Question

If a bond is purchased for exactly its face value, then the YTM is lower than, higher than, the same as the coupon rate printed

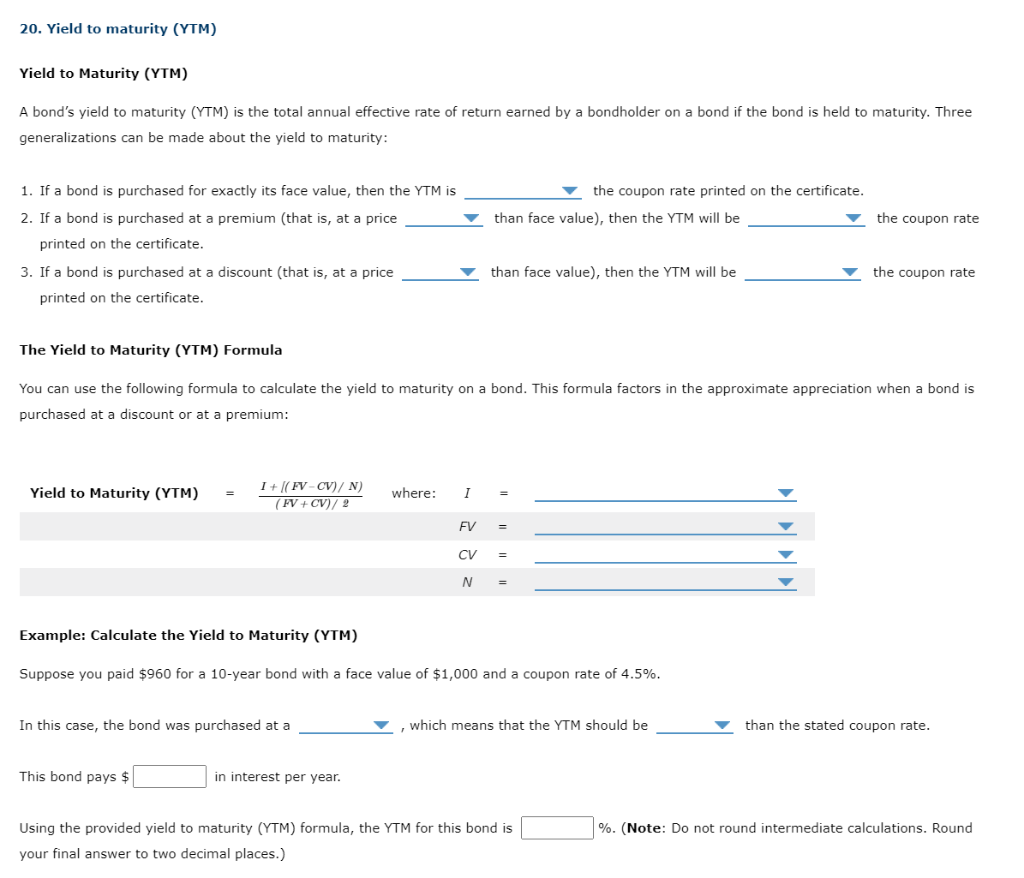

If a bond is purchased for exactly its face value, then the YTM is lower than, higher than, the same as the coupon rate printed on the certificate.

If a bond is purchased at a premium (that is, at a price lower or higher than face value), then the YTM will be lower than, the same as, higher than the coupon rate printed on the certificate.

If a bond is purchased at a discount (that is, at a price higher or lower than face value), then the YTM will be lower than, higher than, the same as the coupon rate printed on the certificate.

I = Number of years until maturity, face value, interest paid annually in dollars, current value

FV = Number of years until maturity, face value, interest paid annually in dollars, current value

CV = Number of years until maturity, face value, interest paid annually in dollars, current value

N = Number of years until maturity, face value, interest paid annually in dollars, current value

In this case, the bond was purchased at a discount or premium which means that the YTM should be lower or higher than the stated coupon rate.

Yield to Maturity (YTM) A bond's yield to maturity (YTM) is the total annual effective rate of return earned by a bondholder on a bond if the bond is held to maturity. Three generalizations can be made about the yield to maturity: 1. If a bond is purchased for exactly its face value, then the YTM is the coupon rate printed on the certificate. 2. If a bond is purchased at a premium (that is, at a price than face value), then the YTM will be the coupon rate printed on the certificate. 3. If a bond is purchased at a discount (that is, at a price than face value), then the YTM will be the coupon rate printed on the certificate. The Yield to Maturity (YTM) Formula You can use the following formula to calculate the yield to maturity on a bond. This formula factors in the approximate appreciation when a bond purchased at a discount or at a premium: YieldtoMaturity(YTM)=(FV+CV)/2I+[(FVCV)/N)where:I=-FV=CV=N= Example: Calculate the Yield to Maturity (YTM) Suppose you paid $960 for a 10-year bond with a face value of $1,000 and a coupon rate of 4.5%. In this case, the bond was purchased at a , which means that the YTM should be than the stated coupon rate. This bond pays \$ in interest per year. Using the provided yield to maturity (YTM) formula, the YTM for this bond is \%. (Note: Do not round intermediate calculations. Round your final answer to two decimal places.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started