Question

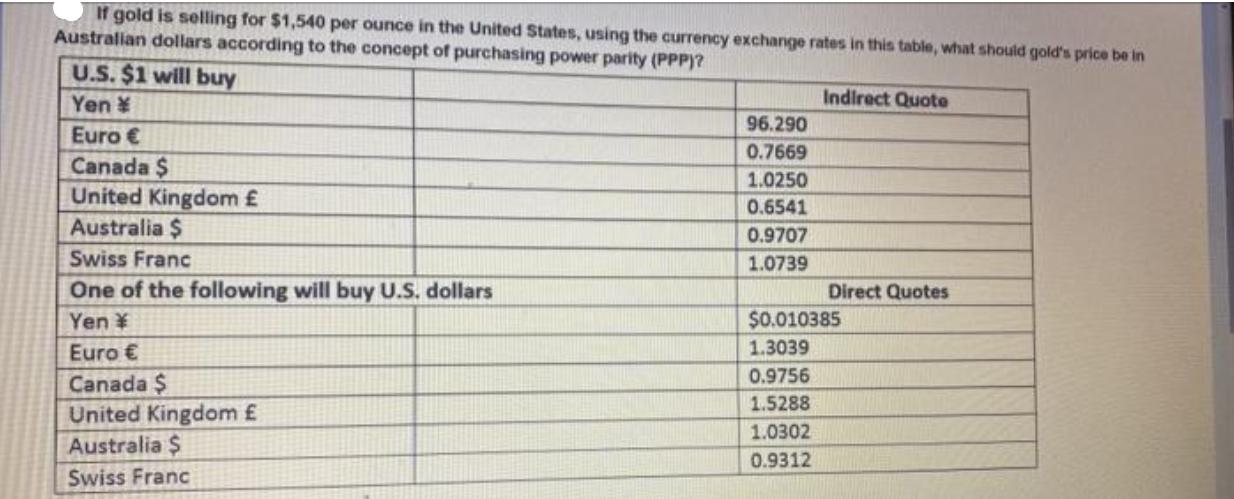

If gold is selling for $1,540 per ounce in the United States, using the currency exchange rates in this table, what should gold's price

If gold is selling for $1,540 per ounce in the United States, using the currency exchange rates in this table, what should gold's price be in Australian dollars according to the concept of purchasing power parity (PPP)? U.S. $1 will buy Yen Indirect Quote 96.290 Euro 0.7669 Canada $ 1.0250 United Kingdom 0.6541 Australia $ 0.9707 Swiss Franc 1.0739 One of the following will buy U.S. dollars Direct Quotes Yen $0.010385 1.3039 Euro 0.9756 Canada $ 1.5288 United Kingdom 1.0302 Australia $ 0.9312 Swiss Franc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Global Strategy

Authors: Mike W. Peng

5th Edition

0357512367, 978-0357512364

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App