Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I would just like an explanation for the answers, a presentation is not necessary 1: Compute the materials price and quantity variances for the year.

I would just like an explanation for the answers, a presentation is not necessary

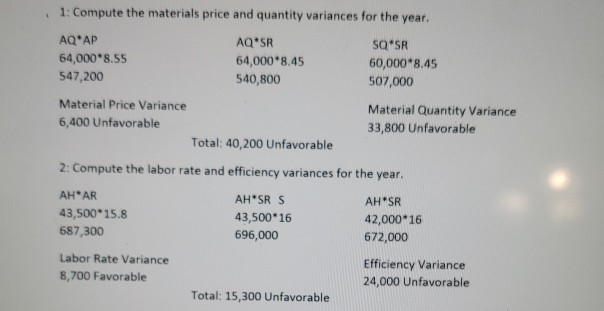

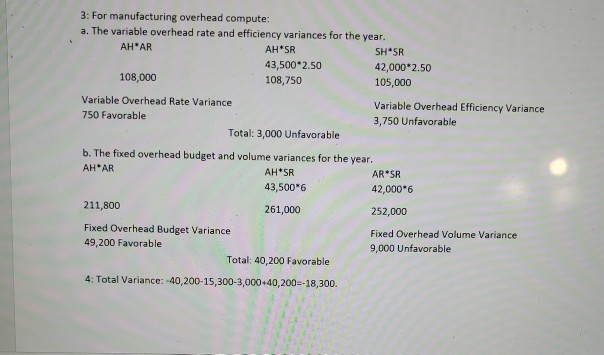

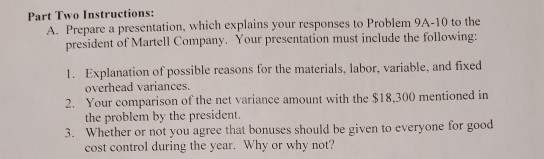

1: Compute the materials price and quantity variances for the year. AQ AP 64,000*8.55 547,200 Material Price Variance 6,400 Unfavorable AQ SR 64,000 8.45 540,800 60,000*8.45 507,000 Material Quantity Variance 33,800 Unfavorable Total: 40,200 Unfavorable 2: Compute the labor rate and efficiency variances for the year. AH AR 43,500 15.8 687,300 Labor Rate Variance 8,700 Favorable AH SR S 43,500*16 696,000 AH SR 42,000*16 672,000 Efficiency Variance 24,000 Unfavorable Total: 15,300 Unfavorable 3: For manufacturing overhead compute: a. The variable overhead rate and efficiency variances for the year. AH AR AH SR 43,500 2.50 108,750 SH SR 42,000 2.50 105,000 108,000 Variable Overhead Rate Variance Variable Overhead Efficiency Variance 3,750 Unfavorable 750 Favorable Total: 3,000 Unfavorable b. The fixed overhead budget and volume variances for the year. AH AR AH SR 43,500 6 261,000 AR SR 42,000 6 252,000 Fixed Overhead Volume Variance 9,000 Unfavorable 211,800 Fixed Overhead Budget Variance 49,200 Favorable Total: 40,200 Favorable 4 Total Variance: 40,200- 5,300-3,000+40,200--18,300. Part Two Instructions: explains your responses to Problem 9A-10 to the A. Prepare a presentation, which president of Martell Company. Your presentation must include the following: 1. Explanation of possible reasons for the materials, labor, variable, and fixed 2. Your comparison of the net variance amount with the $18,300 mentioned in 3. Whether or not you agree that bonuses should be given to everyone for good overhead variances. the problem by the president cost control during the year. Why or why notStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started