Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I what he should do for every month ? it is 8750 Marshall's Swords Ltd makes and sells wooden swords for martial arts practice. The

I what he should do for every month ?

I what he should do for every month ?

it is 8750

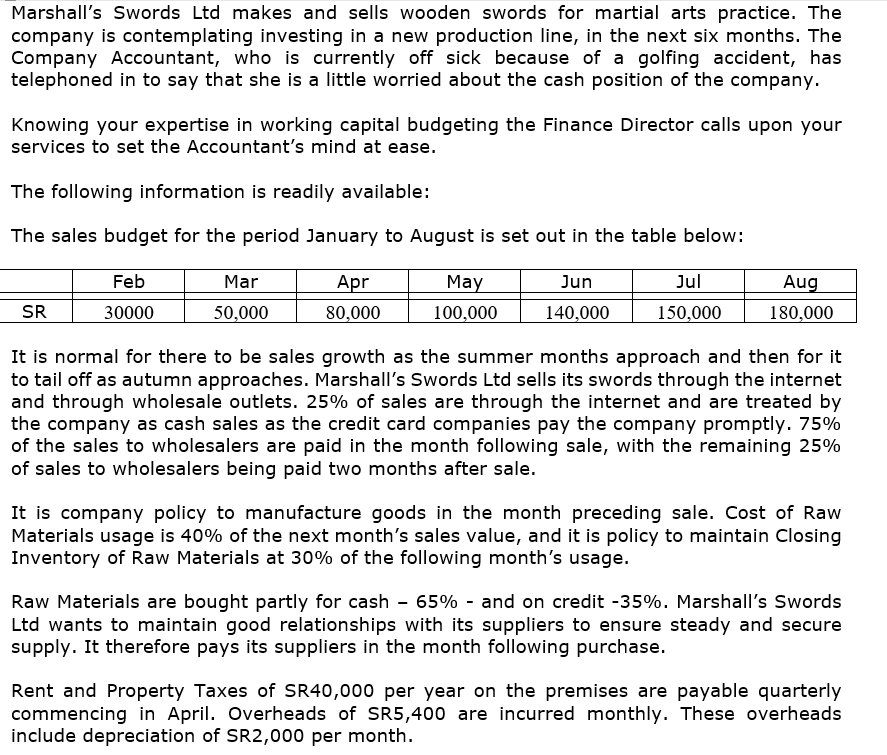

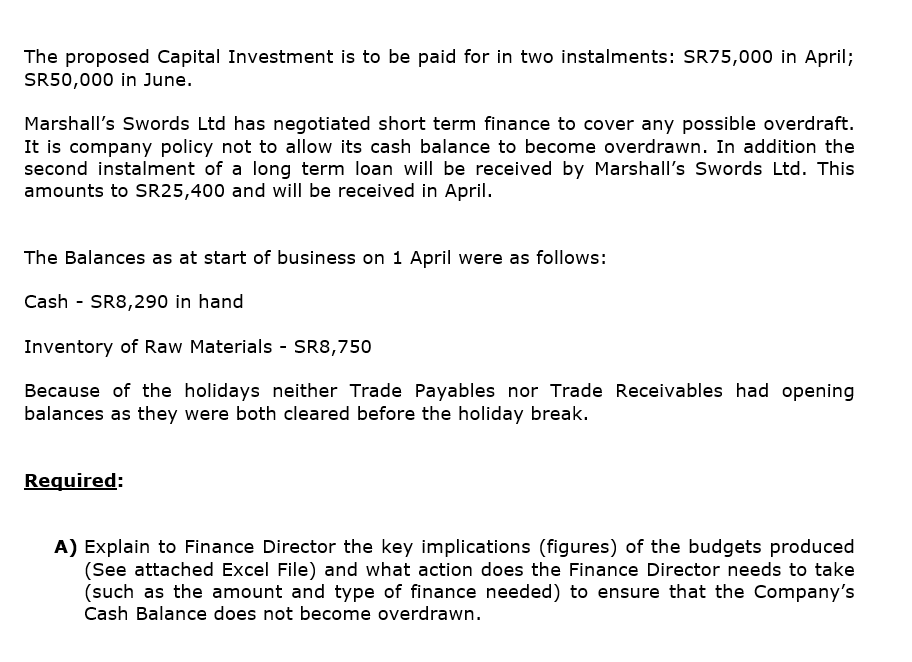

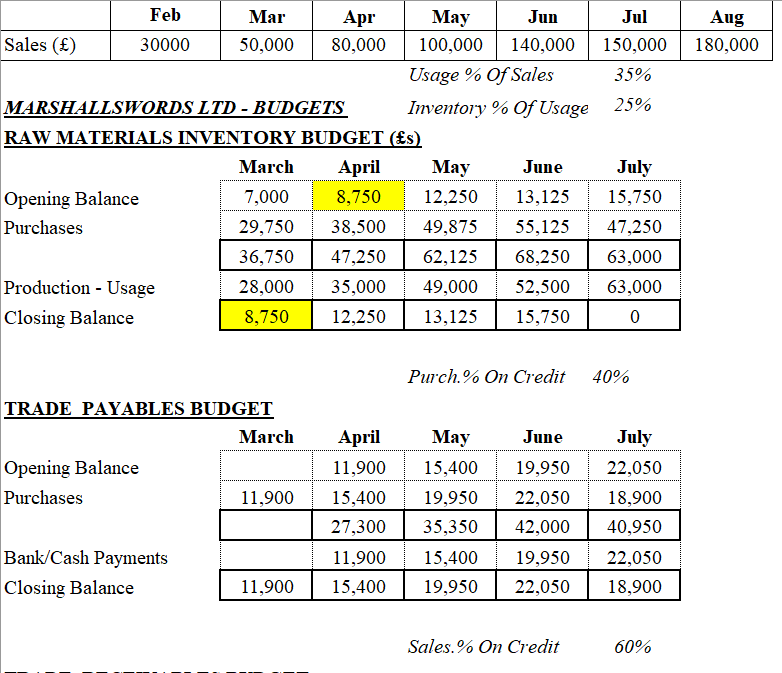

Marshall's Swords Ltd makes and sells wooden swords for martial arts practice. The company is contemplating investing in a new production line, in the next six months. The Company Accountant, who is currently off sick because of a golfing accident, has telephoned in to say that she is a little worried about the cash position of the company. Knowing your expertise in working capital budgeting the Finance Director calls upon your services to set the Accountant's mind at ease. The following information is readily available: The sales budget for the period January to August is set out in the table below: Feb 30000 1 Mar 50,000 Apr 80,000 May 100,000 Jun 140,000 | Jul 150,000 Aug 180,000 SR | | It is normal for there to be sales growth as the summer months approach and then for it to tail off as autumn approaches. Marshall's Swords Ltd sells its swords through the internet and through wholesale outlets. 25% of sales are through the internet and are treated by the company as cash sales as the credit card companies pay the company promptly. 75% of the sales to wholesalers are paid in the month following sale, with the remaining 25% of sales to wholesalers being paid two months after sale. It is company policy to manufacture goods in the month preceding sale. Cost of Raw Materials usage is 40% of the next month's sales value, and it is policy to maintain Closing Inventory of Raw Materials at 30% of the following month's usage. Raw Materials are bought partly for cash - 65% - and on credit -35%. Marshall's Swords Ltd wants to maintain good relationships with its suppliers to ensure steady and secure supply. It therefore pays its suppliers in the month following purchase. Rent and Property Taxes of SR40,000 per year on the premises are payable quarterly commencing in April. Overheads of SR5,400 are incurred monthly. These overheads include depreciation of SR2,000 per month. The proposed Capital Investment is to be paid for in two instalments: SR75,000 in April; SR50,000 in June. Marshall's Swords Ltd has