Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i want the answers for the last 10 pictures pls the journlize and post closing entries and complete the closing process .. On August 1,

i want the answers for the last 10 pictures pls

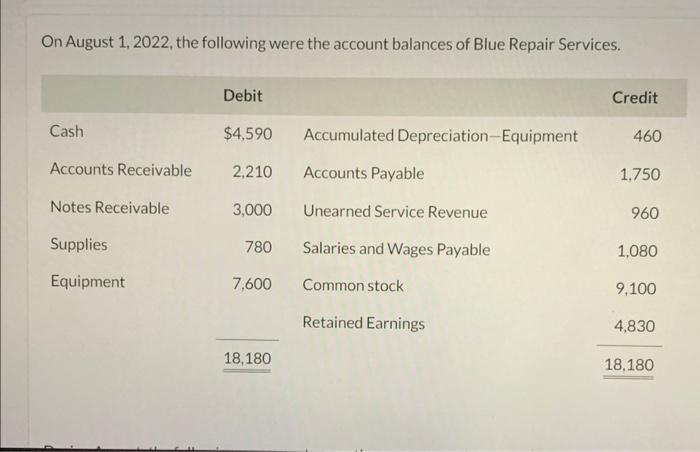

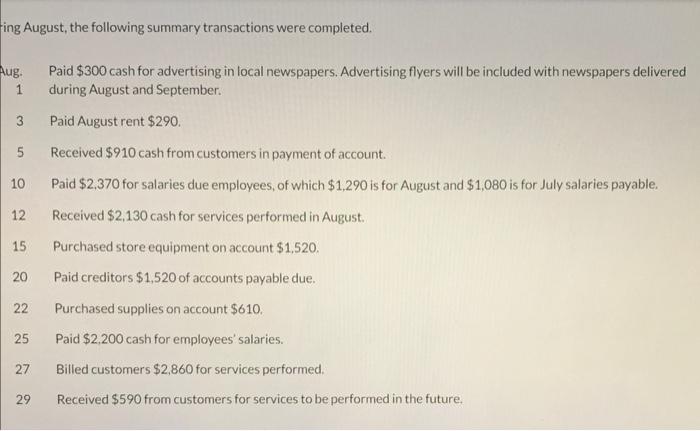

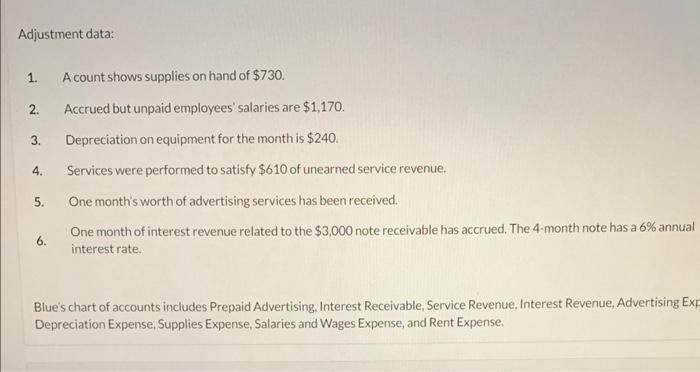

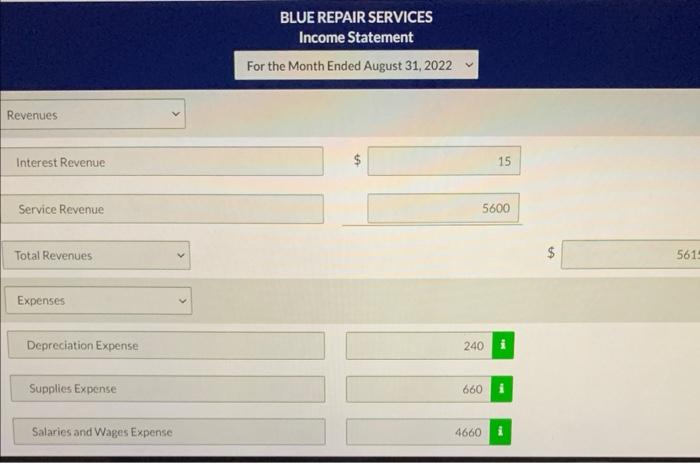

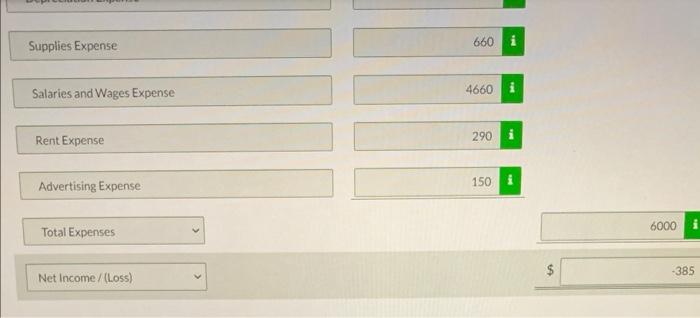

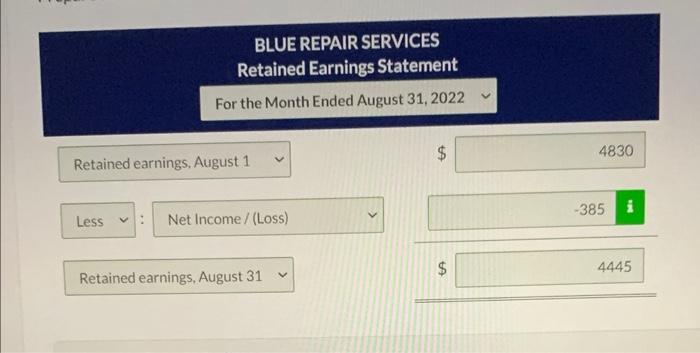

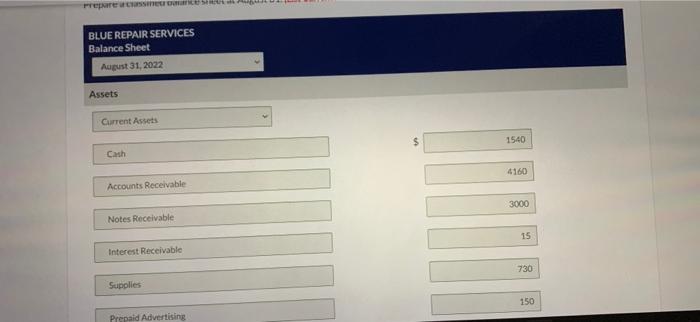

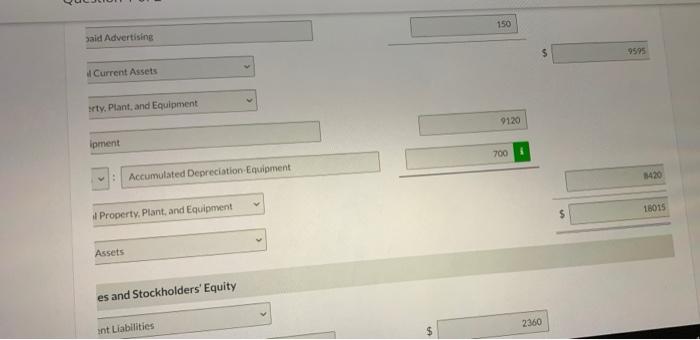

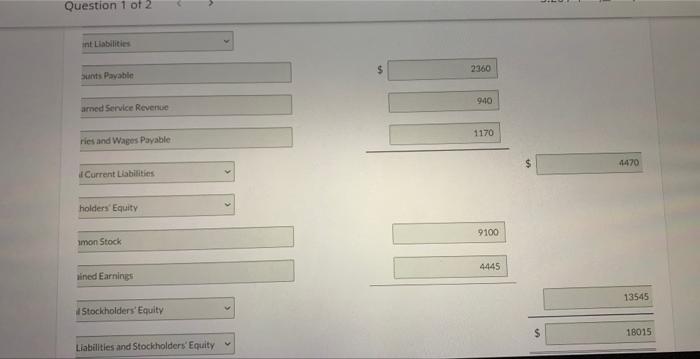

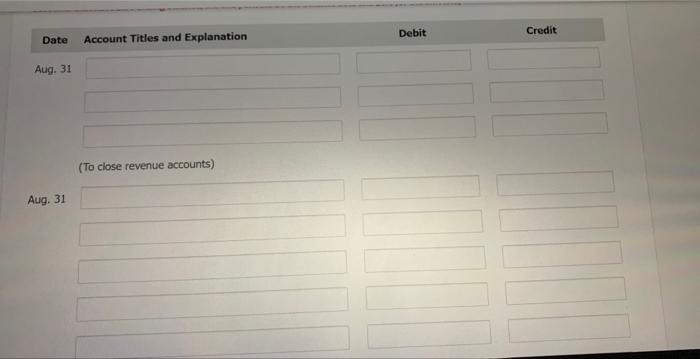

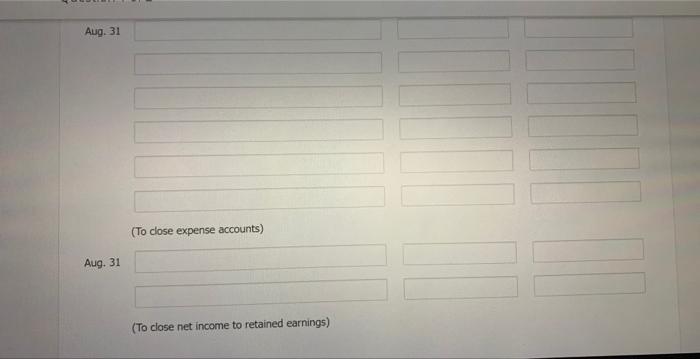

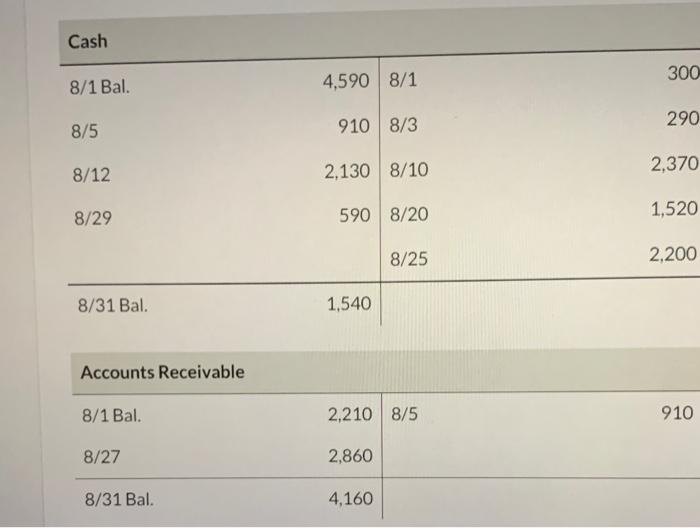

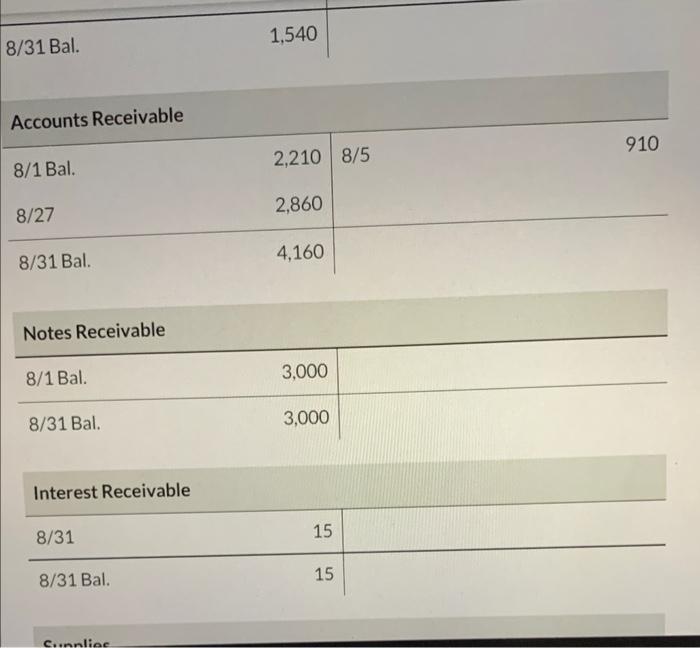

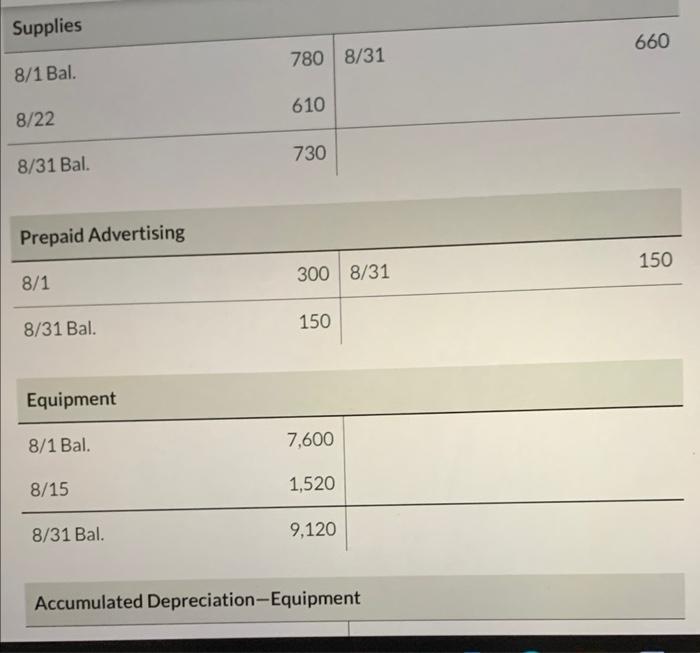

