Answered step by step

Verified Expert Solution

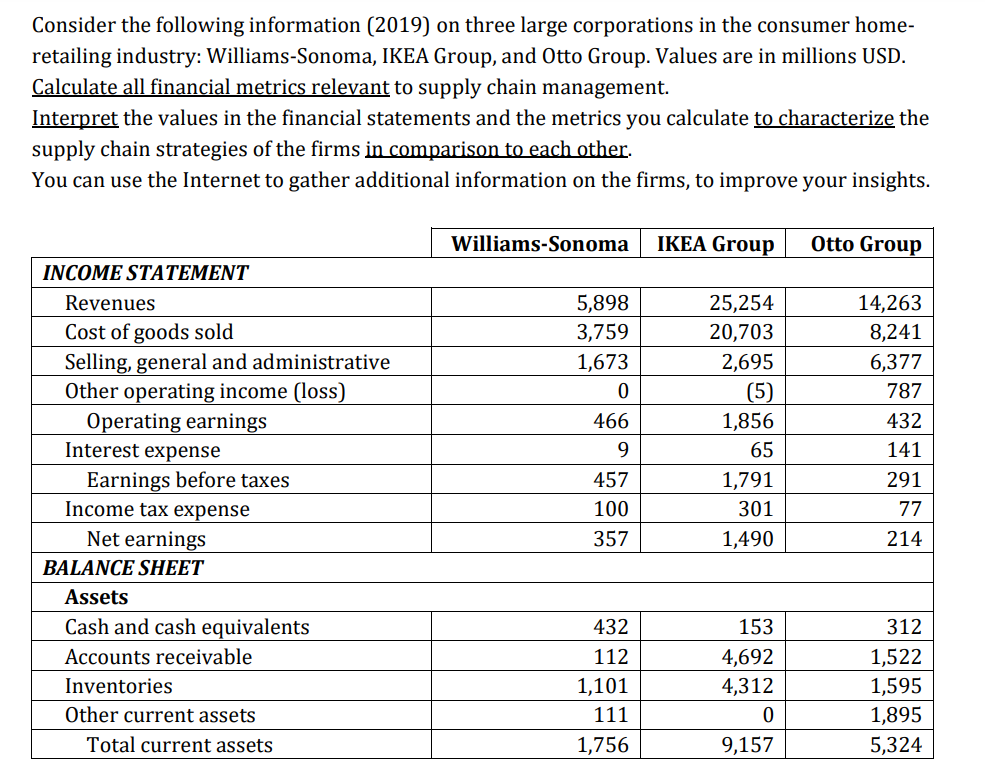

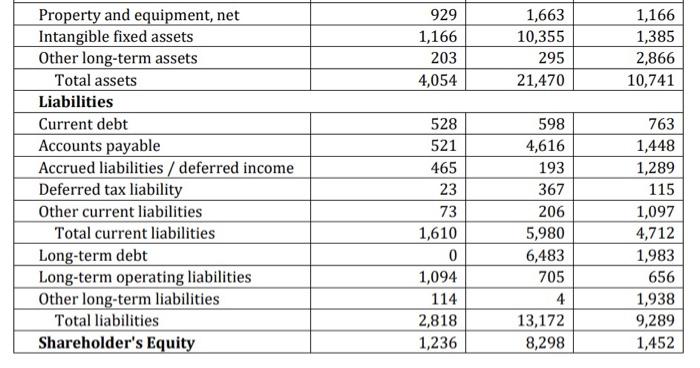

Question

1 Approved Answer

I need interpretations. please dont answer and leave the question without interpretations. I need to know which one is most successful? Do we see efficiency

I need interpretations. please dont answer and leave the question without interpretations.

I need to know which one is most successful? Do we see efficiency or responsiveness approach for each of them?

Which one is physically the most present one? And why? using the metrics ROA, ROE, profit margin, gross margin, ebit, roce, asset turnover, ppet, nvt, do, apt, dpo, art,

dso, ccc, can you make comparisons and identify their supply chain strategy. thank you!

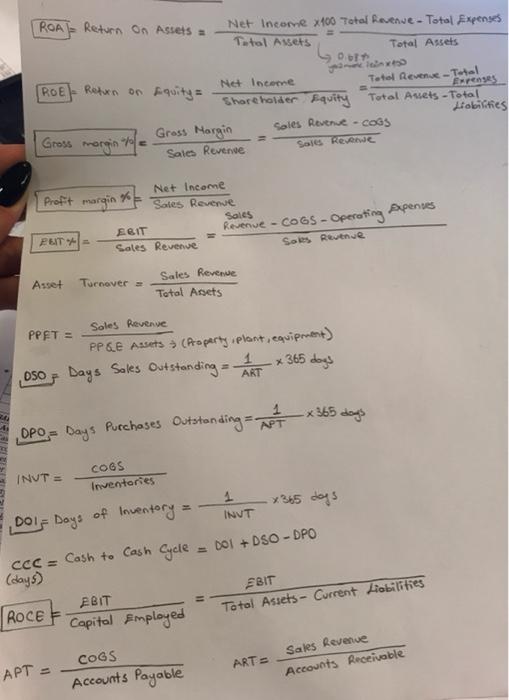

please use the formula sheet I put while making calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started