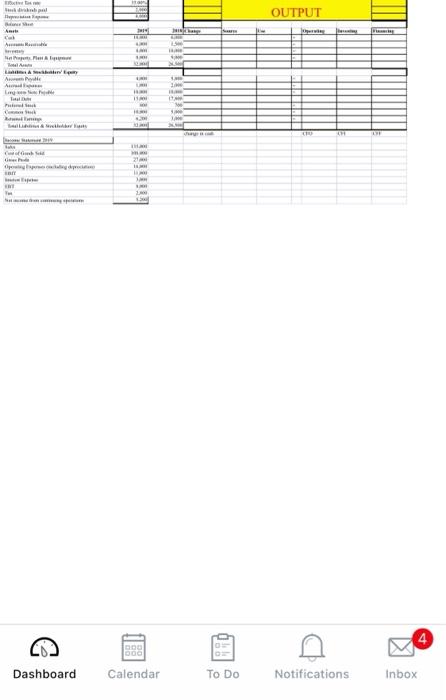

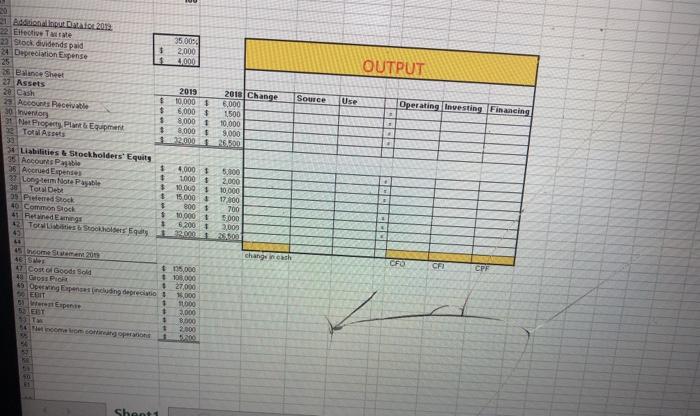

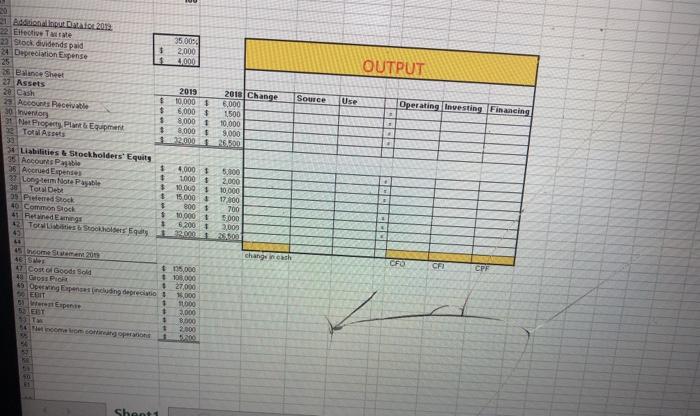

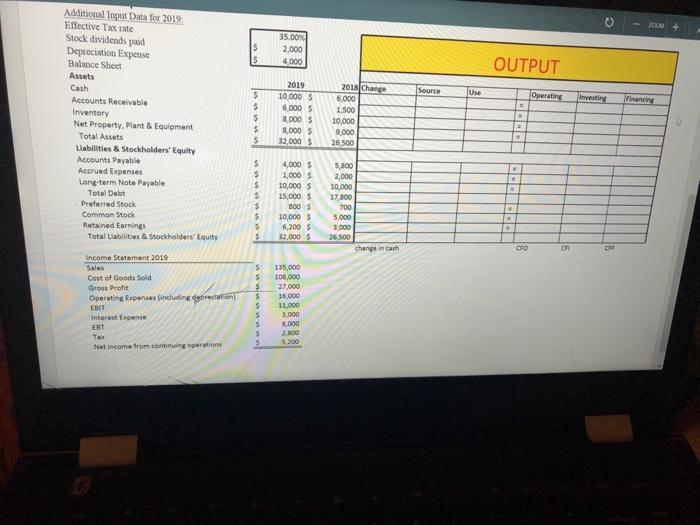

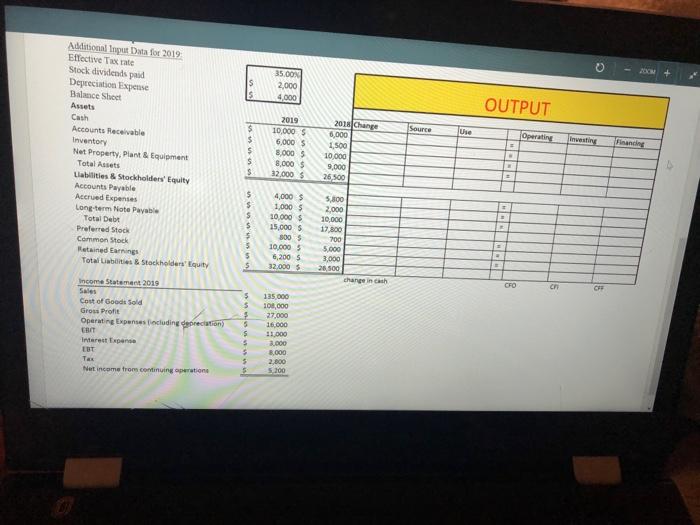

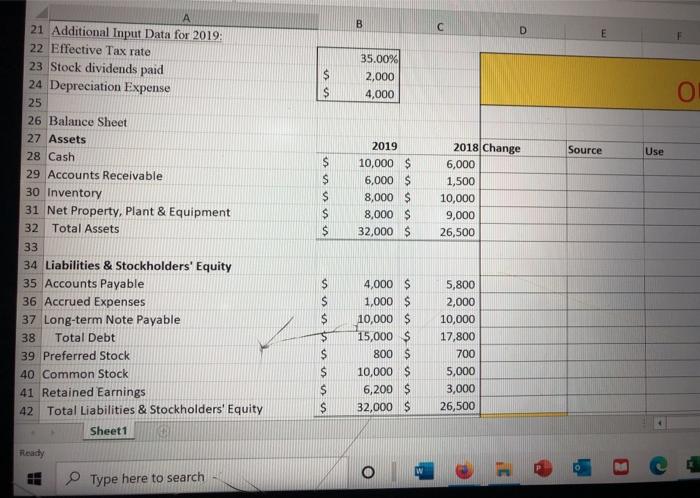

