Answered step by step

Verified Expert Solution

Question

1 Approved Answer

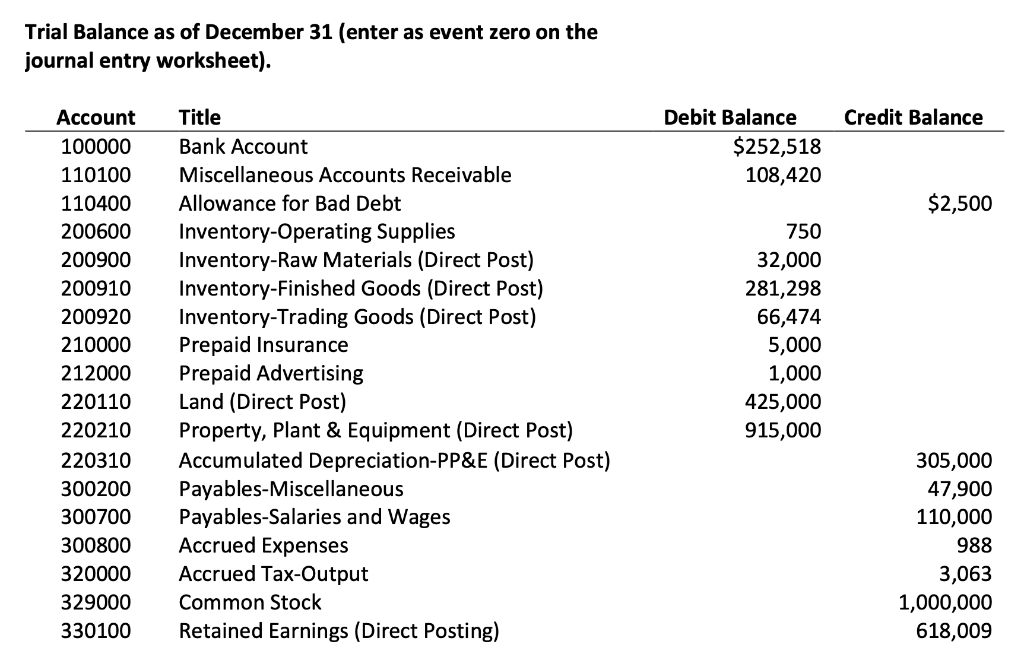

If someone could help me with these 8 Adjusting Journal Entries! Thank you :) Trial Balance as of December 31 (enter as event zero on

If someone could help me with these 8 Adjusting Journal Entries! Thank you :)