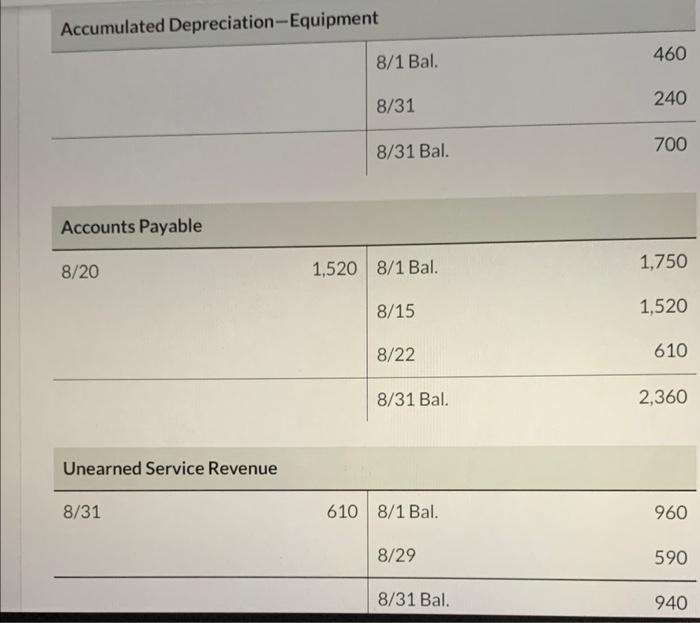

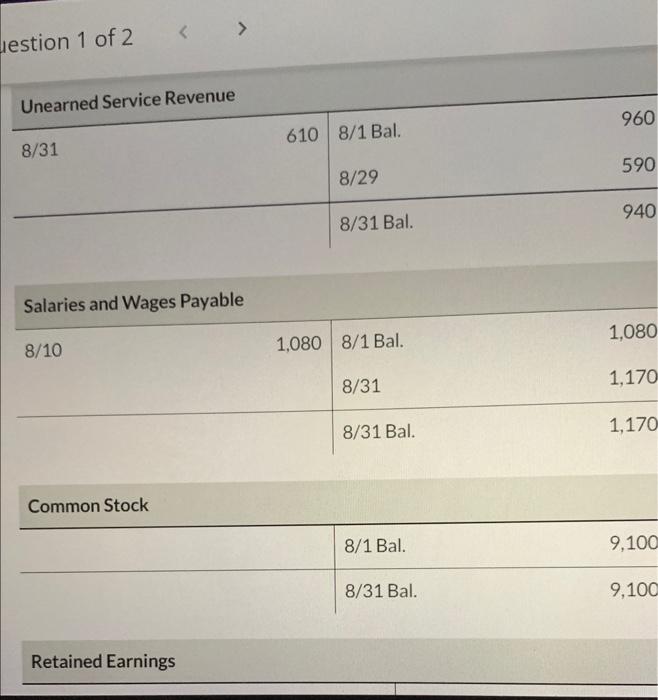

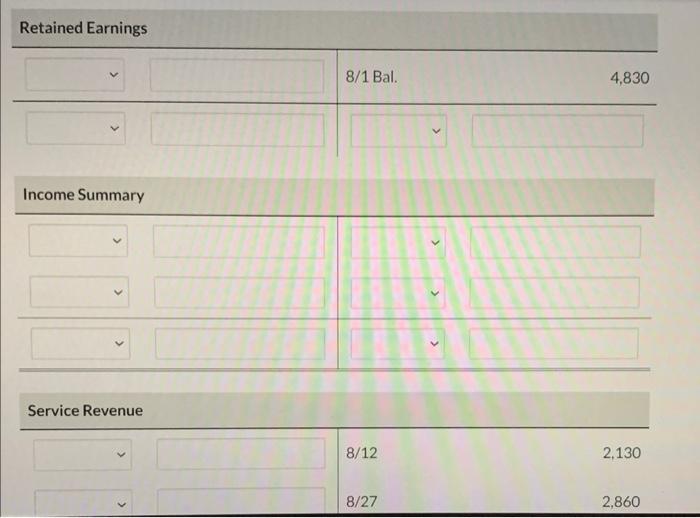

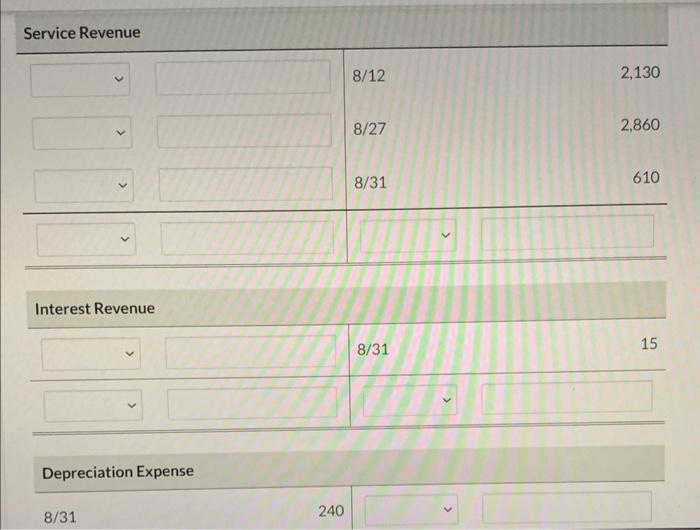

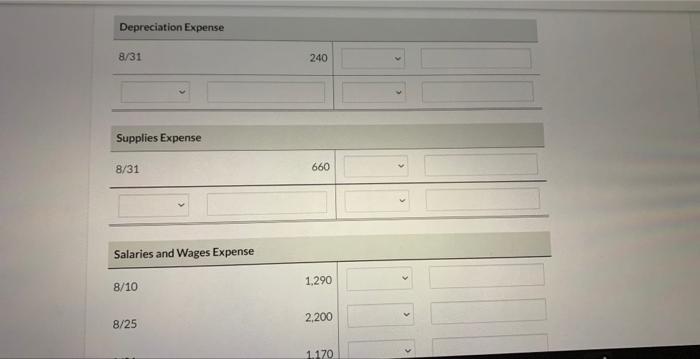

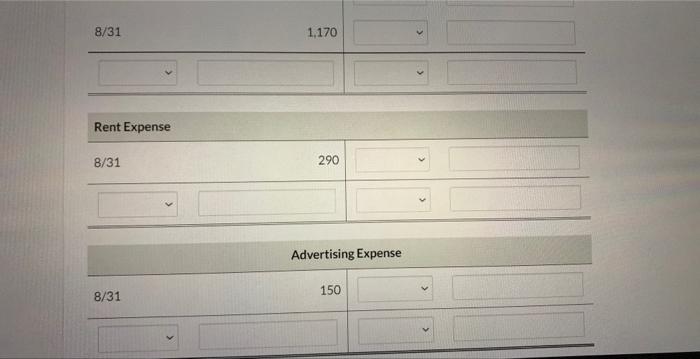

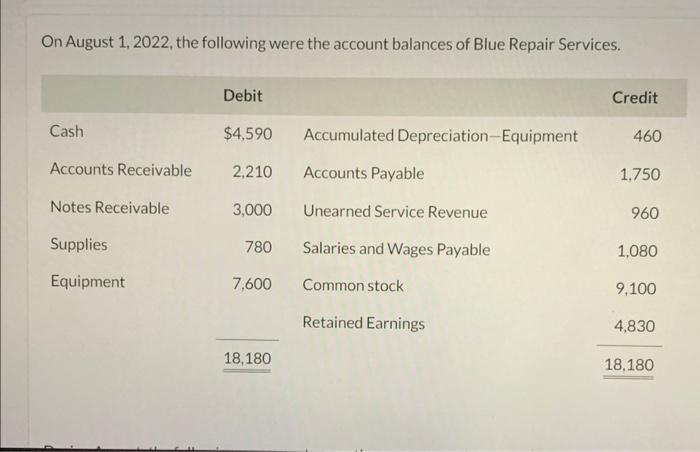

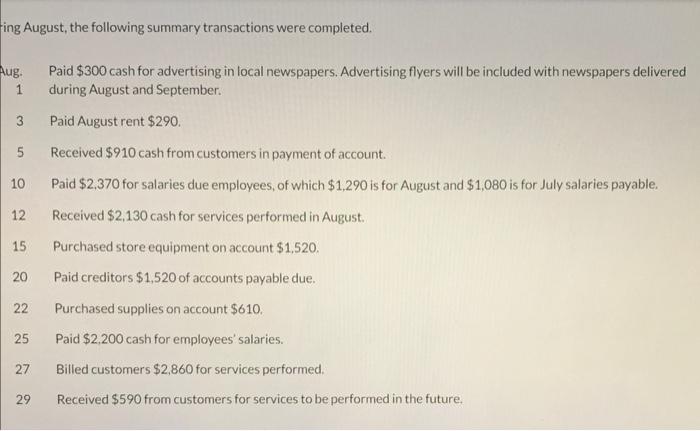

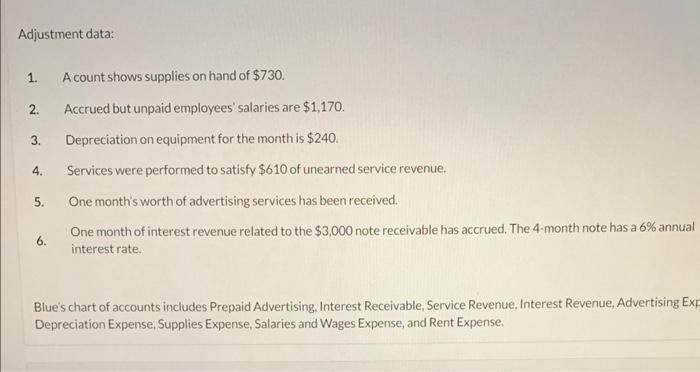

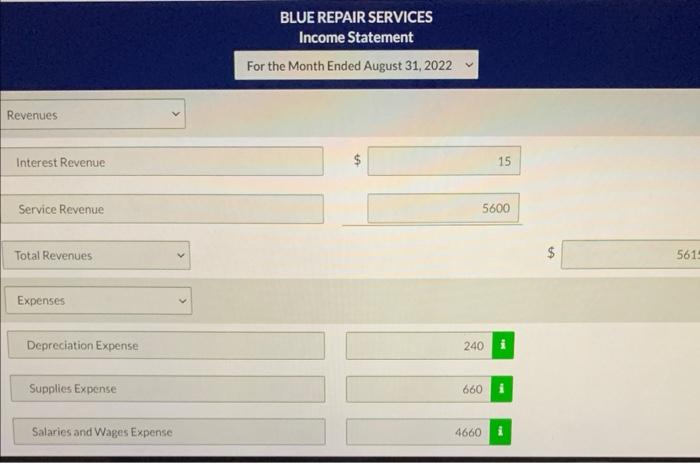

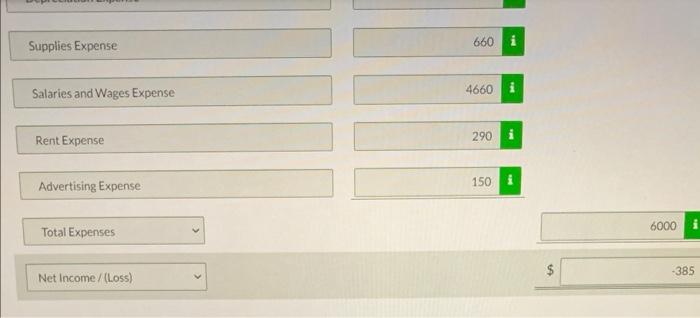

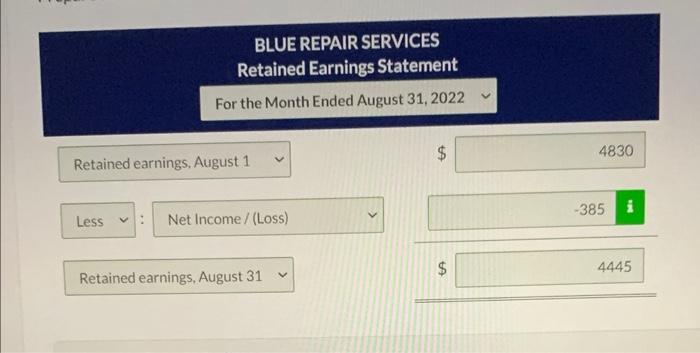

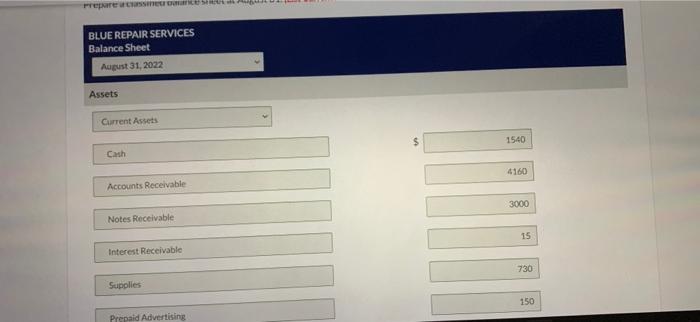

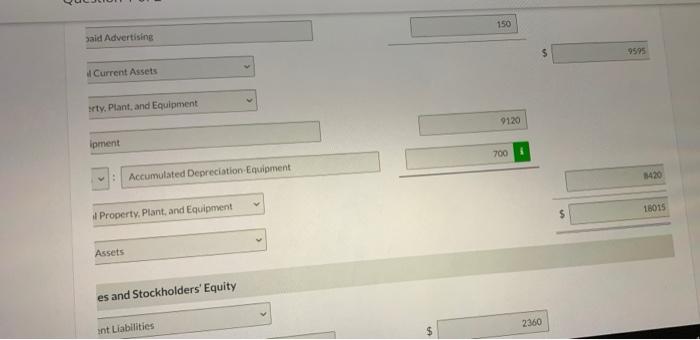

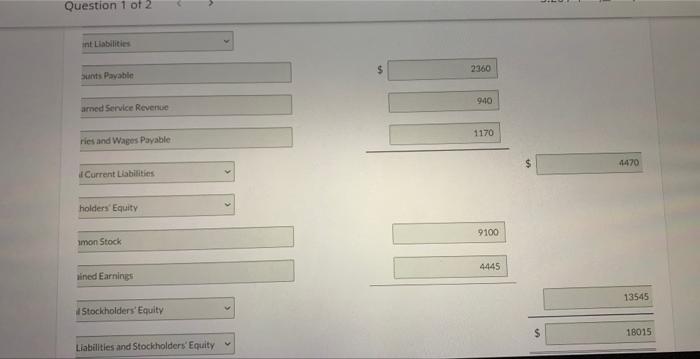

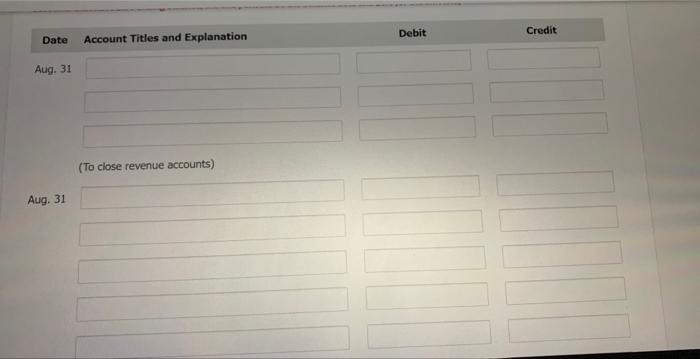

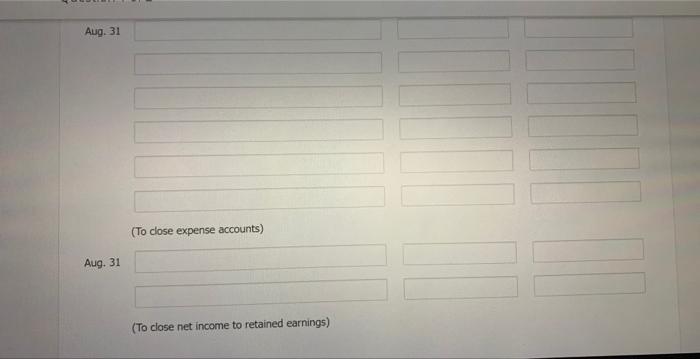

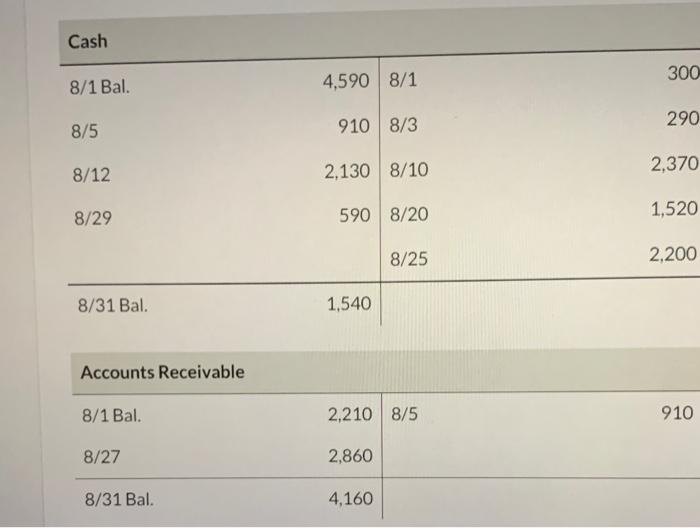

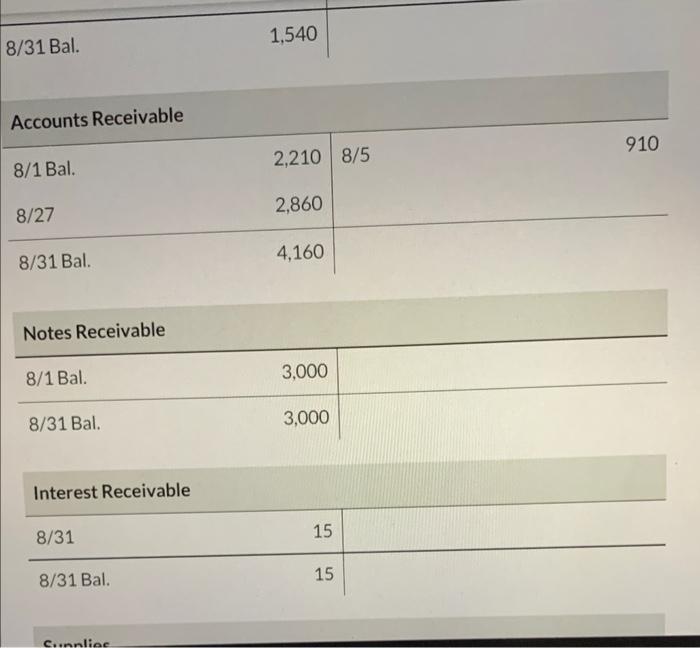

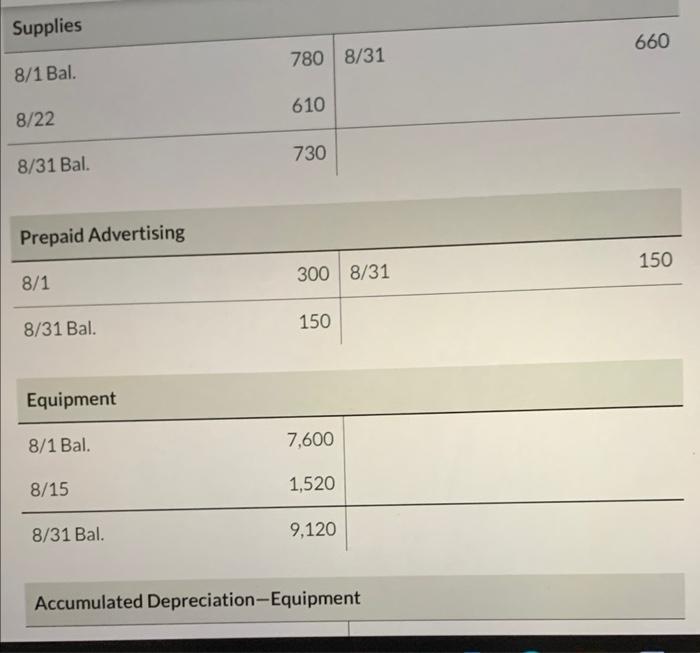

