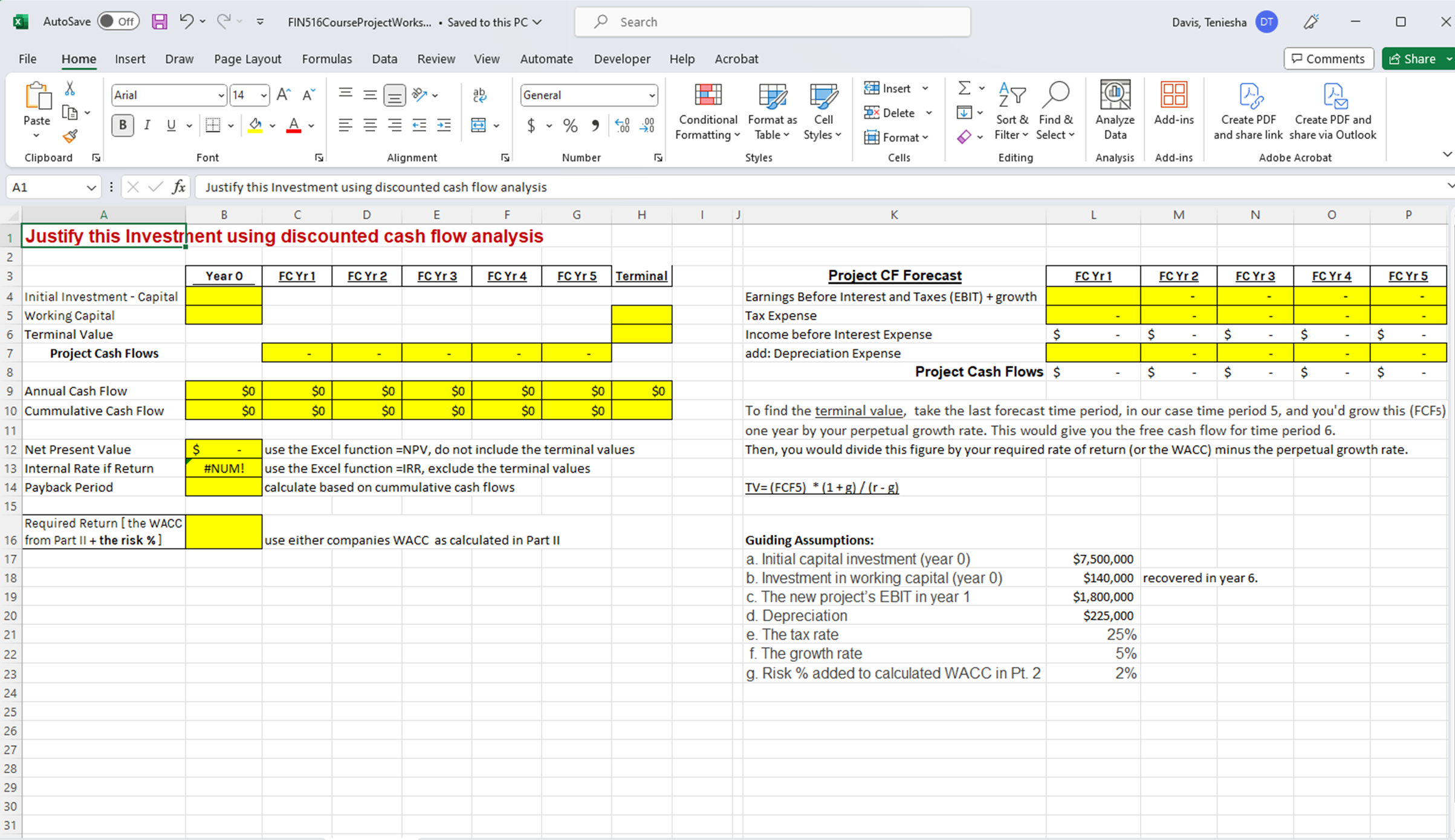

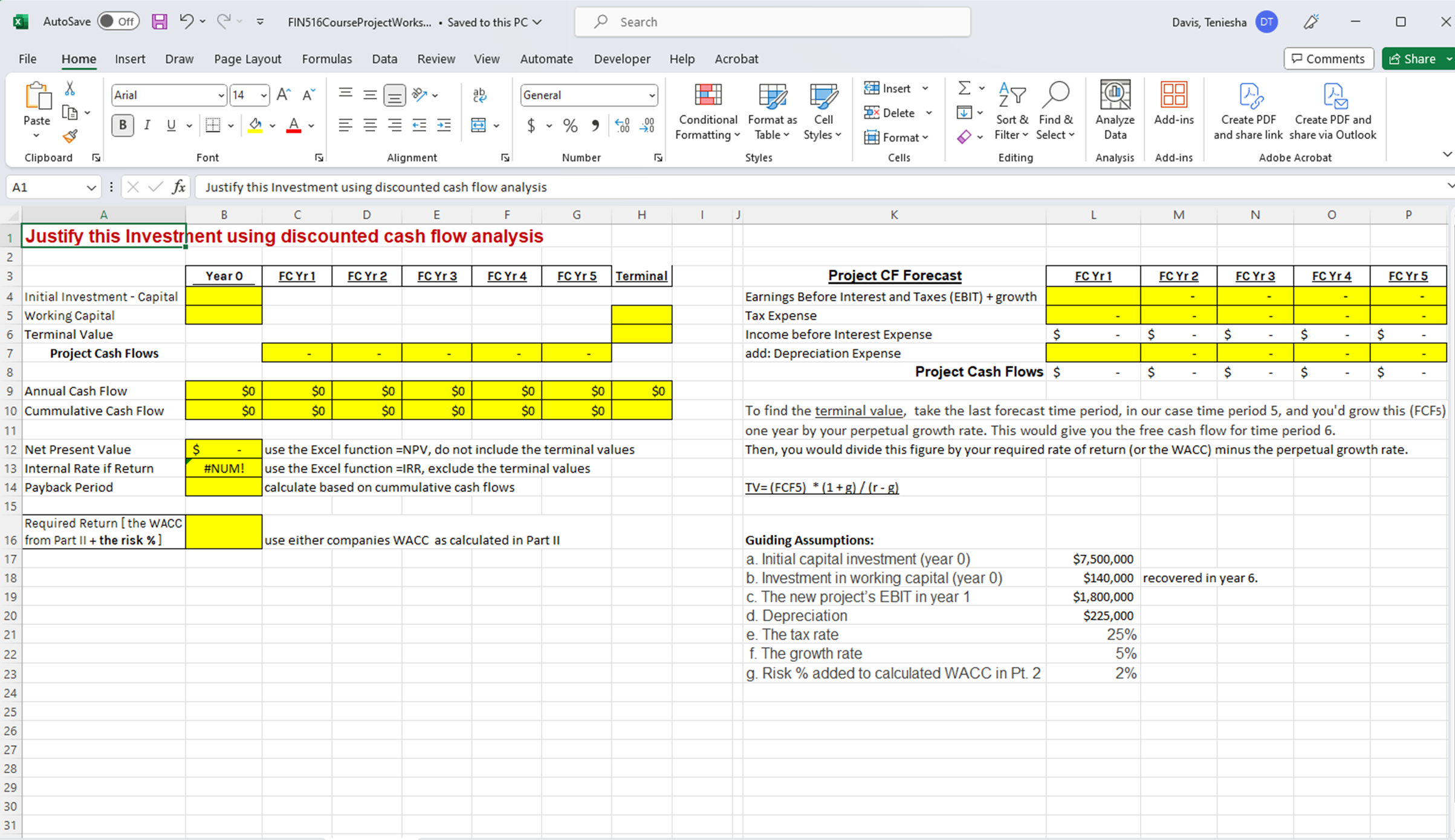

I need the data entered on this page, what's in yellow, all information is given with a WACC of 11%. Thank you

AutoSave Search Davis, Teniesha File Home Insert Draw Page Layout Formulas Data Review View Automate Developer Help Acrobat Pasten Clipboard Font Alignment Number Conditional Format as FormattingTableStyles A Sort&Find&FilterSelectEditing Analyz G Justify this Investrhent using discounted cash flow analysis Initial Investment - Capital Working Capital Terminal Value Project Cash Flows Annual Cash Flow Cummulative Cash Flow \begin{tabular}{|r|r|r|r|r|r|r|} \hline$0 & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline$0 & $0 & $0 & $0 & $0 & $0 & \\ \hline \end{tabular} Net Present Value Internal Rate if Return Payback Period \begin{tabular}{|l|} \hline$ \\ \hline \#NUM! \\ \hline \end{tabular} use the Excel function =NPV, do not include the terminal values use the Excel function =IRR, exclude the terminal values calculate based on cummulative cash flows Required Return [ the WACC from Part II + the risk \% ] use either companies WACC as calculated in Part II 17 18 19 20 22 23 25 26 28 29 30 31 Project CF Forecast Earnings Before Interest and Taxes (EBIT) + growth