negotiated short term finance to cover any possible overdraft. It is company policy not to allow its cash balance to become overdrawn. In addition the second instalment of a long term loan will be received by Marshall's Swords Ltd. This amounts to SR25,400 and will be received in April. The Balances as at start of business on 1 April were as follows: Cash - SR8,290 in hand Inventory of Raw Materials - SR8,750 Because of the holidays neither Trade Payables nor Trade Receivables had opening balances as they were both cleared before the holiday break. Required: A) Explain to Finance Director the key implications (figures) of the budgets produced (See attached Excel File) and what action does the Finance Director needs to take (such as the amount and type of finance needed to ensure that the Company's Cash Balance does not become overdrawn. Aug 180,000 Jul 150,000 35% 25% Feb Mar Apr May Jun Sales () 30000 50,000 80,000 100,000 140,000 Usage % Of Sales MARSHALLSWORDS LTD - BUDGETS Inventory % Of Usage RAW MATERIALS INVENTORY BUDGET (s) March April May June Opening Balance 7,000 8,750 12,250 13,125 Purchases 29,750 38,500 49,875 55,125 36,750 47,250 62,125 | 68,250 Production - Usage 28,000 35,000 49,000 52,500 Closing Balance 8,750 12,250 13,125 15,750 July 15,750 47,250 63,000 63,000 0 40% Purch.% On Credit TRADE PAYABLES BUDGET March April May June Opening Balance 11,900 15,400 19,950 Purchases 11,900 15,400 19,950 22,050 27,300 35,350 42,000 Bank/Cash Payments 11,900 15,400 19,950 Closing Balance | 11,900 | 15,400 | 19,950 22,050 July 22,050 18,900 40,950 22,050 18,900 Sales.% On Credit 60% 35% 60% MARSHALL'S SWORDS LTD Cash Sales.% CASH BUDGET Cash Purchases.% April May June Jul Total RECEIPTS Cash Sales 28,000 35,000 49,000 52,500 | 164,500 Trade Receivable - Receipts 27,000 43,500 57,000 78,000 205,500 Loan Received 25,400 25.400 Total Receipts | 80,400 | 78,500 | 106,000 | 130,500 | 395,400 PAYMENTS Trade Payables- Payments Cash Purchases Rent & Property Tax Overheads Capital Expenditure 11,900 15,400 19,950 22,050 69,300 23,100 29,92533,075 28,350 114,450 10,000 10,000 3,400 3,400 3,400 3,400 13,600 75,000 50,000 125,000 | 123,400 | 48,725 | 106,425 | 53,800 | 332,350 NET CASH FLOW OPENING BALANCE CLOSING BALANCE (43,000)| 29,775 8,750 (34,250) (34,250) (4,475) (425) (4,475) (4,900) 76,700 (4,900) 71,800 63,050 8,750 71,800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started