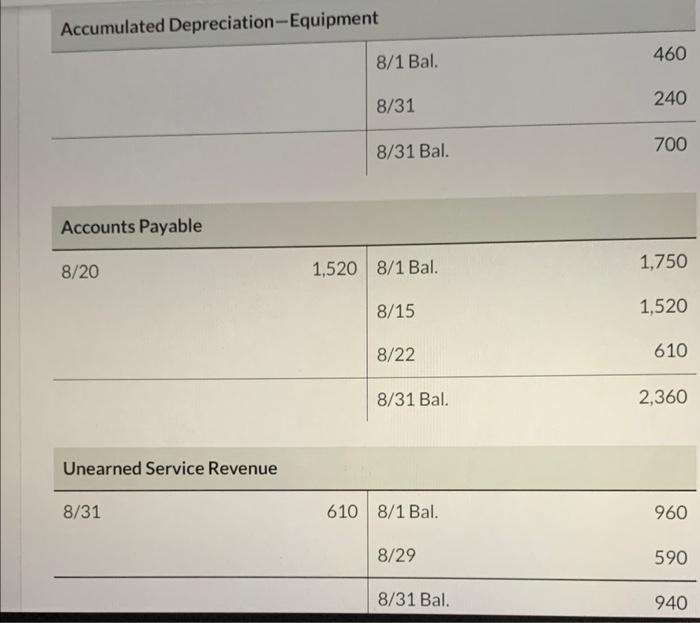

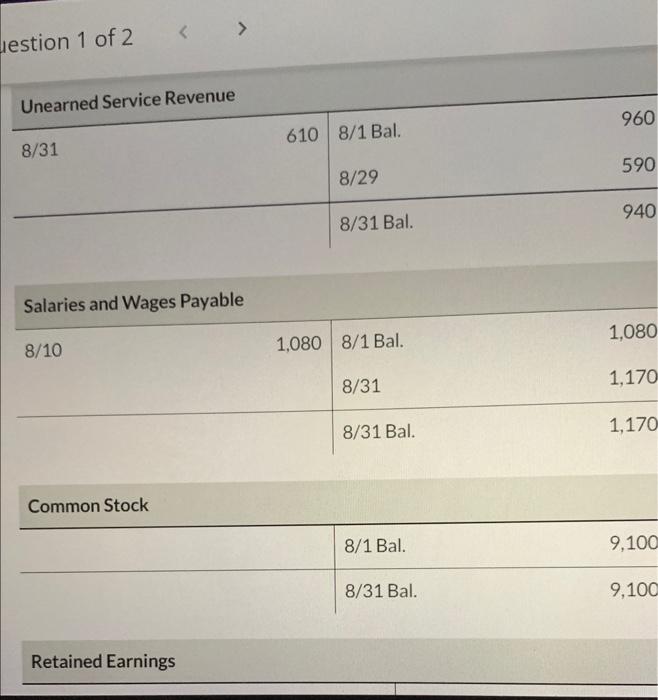

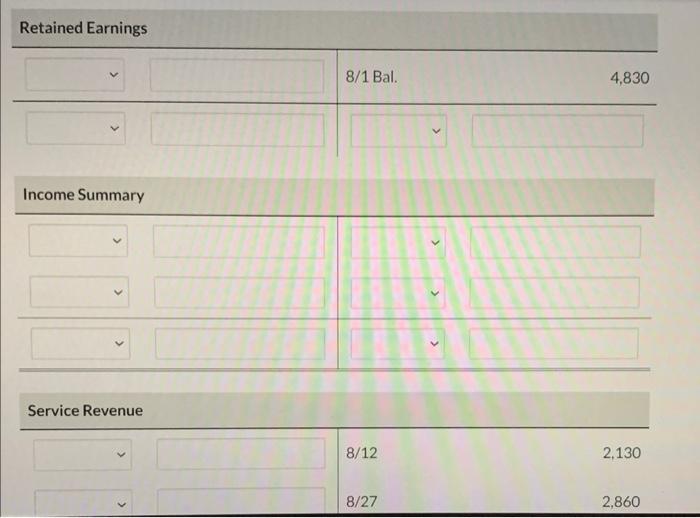

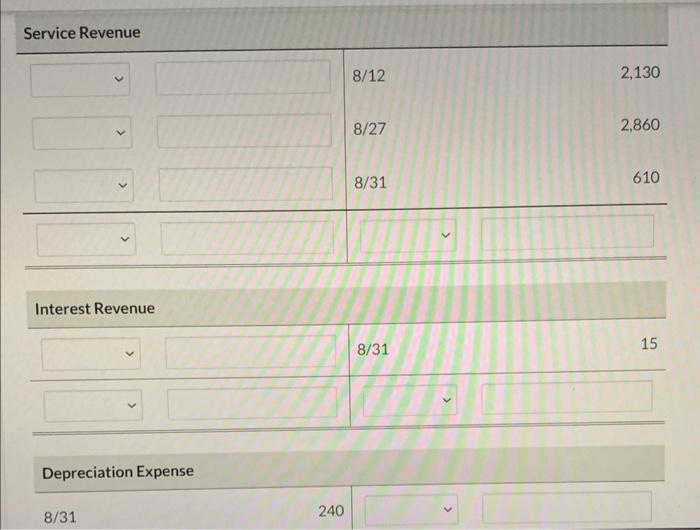

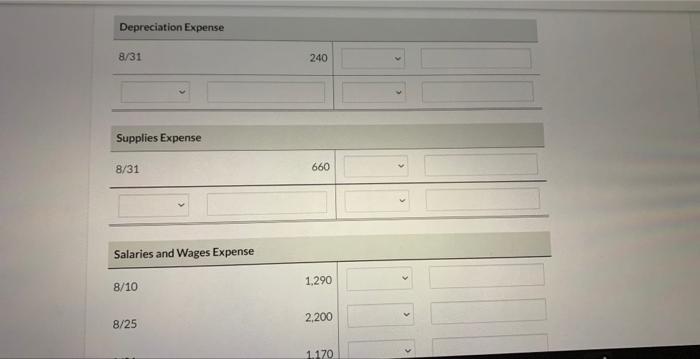

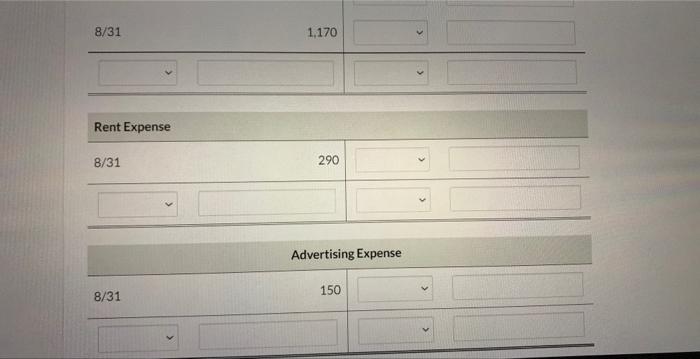

On August 1, 2022, the following were the account balances of Blue Repair Services. ing August, the following summary transactions were completed. Paid $300 cash for advertising in local newspapers. Advertising flyers will be included with newspapers delivered during August and September. 3 Paid August rent $290. 5 Received $910 cash from customers in payment of account. 10 Paid $2,370 for salaries due employees, of which $1,290 is for August and $1,080 is for July salaries payable. 12 Received $2,130 cash for services performed in August. 