Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with this question The comparative balance sheet for Mosaic Travel Services, Inc., for December 31, 2017 and 2016, is as follows: 2

I need help with this question

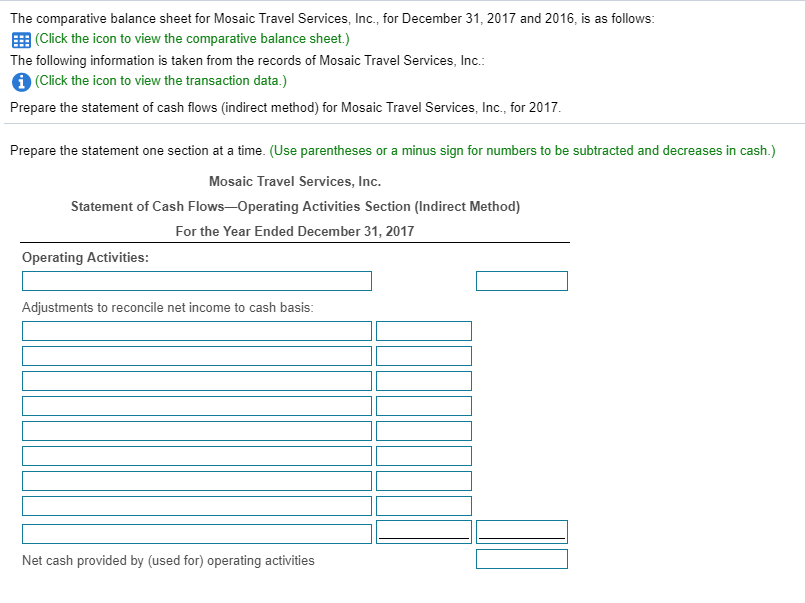

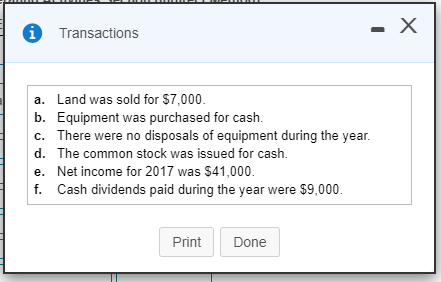

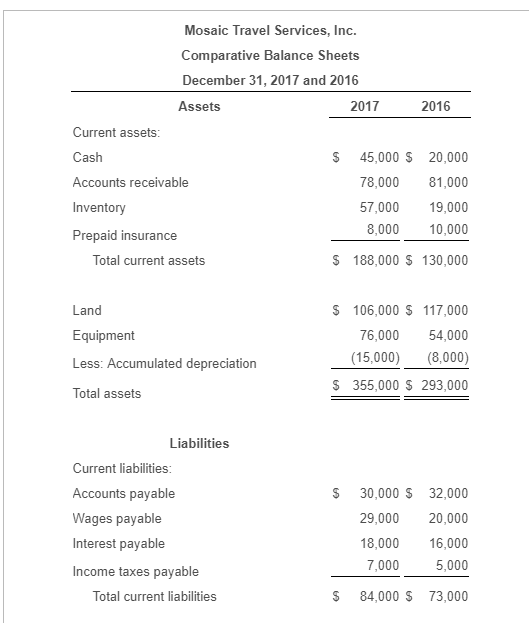

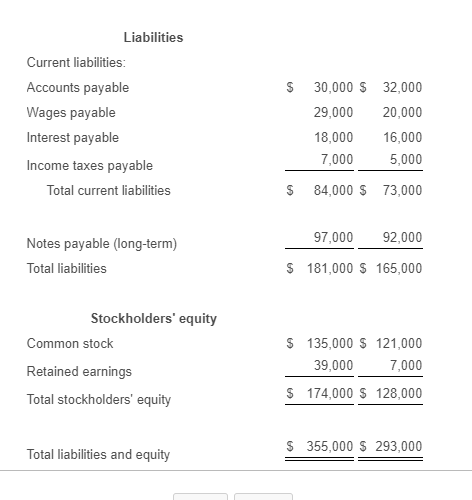

The comparative balance sheet for Mosaic Travel Services, Inc., for December 31, 2017 and 2016, is as follows: 2 (Click the icon to view the comparative balance sheet.) The following information is taken from the records of Mosaic Travel Services, Inc.: (Click the icon to view the transaction data.) Prepare the statement of cash flows (indirect method) for Mosaic Travel Services, Inc., for 2017 Prepare the statement one section at a time. (Use parentheses or a minus sign for numbers to be subtracted and decreases in cash.) Mosaic Travel Services, Inc. Statement of Cash Flows-Operating Activities Section (Indirect Method) For the Year Ended December 31, 2017 Operating Activities: Adjustments to reconcile net income to cash basis: Net cash provided by (used for) operating activities Transactions a. Land was sold for $7,000. b. Equipment was purchased for cash. c. There were no disposals of equipment during the year. d. The common stock was issued for cash. e. Net income for 2017 was $41,000. f. Cash dividends paid during the year were $9,000. Print Done Mosaic Travel Services, Inc. Comparative Balance Sheets December 31, 2017 and 2016 Assets 2017 2016 $ Current assets: Cash Accounts receivable Inventory 45,000 $ 78,000 57,000 8,000 20,000 81,000 19,000 10,000 Prepaid insurance Total current assets $ 188,000 $ 130,000 Land $ Equipment Less: Accumulated depreciation 106,000 $ 117,000 76,000 54,000 (15,000) (8,000) 355,000 $ 293,000 $ Total assets Liabilities Current liabilities: Accounts payable Wages payable $ 30,000 $ 29,000 18,000 7,000 32,000 20,000 16,000 5,000 Interest payable Income taxes payable Total current liabilities $ 84,000 $ 73,000 Liabilities Current liabilities: $ Accounts payable Wages payable Interest payable 30,000 $ 29,000 18,000 7,000 32,000 20,000 16,000 5,000 Income taxes payable Total current liabilities $ 84,000 $ 73,000 Notes payable (long-term) Total liabilities 97,000 92,000 181,000 $ 165,000 $ $ Stockholders' equity Common stock Retained earnings Total stockholders' equity 135,000 $ 121,000 39,000 7,000 174,000 $ 128,000 $ $ 355,000 $ 293,000 Total liabilities and equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started