Question

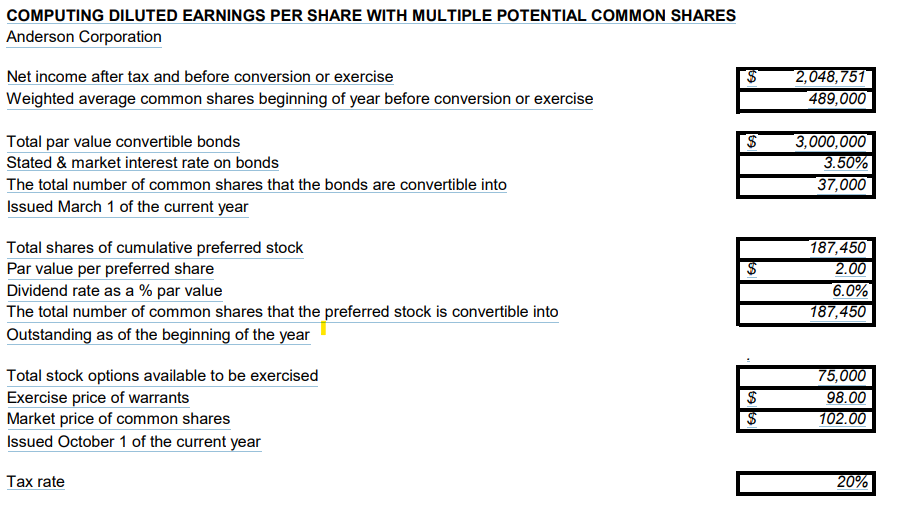

*** I only need help with the ones that I dont have an answer to please*** 1.) Compute net income available to common stockholders. 2,026,281

*** I only need help with the ones that I dont have an answer to please***

1.) Compute net income available to common stockholders.

2,026,281 (this is right)

2.) Compute basic earnings per share. Round to two decimal places.

$4.14 (this is right)

3.) Compute the foregone interest expense AFTER TAX on the convertible bonds.

4.) Compute the per share effect of the convertible bonds. Round to two decimal places.

5.) Compute the foregone dividends on the convertible preferred stock.

22,470 (this is right)

6.) Compute the per share effect of the convertible preferred stock.

.12 (this is right)

7.) Compute the incremental increase in the number of shares outstanding for the stock options.

8.) The convertible bonds should be ranked:

A. First

B. Second

C. Third (this is right)

D. Not ranked; anti-dilutive

9.) The stock options should be ranked:

First

Second

Third

10.) Compute diluted earnings per share. Round to two decimal places.

COMPUTING DILUTED EARNINGS PER SHARE WITH MULTIPLE POTENTIAL COMMON SHARES Anderson Corporation Net income after tax and before conversion or exercise Weighted average common shares beginning of year before conversion or exercise \begin{tabular}{|r|} \hline$ \\ \hline 2,048,751 \\ \hline 489,000 \\ \hline \end{tabular} Total par value convertible bonds Stated \& market interest rate on bonds The total number of common shares that the bonds are convertible into \begin{tabular}{|r|} \hline$3,000,000 \\ \hline 3.50% \\ \hline 37,000 \\ \hline \end{tabular} Issued March 1 of the current year Total shares of cumulative preferred stock Par value per preferred share Dividend rate as a \% par value The total number of common shares that the preferred stock is convertible into Outstanding as of the beginning of the year Total stock options available to be exercised Exercise price of warrants Market price of common shares Issued October 1 of the current year \begin{tabular}{|lr|} \hline & 75,000 \\ \hline$ & 98.00 \\ \hline$ & 102.00 \\ \hline \end{tabular} Tax rate 20% COMPUTING DILUTED EARNINGS PER SHARE WITH MULTIPLE POTENTIAL COMMON SHARES Anderson Corporation Net income after tax and before conversion or exercise Weighted average common shares beginning of year before conversion or exercise \begin{tabular}{|r|} \hline$ \\ \hline 2,048,751 \\ \hline 489,000 \\ \hline \end{tabular} Total par value convertible bonds Stated \& market interest rate on bonds The total number of common shares that the bonds are convertible into \begin{tabular}{|r|} \hline$3,000,000 \\ \hline 3.50% \\ \hline 37,000 \\ \hline \end{tabular} Issued March 1 of the current year Total shares of cumulative preferred stock Par value per preferred share Dividend rate as a \% par value The total number of common shares that the preferred stock is convertible into Outstanding as of the beginning of the year Total stock options available to be exercised Exercise price of warrants Market price of common shares Issued October 1 of the current year \begin{tabular}{|lr|} \hline & 75,000 \\ \hline$ & 98.00 \\ \hline$ & 102.00 \\ \hline \end{tabular} Tax rate 20%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started