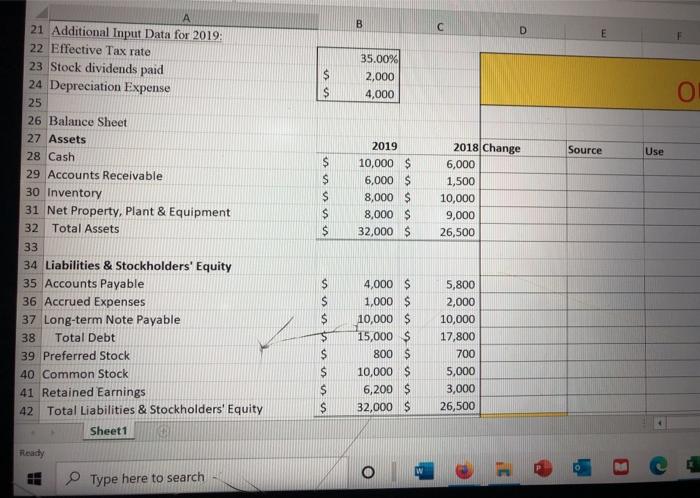

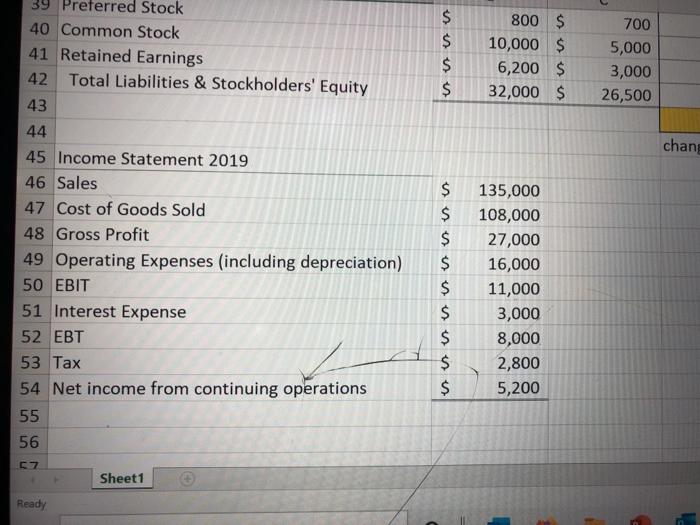

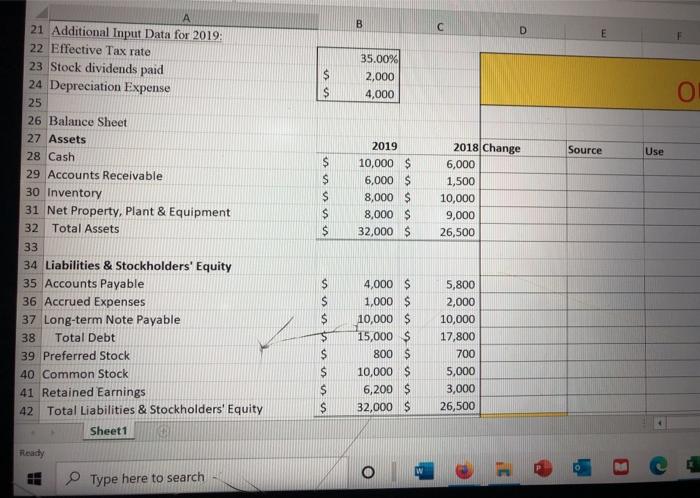

i need to complete a complete cash flow worksheet with the following data . I wanted if possible a step by step explanation oh how to complete this worksheet.

