Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. Ill MTC-Namibia Censu... 20:23 4803 ASS 4 c. Debt collection d. recruitment of etutors 020 Question 20 Notyet answered Marked out of 1.00 P

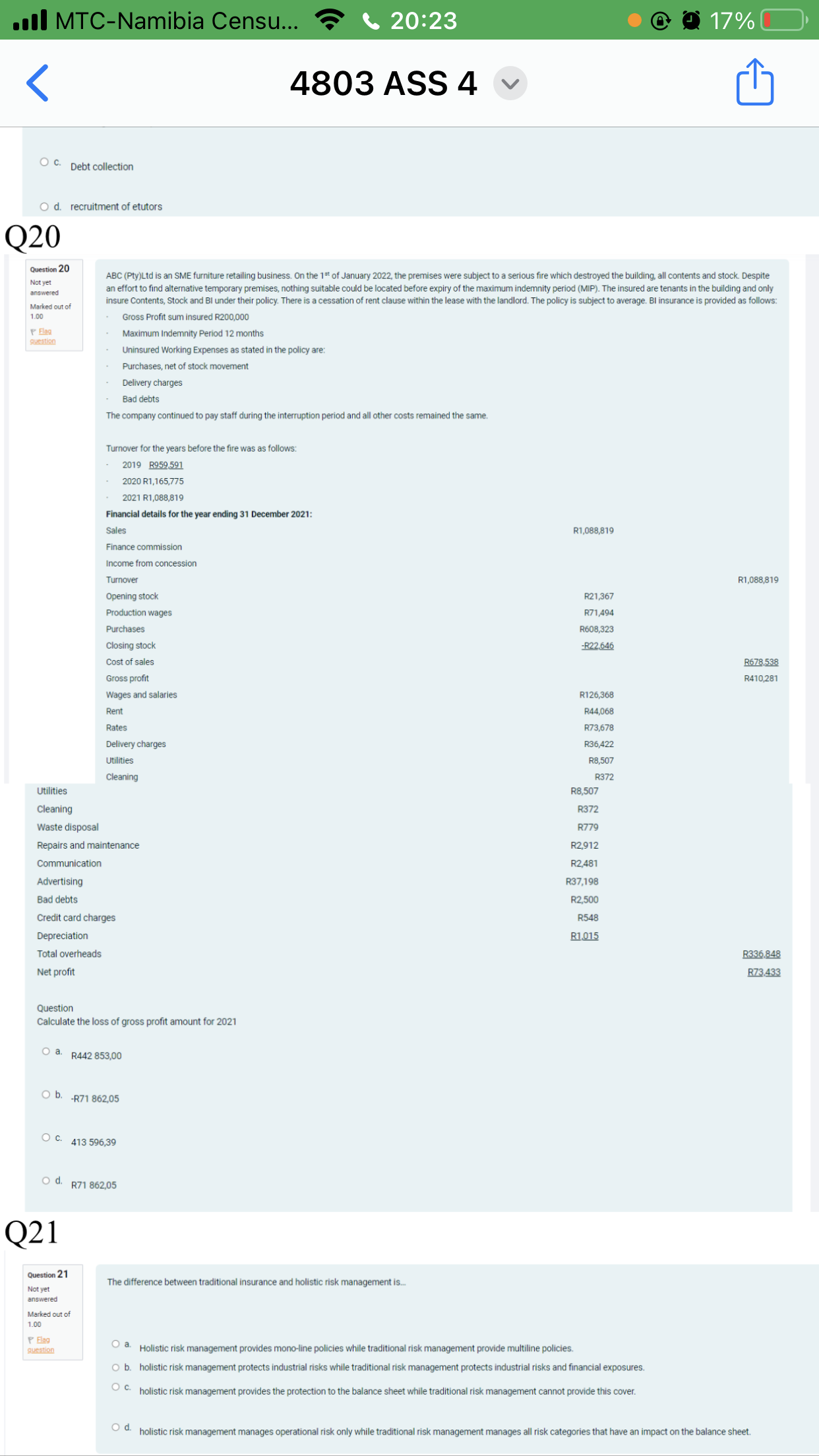

. Ill MTC-Namibia Censu... 20:23 4803 ASS 4 c. Debt collection d. recruitment of etutors 020 Question 20 Notyet answered Marked out of 1.00 P Elea guestion ABC (Pty) Ltd is an SME furniture retailing business. On the 1th of January 2022, the premises were subject to a serious fire which destroyed the building, all contents and stock. Despite an effort to find alternative temporary premises, nothing suitable could be located before expiry of the maximum indemnity period (MIP). The insured are tenants in the building and only insure Contents, Stock and BI under their policy. There is a cessation of rent clause within the lease with the landlord. The policy is subject to average. BI insurance is provided as follows: Gross Profit sum insured R200,000 Maximum Indemnity Period 12 months Uninsured Working Expenses as stated in the policy are: Purchases, net of stock movement Delivery charges Bad debts The company continued to pay staff during the interruption period and all other costs remained the same. Turnover for the years before the fire was as follows: 2019R959,591 2020R1,165,775 2021R1,088,819 Financial details for the year ending 31 December 2021: Sales Finance commission Income from concession Turnover Opening stock Production wages Purchases Closing stock Cost of sales Gross profit Wages and salaries Rent Rates Delivery charges Utilities Cleaning Utilities Cleaning Waste disposal Repairs and maintenance Communication Advertising Bad debts Credit card charges Depreciation Total overheads Net profit Question Calculate the loss of gross profit amount for 2021 O a. R442 853,00 O b. - R71 862,05 c. 413596,39 R1,088,819 R678,538 R410,281 R336,848 R73.433 O d. R71862,05 Q21 \begin{tabular}{|l|} \hline Question 21 \\ Not yet \\ answered \\ Marked out of \\ 1.00 \\ P Elag \\ guestion \\ \hline \end{tabular} The difference between traditional insurance and holistic risk management is... a. Holistic risk management provides mono-line policies while traditional risk management provide multiline policies. b. holistic risk management protects industrial risks while traditional risk management protects industrial risks and financial exposures. c. holistic risk management provides the protection to the balance sheet while traditional risk management cannot provide this cover. d. holistic risk management manages operational risk only while traditional risk management manages all risk categories that have an impact on the balance sheet. . Ill MTC-Namibia Censu... 20:23 4803 ASS 4 c. Debt collection d. recruitment of etutors 020 Question 20 Notyet answered Marked out of 1.00 P Elea guestion ABC (Pty) Ltd is an SME furniture retailing business. On the 1th of January 2022, the premises were subject to a serious fire which destroyed the building, all contents and stock. Despite an effort to find alternative temporary premises, nothing suitable could be located before expiry of the maximum indemnity period (MIP). The insured are tenants in the building and only insure Contents, Stock and BI under their policy. There is a cessation of rent clause within the lease with the landlord. The policy is subject to average. BI insurance is provided as follows: Gross Profit sum insured R200,000 Maximum Indemnity Period 12 months Uninsured Working Expenses as stated in the policy are: Purchases, net of stock movement Delivery charges Bad debts The company continued to pay staff during the interruption period and all other costs remained the same. Turnover for the years before the fire was as follows: 2019R959,591 2020R1,165,775 2021R1,088,819 Financial details for the year ending 31 December 2021: Sales Finance commission Income from concession Turnover Opening stock Production wages Purchases Closing stock Cost of sales Gross profit Wages and salaries Rent Rates Delivery charges Utilities Cleaning Utilities Cleaning Waste disposal Repairs and maintenance Communication Advertising Bad debts Credit card charges Depreciation Total overheads Net profit Question Calculate the loss of gross profit amount for 2021 O a. R442 853,00 O