Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need to come up with my own example. This is what I came up with please help answer. If you need to change numbers

I need to come up with my own example. This is what I came up with please help answer. If you need to change numbers thats fine! THANK YOU!

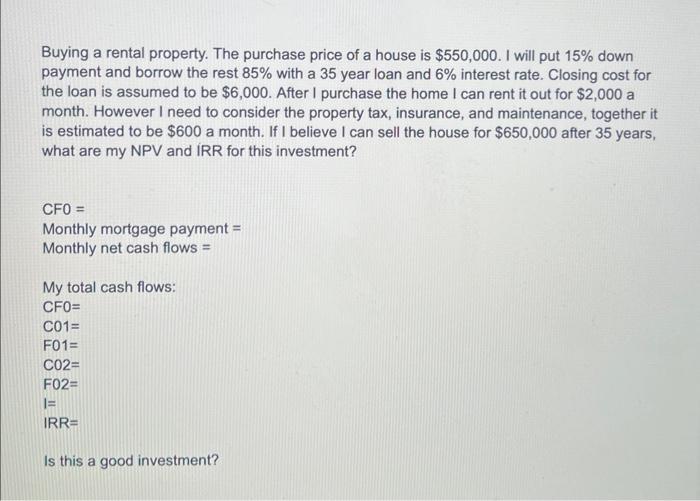

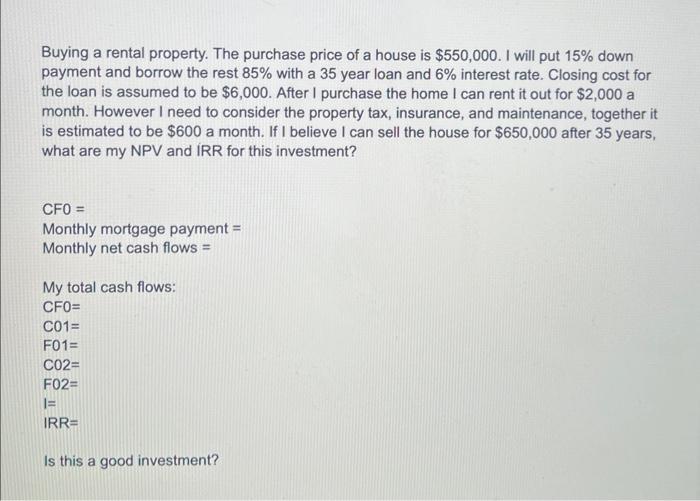

Buying a rental property. The purchase price of a house is $550,000. I will put 15% down payment and borrow the rest 85% with a 35 year loan and 6% interest rate. Closing cost for the loan is assumed to be $6,000. After I purchase the home I can rent it out for $2,000 a month. However I need to consider the property tax, insurance, and maintenance, together it is estimated to be $600 a month. If I believe I can sell the house for $650,000 after 35 years, what are my NPV and IRR for this investment? CFO= Monthly mortgage payment = Monthly net cash flows = My total cash flows: CFO = C01= F01= C02= FO2= I= IRR = Is this a good investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started