Question: I will not pay for help, sorry guys. That is what the first person said when they said I needed to edit the question. A

I will not pay for help, sorry guys. That is what the first person said when they said I needed to edit the question.

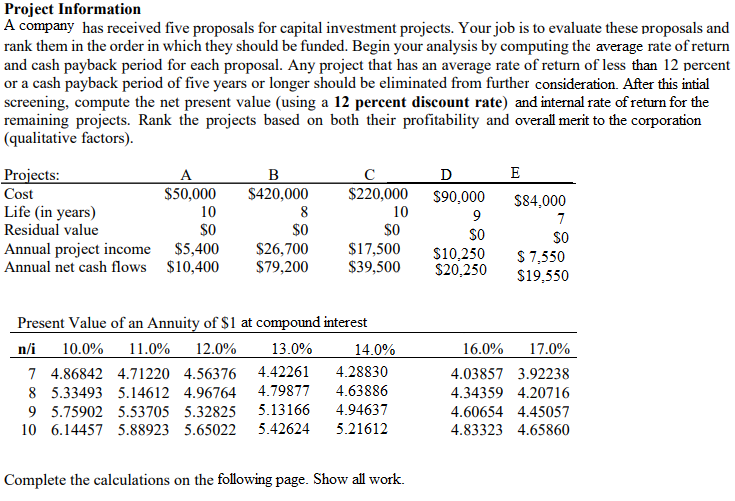

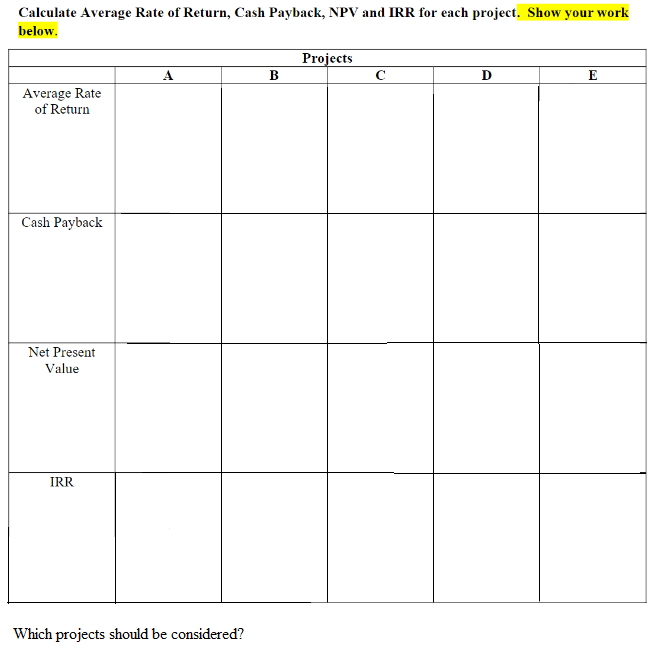

A company has received five proposals for capital investment projects. Your job is to evaluate these proposals and rank them in the order in which they should be funded. Begin your analysis by computing the average rate of return and cash payback period for each proposal. Any project that has an average rate of return of less than 12 percent or a cash payback period of five years or longer should be eliminated from further consideration. After this intial screening, compute the net present value (using a 12 percent discount rate) and internal rate of return for the remaining projects. Rank the projects based on both their profitability and overall merit to the corporation (qualitative factors). Present Value of an Annuity of $1 at compound interest Complete the calculations on the following page. Show all work. Calculate Average Rate of Return, Cash Payback, NPV and IRR for each project. Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts