I need helping computing the red boxes at the bottom please.

Cook Farm Supply Company manufactures and sells a pesticide called Snare. The following data are available for preparing budgets for Snare for the first 2 quarters of 2020.

| 1. | | Sales: quarter 1, 29,400 bags; quarter 2, 42,600 bags. Selling price is $63 per bag. |

| 2. | | Direct materials: each bag of Snare requires 4 pounds of Gumm at a cost of $3.80 per pound and 6 pounds of Tarr at $1.75 per pound. |

| 3. | | Desired inventory levels: |

| Type of Inventory | | January 1 | | April 1 | | July 1 |

| Snare (bags) | | 8,100 | | 12,200 | | 18,100 |

| Gumm (pounds) | | 9,500 | | 10,100 | | 13,200 |

| Tarr (pounds) | | 14,200 | | 20,500 | | 25,400 |

| 4. | | Direct labor: direct labor time is 15 minutes per bag at an hourly rate of $16 per hour. |

| 5. | | Selling and administrative expenses are expected to be 15% of sales plus $179,000 per quarter. |

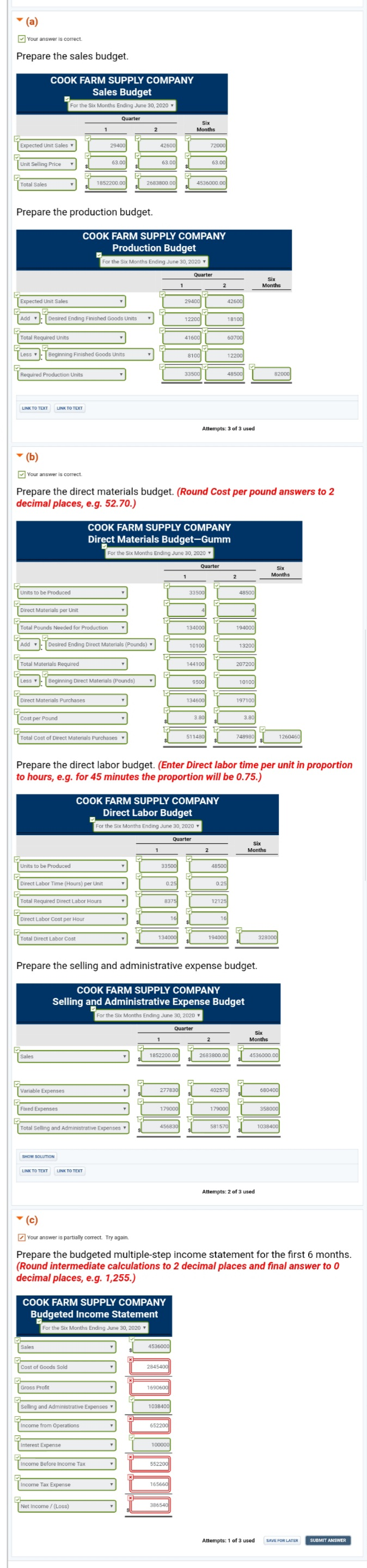

| 6. | | Interest expense is $100,000. |

| 7. | | Income taxes are expected to be 30% of income before income taxes. |

Your assistant has prepared two budgets: (1) the manufacturing overhead budget shows expected costs to be 125% of direct labor cost, and (2) the direct materials budget for Tarr shows the cost of Tarr purchases to be $301,000 in quarter 1 and $426,500 in quarter 2. (Note: Do not prepare the manufacturing overhead budget or the direct materials budget for Tarr.)

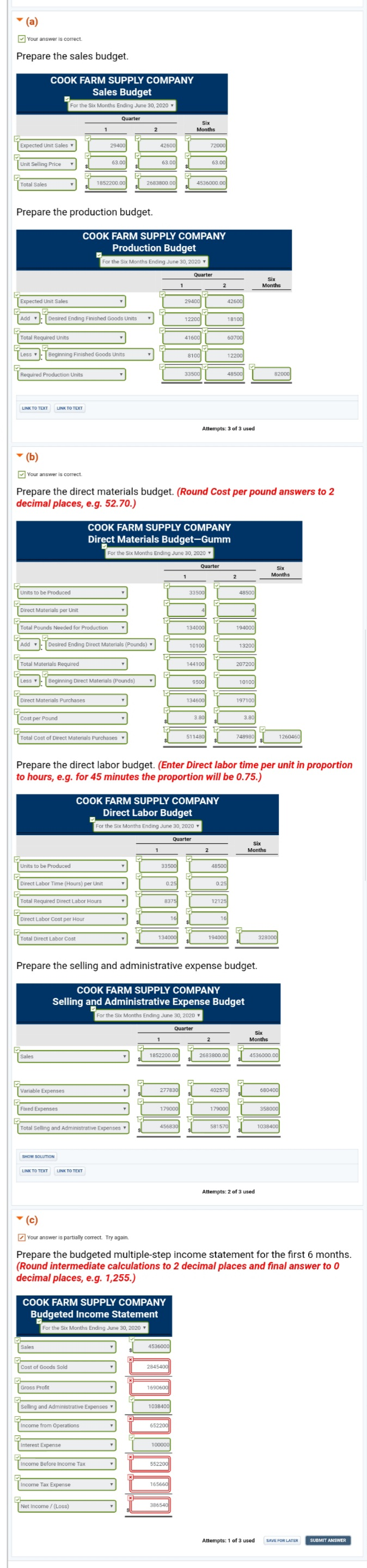

(a) Your answer is correct Prepare the sales budget. COOK FARM SUPPLY COMPANY Sales Budget For the Six Months Ending June 30, 2020 Quarter 2 Months Expected Unit Sales 29400 72000 Unit Selling Price 63.00 63.00 Total Sales 1852200.00 2683800.00 4536000.00 Prepare the production budget. COOK FARM SUPPLY COMPANY Production Budget For the Six Months Ending June 30, 2020 Quarter Six Months 2 Expected Unit Sales 29400 42600 Desired Ending Finished Goods Units 18100 Total Required Units 4160 60700 Less Beginning Finished Goods Units 12200 Required Production Units 33500 48500 82000 LINK TO TEXT LINK TO TEXT Attempts: 3 of 3 used Your answer is correct. Prepare the direct materials budget. (Round Cost per pound answers to 2 decimal places, e.g. 52.70.) COOK FARM SUPPLY COMPANY Direct Materials Budget-Gumm For the Six Months Ending June 30, 2020 Quarter Six Months Units to be produced 3350 48500 Direct Materials per Unit 14 Total Pounds Needed for Production 134000 194000 Desired Ending Direct Materials (Pounds) T 10100 13200 Total Materials Required T 144100 207200 Less Beginning Direct Materials (Pounds) - T 9500 T 10100 Direct Materials Purchases T 134600 T 197100 Cost per Pound 3.00 3.80 511480 Total Cost of Direct Materials Purchases 748980 1260460 Prepare the direct labor budget. (Enter Direct labor time per unit in proportion to hours, e.g. for 45 minutes the proportion will be 0.75.) COOK FARM SUPPLY COMPANY Direct Labor Budget For the Six Months Ending June 30, 2020 Quarter Six Months 2 Units to be produced 33500 T 48500 Direct Labor Time (Hours) per Unit 0.25 T 0.25 Total Required Direct Labor Hours 12125 Direct Labor Cost per Hour Total Direct Labor Cost 134000 1 94000 194000 328000 Prepare the selling and administrative expense budget. COOK FARM SUPPLY COMPANY Selling and Administrative Expense Budget For the Six Months Ending June 30, 2020 Quarter 2 Six Months 52200.00 2683800.00 4536000.00 Variable Expenses 277830 402520 680400 Fixed Expenses T 179000 179000 358000 Total Selling and Administrative Expenses 456830 581570 1038400 SHOW SOLUTION LINK TO TEXT UNK TO TEXT Attempts: 2 of 3 used Your answer is partially correct. Try again. Prepare the budgeted multiple-step income statement for the first 6 months. (Round intermediate calculations to 2 decimal places and final answer to O decimal places, e.g. 1,255.) COOK FARM SUPPLY COMPANY Budgeted Income Statement For the Six Months Ending June 30, 2020 Sales 4536000 Cost of Goods Sold 2845400 Gross Profit 1690600 Selling and Administrative Expenses 1038400 Income from Operations 652200 Interest Expense 100000 Income Before Income Tax 552200 Income Tax Expense 165660 Net Income /(Loss) 386540 Attempts: 1 of 3 used