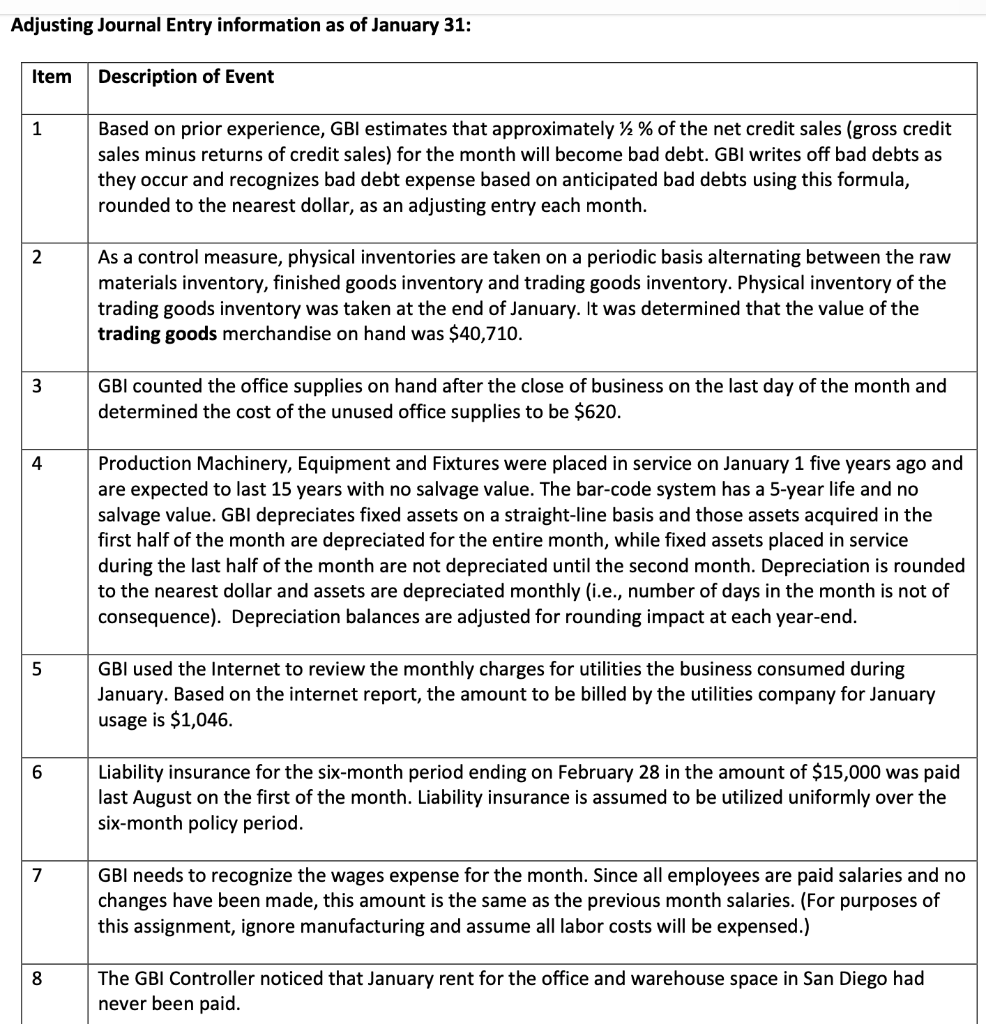

Trial Balance as of December 31 (enter as event zero on the journal entry worksheet). Account Title 100000 Bank Account 110100 Miscellaneous Accounts Receivable 110400 Allowance for Bad Debt 200600 Inventory-Operating Supplies 200900 Inventory-Raw Materials (Direct Post) 200910 200920 Inventory-Finished Goods (Direct Post) Inventory-Trading Goods (Direct Post) Prepaid Insurance 210000 212000 Prepaid Advertising 220110 Land (Direct Post) 220210 Property, Plant & Equipment (Direct Post) 220310 Accumulated Depreciation-PP&E (Direct Post) Payables-Miscellaneous 300200 300700 Payables-Salaries and Wages 300800 Accrued Expenses 320000 Accrued Tax-Output 329000 Common Stock 330100 Retained Earnings (Direct Posting) Debit Balance $252,518 108,420 750 32,000 281,298 66,474 5,000 1,000 425,000 915,000 Credit Balance $2,500 305,000 47,900 110,000 988 3,063 1,000,000 618,009 Adjusting Journal Entry information as of January 31: Item Description of Event 1 Based on prior experience, GBI estimates that approximately % of the net credit sales (gross credit sales minus returns of credit sales) for the month will become bad debt. GBI writes off bad debts as they occur and recognizes bad debt expense based on anticipated bad debts using this formula, rounded to the nearest dollar, as an adjusting entry each month. 2 As a control measure, physical inventories are taken on a periodic basis alternating between the raw materials inventory, finished goods inventory and trading goods inventory. Physical inventory of the trading goods inventory was taken at the end of January. It was determined that the value of the trading goods merchandise on hand was $40,710. 3 GBI counted the office supplies on hand after the close of business on the last day of the month and determined the cost of the unused office supplies to be $620. 4 Production Machinery, Equipment and Fixtures were placed in service on January 1 five years ago and are expected to last 15 years with no salvage value. The bar-code system has a 5-year life and no salvage value. GBI depreciates fixed assets on a straight-line basis and those assets acquired in the first half of the month are depreciated for the entire month, while fixed assets placed in service during the last half of the month are not depreciated until the second month. Depreciation is rounded to the nearest dollar and assets are depreciated monthly (i.e., number of days in the month is not of consequence). Depreciation balances are adjusted for rounding impact at each year-end. 5 GBI used the Internet to review the monthly charges for utilities the business consumed during January. Based on the internet report, the amount to be billed by the utilities company for January usage is $1,046. 6 Liability insurance for the six-month period ending on February 28 in the amount of $15,000 was paid last August on the first of the month. Liability insurance is assumed to be utilized uniformly over the six-month policy period. 7 GBI needs to recognize the wages expense all employees are paid salaries and no changes have been made, this amount is the same as the previous month salaries. (For purposes of this assignment, ignore manufacturing and assume all labor costs will be expensed.) 8 The GBI Controller noticed that January rent for the office and warehouse space in San Diego had never been paidStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started