Tax Expense Income before Interest Expense add: Depreciation Expense Project Cash Flows To find the terminal value, take the last forecast time period, in our case time period 5, and you'd grow this (FCF5) one year by your perpetual growth rate. This would give you the free cash flow for time period 6. Then, you would divide this figure by your required rate of return (or the WACC) minus the perpetual growth rate. TV=(FCF5)(1+g)/(rg) Guiding Assumptions: a. Initial capital investment (year 0) b. Investment in working capital (year 0) c. The new project's EBIT in year 1 d. Depreciation e. The tax rate f. The growth rate g. Risk \% added to calculated WACC in Pt. 2 $7,500,000 $140,000 recovered in year 6 . $1,800,000 $225,000 25% 5% 2% AutoSave Search Davis, Teniesha File Home Insert Draw Page Layout Formulas Data Review View Automate Developer Help Acrobat Pasten Clipboard Font Alignment Number Conditional Format as FormattingTableStyles A Sort&Find&FilterSelectEditing Analyz G Justify this Investrhent using discounted cash flow analysis Initial Investment - Capital Working Capital Terminal Value Project Cash Flows Annual Cash Flow Cummulative Cash Flow \begin{tabular}{|r|r|r|r|r|r|r|} \hline$0 & $0 & $0 & $0 & $0 & $0 & $0 \\ \hline$0 & $0 & $0 & $0 & $0 & $0 & \\ \hline \end{tabular} Net Present Value Internal Rate if Return Payback Period \begin{tabular}{|l|} \hline$ \\ \hline \#NUM! \\ \hline \end{tabular} use the Excel function =NPV, do not include the terminal values use the Excel function =IRR, exclude the terminal values calculate based on cummulative cash flows Required Return [ the WACC from Part II + the risk \% ] use either companies WACC as calculated in Part II 17 18 19 20 22 23 25 26 28 29 30 31 Project CF Forecast Earnings Before Interest and Taxes (EBIT) + growth Tax Expense Income before Interest Expense add: Depreciation Expense Project Cash Flows To find the terminal value, take the last forecast time period, in our case time period 5, and you'd grow this (FCF5) one year by your perpetual growth rate. This would give you the free cash flow for time period 6. Then, you would divide this figure by your required rate of return (or the WACC) minus the perpetual growth rate. TV=(FCF5)(1+g)/(rg) Guiding Assumptions: a. Initial capital investment (year 0) b. Investment in working capital (year 0) c. The new project's EBIT in year 1 d. Depreciation e. The tax rate f. The growth rate g. Risk \% added to calculated WACC in Pt. 2 $7,500,000 $140,000 recovered in year 6 . $1,800,000 $225,000 25% 5% 2%