Answered step by step

Verified Expert Solution

Question

1 Approved Answer

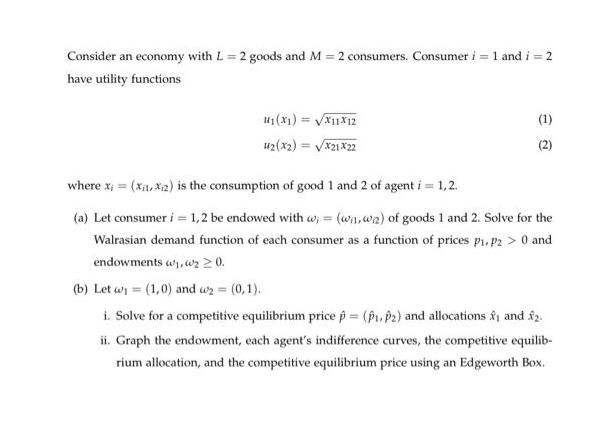

Consider an economy with L = 2 goods and M = 2 consumers. Consumer i = 1 and i = 2 have utility functions

Consider an economy with L = 2 goods and M = 2 consumers. Consumer i = 1 and i = 2 have utility functions u(x1) = X11X12 12(x2)=x21x22 (1) (2) where x = (x, x2) is the consumption of good 1 and 2 of agent i = 1,2. (a) Let consumer i = 1,2 be endowed with w;= (w.wa) of goods 1 and 2. Solve for the Walrasian demand function of each consumer as a function of prices P, P2> 0 and endowments , 0. (b) Let w = (1,0) and = (0,1). i. Solve for a competitive equilibrium price p = (P, P2) and allocations and 22. ii. Graph the endowment, each agent's indifference curves, the competitive equilib- rium allocation, and the competitive equilibrium price using an Edgeworth Box.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

This economics problem is asking for the Walrasian or Marshallian demand functions of consumers given their utility functions and endowments as well as the competitive equilibrium price and allocations Lets break it down step by step Part a Walrasian Demand Functions The Walrasian demand function for each consumer can be computed using their utility maximization problem subject to their budget constraint Consumer 1s budget constraint is given by p1 x11 p2 x12 p1 omega11 p2 omega12 We maximize Consumer 1s utility subject to this constraint The utility maximization problem can be set up using Lagrange multipliers L sqrtx11 x12 lambda p1 omega11 p2 omega12 p1 x11 p2 x12 Taking derivatives with respect to x11 x12 and lambda and setting each equal to zero gives fracpartial Lpartial x11 frac12sqrtx11 x12x12 lambda p1 0 quad 3 fracpartial Lpartial x12 frac12sqrtx11 x12x11 lambda p2 0 quad 4 fracpartial Lpartial lambda p1 omega11 p2 omega12 p1 x11 p2 x12 0 quad 5 From equations 3 and 4 we get fracx12x11 fracp1p2 This gives us x12 fracp1p2 x11 Plugging this into the budget constraint 5 we get p1 x11 p2 fracp1p2 x11 p1 omega11 p2 omega12 2 p1 x11 p1 omega11 p2 omega12 x11 fracomega11 fracp2p1 omega122 Using the relation x12 fracp1p2 x11 we find x12 fracp1p2 fracomega11 fracp2p1 omega122 We can simplify and solve for x12 as well x12 fracfracp1p2omega11 omega122 Thus the Walrasian demand functions for Consumer 1 are x11p1 p2 omega11 omega12 fracomega11 fracp2p1 omega122 x12p1 p2 omega11 omega12 fracfracp1p2omega11 omega122 You would follow a similar procedure for Consumer 2 considering their utility function and budget constraint Part b Competitive Equilibrium Price Allocations and Edgeworth Box This part of the question involves solving for the equilibrium where the aggregated demand equals the aggregated supply which is just the sum of the endowments since there is no production and graphing the result in an Edgeworth box Lets denote the competitive equilibrium prices as p p1 p2 To solve for these prices we would set the total demand for each good equal to the total endowment of that good x11p1 p2 omega11 omega12 x21p1 p2 omega21 omega22 omega11 omega21 x12p1 p2 omega11 omega12 x22p1 p2 omega21 omega22 omega12 omega22 These two equations would be solved simultaneously to find p1 and p2 After finding p1 and p2 you can substitute these prices into the Walrasian demand functions to find the allocation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started