Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If you write a call option you: a) may exercise the option if the stock price rises. b) may be forced to sell the

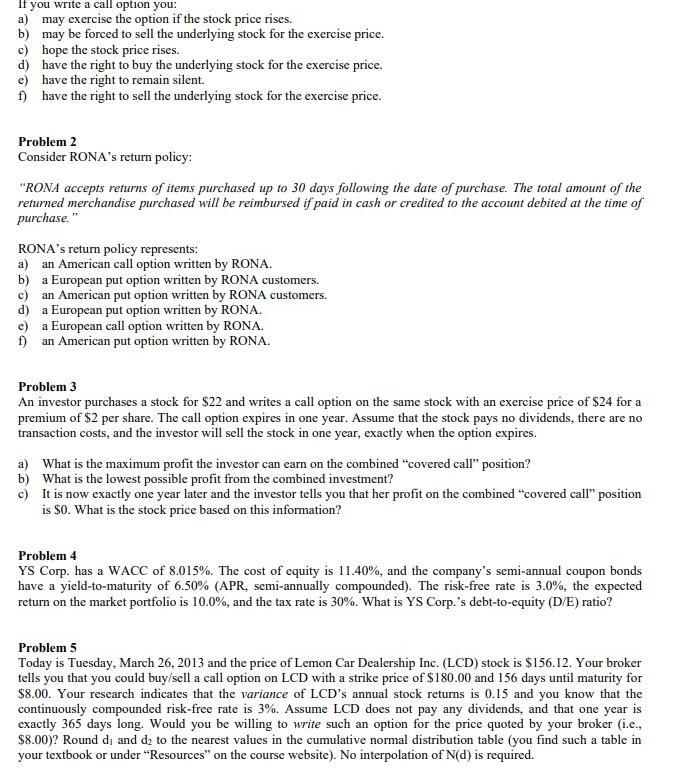

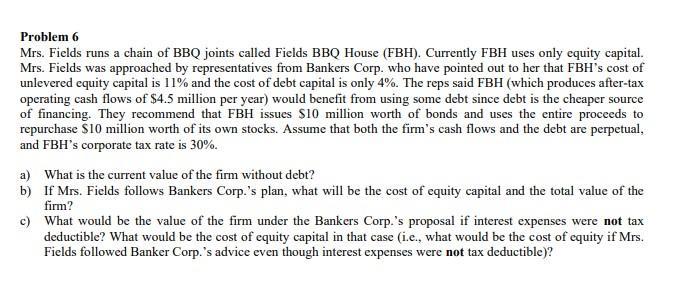

If you write a call option you: a) may exercise the option if the stock price rises. b) may be forced to sell the underlying stock for the exercise price. c) hope the stock price rises. d) have the right to buy the underlying stock for the exercise price. e) have the right to remain silent. f) have the right to sell the underlying stock for the exercise price. Problem 2 Consider RONA's return policy: "RONA accepts returns of items purchased up to 30 days following the date of purchase. The total amount of the returned merchandise purchased will be reimbursed if paid in cash or credited to the account debited at the time of purchase." RONA's return policy represents: a) an American call option written by RONA. b) a European put option written by RONA customers. c) an American put option written by RONA customers. d) a European put option written by RONA. e) f) a European call option written by RONA. an American put option written by RONA. Problem 3 An investor purchases a stock for $22 and writes a call option on the same stock with an exercise price of $24 for a premium of $2 per share. The call option expires in one year. Assume that the stock pays no dividends, there are no transaction costs, and the investor will sell the stock in one year, exactly when the option expires. a) What is the maximum profit the investor can earn on the combined "covered call" position? b) What is the lowest possible profit from the combined investment? c) It is now exactly one year later and the investor tells you that her profit on the combined "covered call" position is $0. What is the stock price based on this information? Problem 4 YS Corp. has a WACC of 8.015%. The cost of equity is 11.40%, and the company's semi-annual coupon bonds have a yield-to-maturity of 6.50% (APR, semi-annually compounded). The risk-free rate is 3.0%, the expected return on the market portfolio is 10.0%, and the tax rate is 30%. What is YS Corp.'s debt-to-equity (D/E) ratio? Problem 5 Today is Tuesday, March 26, 2013 and the price of Lemon Car Dealership Inc. (LCD) stock is $156.12. Your broker tells you that you could buy/sell a call option on LCD with a strike price of $180.00 and 156 days until maturity for $8.00. Your research indicates that the variance of LCD's annual stock returns is 0.15 and you know that the continuously compounded risk-free rate is 3%. Assume LCD does not pay any dividends, and that one year is exactly 365 days long. Would you be willing to write such an option for the price quoted by your broker (i.c., $8.00)? Round di and d to the nearest values in the cumulative normal distribution table (you find such a table in your textbook or under "Resources" on the course website). No interpolation of N(d) is required. Problem 6 Mrs. Fields runs a chain of BBQ joints called Fields BBQ House (FBH). Currently FBH uses only equity capital. Mrs. Fields was approached by representatives from Bankers Corp. who have pointed out to her that FBH's cost of unlevered equity capital is 11% and the cost of debt capital is only 4%. The reps said FBH (which produces after-tax operating cash flows of $4.5 million per year) would benefit from using some debt since debt is the cheaper source of financing. They recommend that FBH issues $10 million worth of bonds and uses the entire proceeds to repurchase $10 million worth of its own stocks. Assume that both the firm's cash flows and the debt are perpetual, and FBH's corporate tax rate is 30%. a) What is the current value of the firm without debt? b) If Mrs. Fields follows Bankers Corp.'s plan, what will be the cost of equity capital and the total value of the firm? c) What would be the value of the firm under the Bankers Corp.'s proposal if interest expenses were not tax deductible? What would be the cost of equity capital in that case (i.e., what would be the cost of equity if Mrs. Fields followed Banker Corp.'s advice even though interest expenses were not tax deductible)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets go through each problem step by step Problem 2 RONAs return policy represents b a European put option written by RONA customers Problem 3 a The maximum profit the investor can earn on the combine...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started