If I could please get help with the associate formulas for the exercise below, I'd really appreciate the help!

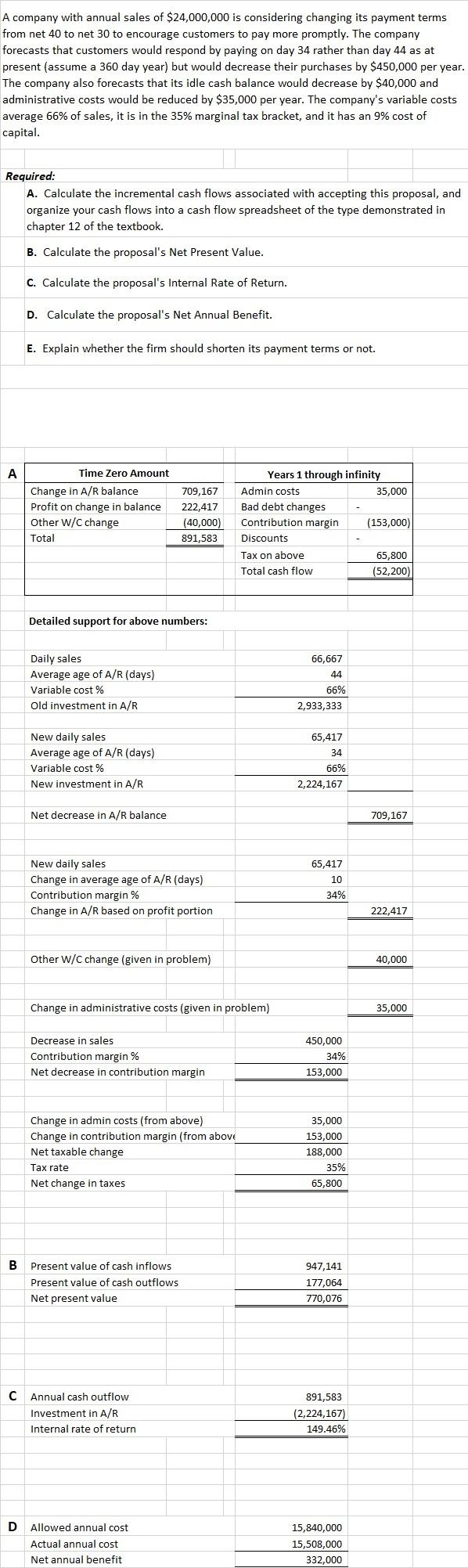

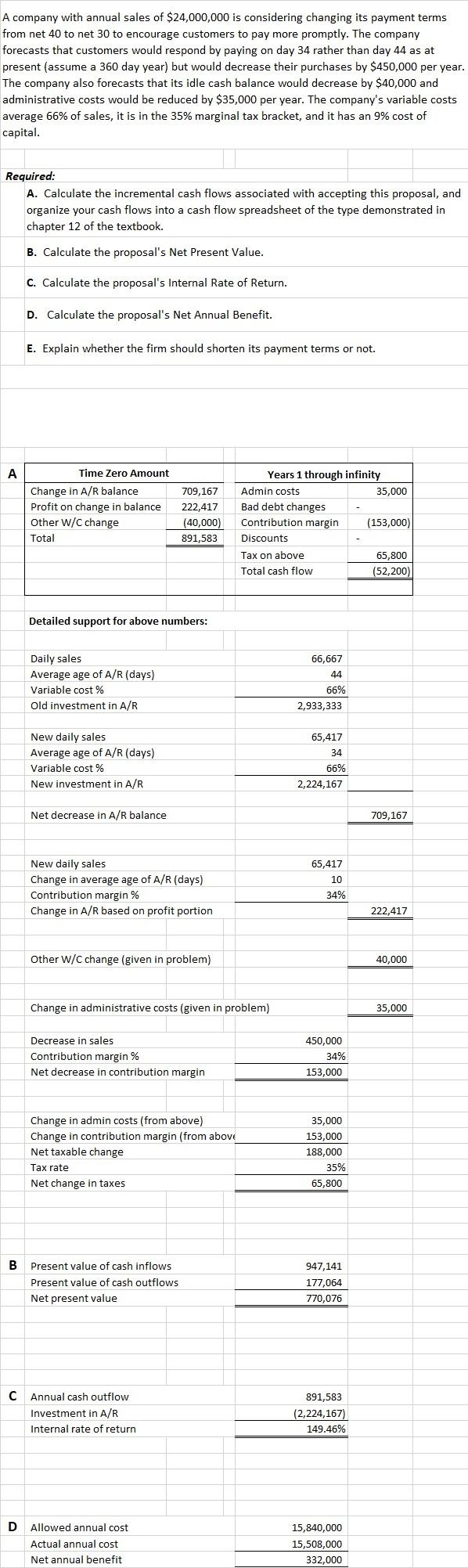

A company with annual sales of $24,000,000 is considering changing its payment terms from net 40 to net 30 to encourage customers to pay more promptly. The company forecasts that customers would respond by paying on day 34 rather than day 44 as at present (assume a 360 day year) but would decrease their purchases by $450,000 per year. The company also forecasts that its idle cash balance would decrease by $40,000 and administrative costs would be reduced by $35,000 per year. The company's variable costs average 66% of sales, it is in the 35% marginal tax bracket, and it has an 9% cost of capital. Required: A. Calculate the incremental cash flows associated with accepting this proposal, and organize your cash flows into a cash flow spreadsheet of the type demonstrated in chapter 12 of the textbook. a B. Calculate the proposal's Net Present Value. C. Calculate the proposal's Internal Rate of Return. D. Calculate the proposal's Net Annual Benefit. E. Explain whether the firm should shorten its payment terms or not. A Time Zero Amount Change in A/R balance Profit on change in balance Other W/C change Total 709,167 222,417 (40,000) 891,583 Years 1 through infinity Admin costs 35,000 Bad debt changes Contribution margin (153,000) Discounts Tax on above 65,800 Total cash flow (52,200) Detailed support for above numbers: Daily sales Average age of A/R (days) Variable cost % Old investment in A/R 66,667 44 66% 2,933,333 65,417 34 New daily sales Average age of A/R (days) Variable cost % New investment in A/R 66% 2,224,167 Net decrease in A/R balance 709.167 New daily sales Change in average age of A/R (days) Contribution margin % Change in A/R based on profit portion 65,417 10 34% 222,417 Other W/C change (given in problem) 40,000 Change in administrative costs (given in problem) 35,000 450,000 Decrease in sales Contribution margin % Net decrease in contribution margin 34% 153,000 Change in admin costs (from above) Change in contribution margin (from above Net taxable change Tax rate Net change in taxes 35,000 153,000 188,000 35% 65,800 B Present value of cash inflows Present value of cash outflows Net present value 947,141 177,064 770,076 C Annual cash outflow Investment in A/R Internal rate of return 891,583 (2,224,167) 