15 Purchased store equipment on account $1,520. 20 Paid creditors $1,520 of accounts payable due. 22 Purchased supplies on account $610. 25 Paid $2,200 cash for employees' salaries. 27 Billed customers $2,860 for services performed. 29 Received $590 from customers for services to be performed in the future. Adjustment data: 1. A count shows supplies on hand of $730. 2. Accrued but unpaid employees' salaries are $1,170. 3. Depreciation on equipment for the month is $240. 4. Services were performed to satisfy $610 of unearned service revenue. 5. One month's worth of advertising services has been received. 6. One month of interest revenue related to the $3,000 note receivable has accrued. The 4-month note has a 6% annual interest rate. Blue's chart of accounts includes Prepaid Advertising, Interest Receivable, Service Revenue, Interest Revenue, Advertising Exp Depreciation Expense, Supplies Expense, Salaries and Wages Expense, and Rent Expense. BLUE REPAIR SERVICES Income Statement For the Month Ended August 31, 2022 Revenues Interest Revenue Service Revenue Total Revenues 5600 Expenses Depreciation Expense Supplies Expense Salaries and Wages Expense Supplies Expense \begin{tabular}{|l|} \hline 660 i \\ \hline \end{tabular} Salaries and Wages Expense \begin{tabular}{|l|l|} \hline 46601 \\ \hline \end{tabular} Rent Expense Advertising Expense \begin{tabular}{|l|l|} \hline 290 & i \\ \hline & \\ \hline 150 & 1 \\ \hline \end{tabular} Total Expenses Net Income / (Loss) BLUEREPAIR SERVICES Retained Earnings Statement For the Month Ended August 31, 2022 \begin{tabular}{l} Retained earnings, August 1 \\ \hline Less : Net Income / (Loss) \\ \hline Retained