separately Single or Married Filing Separately SO $ 1,046 $ 0.00 0% SO SO $ 523 $ 0.00 0% SO $1,046 $ 1,875 $ 0.00 10% $ 1,046 $ 523 $938 $ 0.00 10% $ 523 $ 1,875 $ 4,423 $ 82.90 12% $ 1,875 $ 938 $ 2,211 $ 41.50 12% $ 938 $ 4,423 S 8,244 $ 388.66 22% $ 4,423 $ 2.211 $ 4,122 $ 194.26 22% $ 2,211 $ 8,244 $ 14,790 $ 1,229.28 24% S 8,244 $ 4,122 $ 7,395 $614.68 24% $ 4,122 $ 14,790 $ 18,498 $ 2.800.32 32% $ 14,790 $ 7,395 $ 9,249 S 1,400.20 32% $ 7,395 $ 18,498 $ 44.679 $ 3,986.88 35% $ 18,498 $ 9,249 $ 22,340 $ 1.993.48 35% $ 9,249 $ 44,679 $ 13,150.23 37% $ 44.679 $ 22,340 $ 6,575.33 37% $ 22,340 Head of Household Head of Household SO $ 1,567 $ 0.00 0% SO SO $ 783 $ 0.00 0% SO $ 1,567 $ 2,750 $ 0.00 10% $1,567 $ 783 $1,375 $ 0.00 10% $ 783 $ 2,750 $ 6,083 $ 118.30 12% $ 2,750 $ 1,375 $3,042 $ 59.20 12% $ 1.375 $ 6,083 S 8,763 $ 518.26 22% $6,083 $ 3,042 $ 4,381 $ 259.24 22% $ 3,042 $ 8,763 $ 15,308 $ 1,107.86 24% $ 8,763 $ 4,381 $ 7,654 $ 553.82 24% $ 4.381 $ 15,308 $ 19,017 $ 2,678.66 32% $ 15,308 $ 7,654 $ 9,508 $ 1,339.34 32% $ 7,654 $ 19,017 $ 45,200 $ 3,865.54 35% $ 19,017 $ 9,508 $ 22,600 $ 1,932.62 35% $9,508 $ 45,200 $ 13,029.59 37% $ 45,200 $ 22,600 $ 6,514.82 37% $ 22,600

I need help with part A, I got part B

I need help with part A, I got part B