here are pictures with bigger font size

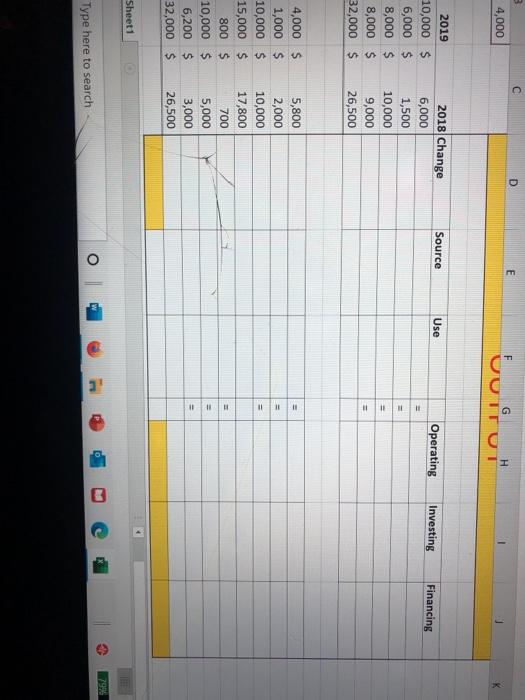

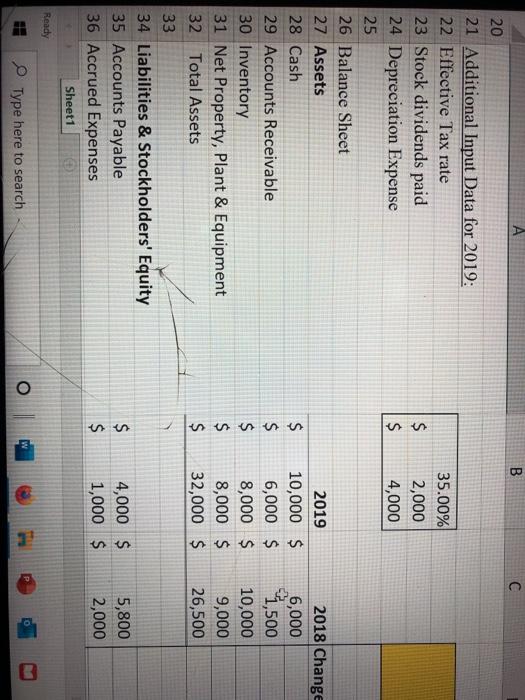

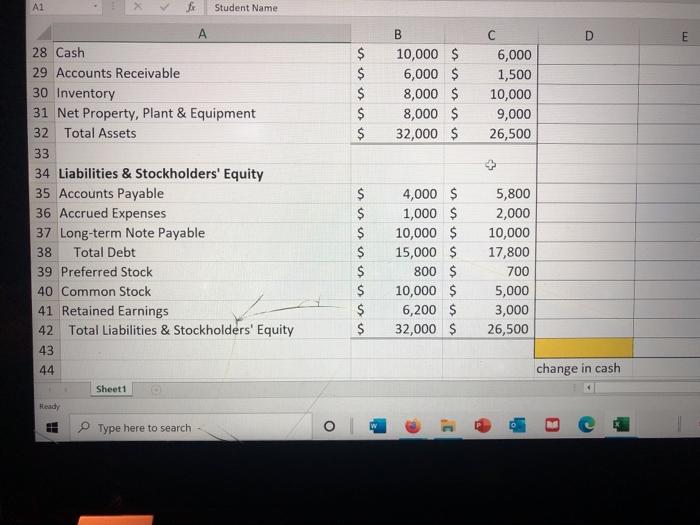

Ball OUTPUT Are NA LA AP Long 11 w Opel 000 Dashboard Calendar To Do Notifications Inbox OUTPUT 2018 Change Source Use Operating Investing Financing 20 21 But 2013 22 Elective Taste 35.00% 2 Stock duidends paid 1 2,000 24 Deprecision Expense 25 3000 36 since sheet 27 Assets 20 Cash 2019 $ 10,000 6.000 23 Accounts Receivable $ 6,000 1500 30 Inventory $ 8000 1 10.000 31 Net Property Plant Equipment Tot Ass 9,000 15.500 34 Liabilities Stockholders' Equity 15 ANSP $ 4.0001 35 AcondExpenses 5.000 1000 + 2.000 27 Long term Note Payable $ 10.000 1 10.000 38 Tots Debt 15.000 1 Pedrock 17100 1 800 1 40 Common Stock 700 $ 10.000 5.000 ned 1 62001 2,000 Tort Shoes 50 123012 43 1 8.000 $ change in cash CFO CF CPF # 15.000 47 Cool Goods Sold 40 Go POR 45 Opening depec 27000 1,000 . 1 10000 + 3.000 1 8.000 1 2.000 . Sheet1 5 200+ S s 35.00 2.000 4,000 OUTPUT Source Operating Investing Additional Input Data for 2019 Effective Tax rate Stock dividends paid Depreciation Expense Balance Sheet Assets Cash Accounts Receivable Inventory Net Property, Plant & Equipment Total Assets Liabilities & Stockholders' Equity Accounts Payable Accrued Expenses Long-term Note Payable Total Debt Preferred Stock Common Stock Retained Earnings Total Liabilities & Stockholders' Equity $ $ 5 $ 5 2019 10,000 $ 6,000 $ 8,000 $ 8,000 $ 32.000 5 2018 Change 6000 1,500 10,000 9.000 26.500 s $ S $ 5 $ 4,000 $ 1,000 $ 10,000 $ 15,000 $ 800 5 10,000 $ 5,200 $ 32,000 5 5.800 2,000 10,000 17,800 700 5,000 3.000 26 500 change in tash $ CHO CR CAP Income Statement 2010 Sales Cost of Goods Sold Gross Profit Operating Expenses includina goreciation ET Interest Expense EBT Tas Net income from continuing operations 