earnings, August 31 \\ \hline \end{tabular} $4830 \begin{tabular}{|c|} \hline 4385k \\ $4 \end{tabular} BLUE REPAR SERVICES Balance Sheet August 31, 2022 Assets Current Assets Cahh $ 1540 Accounts Receivable 4160 Notes Receivable 3000 Interest Receivable Sapplies: 730 Prepaid Advertising 150 \begin{tabular}{l} said Advertising \\ \hline Current Assets \\ srty, Plant, and Equipment \\ ipment \end{tabular} es and Stockholders' Equity Question 1 of 2 \begin{tabular}{l|l} Date Account Titles and Explanation & Debit \\ \hline Aug. 31 & \end{tabular} (To close revenue accounts) Aug. 31 Aug. 31 (To close expense accounts) Aug. 31 (To close net income to retained earnings) 8/31 Bal. 1,540 Accounts Receivable \begin{tabular}{ll|l} Accounts Receivable & & \\ \hline 8/1 Bal. & 2,210 & 8/5 \\ 8/27 & 2,860 & \\ \hline 8/31 Bal. & 4,160 & \end{tabular} Notes Receivable \begin{tabular}{lr|l} \hline 8/1 Bal. & 3,000 & \\ \hline 8/31 Bal. & 3,000 & \end{tabular} \begin{tabular}{lr|l} Interest Receivable \\ \hline 8/31 & 15 & \\ \hline 8/31Bal. & 15 & \end{tabular} \begin{tabular}{lr|ll} \hline Supplies & 780 & 8/31 \\ \hline 8/1 Bal. & 610 & \\ 8/22 & 730 & \end{tabular} \begin{tabular}{lr|l} \hline Prepaid Advertising & \multicolumn{2}{l}{150} \\ \hline 8/1 & 300 & 8/31 \\ \hline 8/31 Bal. & 150 & \\ \hline Equipment & & \\ \hline 8/1 Bal. & 7,600 & \\ \hline 8/15 & 1,520 & \\ \hline 8/31 Bal. & 9,120 & \end{tabular} Accumulated Depreciation-Equipment Accumulated Depreciation-Equipment Unearned Service Revenue lestion 1 of 2 \begin{tabular}{ll|ll} \hline \multicolumn{2}{l}{ Unearned Service Revenue } & \\ \hline 8/31 & 610 & 8/1 Bal. & 960 \\ & 8/29 & 590 \\ \hline & 8/31 Bal. & 940 \end{tabular} \begin{tabular}{ll|ll} \hline \multicolumn{2}{l|}{ Salaries and Wages Payable } & \multicolumn{2}{l}{} \\ \hline 8/10 & 1,080 & 8/1Bal & 1,080 \\ & 8/31 & 1,170 \\ \hline & 8/31Bal & 1,170 \\ \hline & & \end{tabular} \begin{tabular}{l|lr} Common Stock & 8/1 Bal. & 9,100 \\ \hline & 8/31 Bal. & 9,100 \end{tabular} Retained Earnings Retained Earnings Income Summary Service Revenue \begin{tabular}{l|l|lc} \hline & 8/12 & 2,130 \\ \hline & & & \\ \hline & 8/27 & 2,860 \\ \hline \end{tabular} Service Revenue Depreciation Expense 8/31 240 Depreciation Expense Supplies Expense Salaries and Wages Expense 8/25 2,200 8/31 1,170 Rent Expense the journlize and post closing entries and complete the closing process ..

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started