149.46% D Allowed annual cost Actual annual cost Net annual benefit 15,840,000 15,508,000 332,000 A company with annual sales of $24,000,000 is considering changing its payment terms from net 40 to net 30 to encourage customers to pay more promptly. The company forecasts that customers would respond by paying on day 34 rather than day 44 as at present (assume a 360 day year) but would decrease their purchases by $450,000 per year. The company also forecasts that its idle cash balance would decrease by $40,000 and administrative costs would be reduced by $35,000 per year. The company's variable costs average 66% of sales, it is in the 35% marginal tax bracket, and it has an 9% cost of capital. Required: A. Calculate the incremental cash flows associated with accepting this proposal, and organize your cash flows into a cash flow spreadsheet of the type demonstrated in chapter 12 of the textbook. a B. Calculate the proposal's Net Present Value. C. Calculate the proposal's Internal Rate of Return. D. Calculate the proposal's Net Annual Benefit. E. Explain whether the firm should shorten its payment terms or not. A Time Zero Amount Change in A/R balance Profit on change in balance Other W/C change Total 709,167 222,417 (40,000) 891,583 Years 1 through infinity Admin costs 35,000 Bad debt changes Contribution margin (153,000) Discounts Tax on above 65,800 Total cash flow (52,200) Detailed support for above numbers: Daily sales Average age of A/R (days) Variable cost % Old investment in A/R 66,667 44 66% 2,933,333 65,417 34 New daily sales Average age of A/R (days) Variable cost % New investment in A/R 66% 2,224,167 Net decrease in A/R balance 709.167 New daily sales Change in average age of A/R (days) Contribution margin % Change in A/R based on profit portion 65,417 10 34% 222,417 Other W/C change (given in problem) 40,000 Change in administrative costs (given in problem) 35,000 450,000 Decrease in sales Contribution margin % Net decrease in contribution margin 34% 153,000 Change in admin costs (from above) Change in contribution margin (from above Net taxable change Tax rate Net change in taxes 35,000 153,000 188,000 35% 65,800 B Present value of cash inflows Present value of cash outflows Net present value 947,141 177,064 770,076 C Annual cash outflow Investment in A/R Internal rate of return 891,583 (2,224,167) 149.46% D Allowed annual cost Actual annual cost Net annual benefit 15,840,000 15,508,000 332,000