5 $ $ 5 5 5 $ $ 5 135,000 106,000 27.000 16.000 11,000 3,000 1,000 2.000 5.200 S $ 35.00 2.000 4,000 OUTPUT 2018 Change Source Une Operating Investing Additional Lipat Data for 2019 Effective Tax rate Stock dividends pad Depreciation Expense Balance Short Assets Cash Accounts Receivable Inventory Net Property, Plant & Equipment Total Assets Labilities & Stockholders' Equity Accounts Payable Accrued Expenses Long-term Note Payable Total Debt Preferred Stock Common Stock Retained Earnings Total abilities & Stockholders' Equity Financing 2019 10.000 $ 6.000 $ 8.000 5 8.000 $ 32.000 $ $ $ S $ 6,000 1,500 10,000 9,000 26,500 $ $ $ $ 5 4.000 $ 1,000 $ 10.000 $ 15.000 $ 800 5 10.000 6, 2005 32.000 5,800 2,000 10,000 17,800 700 5.000 3,000 26.500 change in cash CFO ch $ Income Statement 2019 Sales Cost of Good Sold Gross Profit Operating Expenses including depreciation BT Interest Expense LBT Tax Net income from continuing operatione depreciation 5 $ S 5 5 135.000 108,000 27,000 16.000 11.000 2000 8,000 2.000 5.100 A B D $ 35.00% 2,000 4,000 O Source Use $ 21 Additional Input Data for 2019: 22 Effective Tax rate 23 Stock dividends paid 24 Depreciation Expense 25 26 Balance Sheet 27 Assets 28 Cash 29 Accounts Receivable 30 Inventory 31 Net Property, Plant & Equipment 32 Total Assets 33 34 Liabilities & Stockholders' Equity 35 Accounts Payable 36 Accrued Expenses 37 Long-term Note Payable 38 Total Debt 39 Preferred Stock 40 Common Stock 41 Retained Earnings 42 Total Liabilities & Stockholders' Equity Sheet1 S $ $ $ 2019 10,000 $ 6,000 $ 8,000 $ 8,000 $ 32,000 $ 2018 Change 6,000 1,500 10,000 9,000 26,500 $ S $ 4,000 $ 1,000 $ 10,000 $ 15,000 $ 800 $ 10,000 $ 6,200 $ 32,000 $ 5,800 2,000 10,000 17,800 700 5,000 3,000 26,500 $ $ $ $ Ready O W Type here to search $ $ $ $ 800 $ 10,000 $ 6,200 $ 32,000 $ 700 5,000 3,000 26,500 chang 39 Preferred Stock 40 Common Stock 41 Retained Earnings 42 Total Liabilities & Stockholders' Equity 43 44 45 Income Statement 2019 46 Sales 47 Cost of Goods Sold 48 Gross Profit 49 Operating Expenses (including depreciation) 50 EBIT 51 Interest Expense 52 EBT 53 Tax 54 Net income from continuing operations 55 56 $ $ $ $ $ $ $ $ $ 135,000 108,000 27,000 16,000 11,000 3,000 8,000 2,800 5,200 57 Sheet1 Ready D 3 4,000 E H U Source Use Operating Investing Financing 2019 10,000 $ 6,000 $ 8,000 $ 8,000 $ 32,000 $ 2018 Change 6,000 1,500 10,000 9,000 26,500 III 11 4,000 $ 1,000 $ 10,000 $ 15,000 $ 800 $ 10,000 $ 6,200 $ 32,000 $ 5,800 2,000 10,000 17,800 700 5,000 3,000 26,500 1111 Sheet1 10 791 W Type here to search ol 3 B $ $ 35.00% 2,000 4,000 20 21 Additional Input Data for 2019: 22 Effective Tax rate 23 Stock dividends paid 24 Depreciation Expense 25 26 Balance Sheet 27 Assets 28 Cash 29 Accounts Receivable 30 Inventory 31 Net Property, Plant & Equipment 32 Total Assets 33 34 Liabilities & Stockholders' Equity 35 Accounts Payable 36 Accrued Expenses $ $ $ $ $ 2019 10,000 $ 6,000 $ 8,000 $ 8,000 $ 32,000 $ 2018 Change 6,000 1,500 10,000 9,000 26,500 $ $ 4,000 $ 1,000 $ 5,800 2,000 Sheet1 Ready w O P Type here to search M A1 Student Name A D E $ $ $ $ $ B 10,000 $ 6,000 $ 8,000 $ 8,000 $ 32,000 $ 6,000 1,500 10,000 9,000 26,500 28 Cash 29 Accounts Receivable 30 Inventory 31 Net Property, Plant & Equipment 32 Total Assets 33 34 Liabilities & Stockholders' Equity 35 Accounts Payable 36 Accrued Expenses 37 Long-term Note Payable 38 Total Debt 39 Preferred Stock 40 Common Stock 41 Retained Earnings 42 Total Liabilities & Stockholders' Equity 43 $ $ $ $ $ $ $ $ 4,000 $ 1,000 $ 10,000 $ 15,000 $ 800 $ 10,000 $ 6,200 $ 32,000 $ 5,800 2,000 10,000 17,800 700 5,000 3,000 26,500 44 change in cash Sheet1 Heady Type here to search O