b. - R71 862,05 c. 413596,39 R1,088,819 R678,538 R410,281 R336,848 R73.433 O d. R71862,05 Q21 \begin{tabular}{|l|} \hline Question 21 \\ Not yet \\ answered \\ Marked out of \\ 1.00 \\ P Elag \\ guestion \\ \hline \end{tabular} The difference between traditional insurance and holistic risk management is... a. Holistic risk management provides mono-line policies while traditional risk management provide multiline policies. b. holistic risk management protects industrial risks while traditional risk management protects industrial risks and financial exposures. c. holistic risk management provides the protection to the balance sheet while traditional risk management cannot provide this cover. d. holistic risk management manages operational risk only while traditional risk management manages all risk categories that have an impact on the balance sheet

. Ill MTC-Namibia Censu... 20:23 4803 ASS 4 c. Debt collection d. recruitment of etutors 020 Question 20 Notyet answered Marked out of 1.00 P Elea guestion ABC (Pty) Ltd is an SME furniture retailing business. On the 1th of January 2022, the premises were subject to a serious fire which destroyed the building, all contents and stock. Despite an effort to find alternative temporary premises, nothing suitable could be located before expiry of the maximum indemnity period (MIP). The insured are tenants in the building and only insure Contents, Stock and BI under their policy. There is a cessation of rent clause within the lease with the landlord. The policy is subject to average. BI insurance is provided as follows: Gross Profit sum insured R200,000 Maximum Indemnity Period 12 months Uninsured Working Expenses as stated in the policy are: Purchases, net of stock movement Delivery charges Bad debts The company continued to pay staff during the interruption period and all other costs remained the same. Turnover for the years before the fire was as follows: 2019R959,591 2020R1,165,775 2021R1,088,819 Financial details for the year ending 31 December 2021: Sales Finance commission Income from concession Turnover Opening stock Production wages Purchases Closing stock Cost of sales Gross profit Wages and salaries Rent Rates Delivery charges Utilities Cleaning Utilities Cleaning Waste disposal Repairs and maintenance Communication Advertising Bad debts Credit card charges Depreciation Total overheads Net profit Question Calculate the loss of gross profit amount for 2021 O a. R442 853,00 O b. - R71 862,05 c. 413596,39 R1,088,819 R678,538 R410,281 R336,848 R73.433 O d. R71862,05 Q21 \begin{tabular}{|l|} \hline Question 21 \\ Not yet \\ answered \\ Marked out of \\ 1.00 \\ P Elag \\ guestion \\ \hline \end{tabular} The difference between traditional insurance and holistic risk management is... a. Holistic risk management provides mono-line policies while traditional risk management provide multiline policies. b. holistic risk management protects industrial risks while traditional risk management protects industrial risks and financial exposures. c. holistic risk management provides the protection to the balance sheet while traditional risk management cannot provide this cover. d. holistic risk management manages operational risk only while traditional risk management manages all risk categories that have an impact on the balance sheet. . Ill MTC-Namibia Censu... 20:23 4803 ASS 4 c. Debt collection d. recruitment of etutors 020 Question 20 Notyet answered Marked out of 1.00 P Elea guestion ABC (Pty) Ltd is an SME furniture retailing business. On the 1th of January 2022, the premises were subject to a serious fire which destroyed the building, all contents and stock. Despite an effort to find alternative temporary premises, nothing suitable could be located before expiry of the maximum indemnity period (MIP). The insured are tenants in the building and only insure Contents, Stock and BI under their policy. There is a cessation of rent clause within the lease with the landlord. The policy is subject to average. BI insurance is provided as follows: Gross Profit sum insured R200,000 Maximum Indemnity Period 12 months Uninsured Working Expenses as stated in the policy are: Purchases, net of stock movement Delivery charges Bad debts The company continued to pay staff during the interruption period and all other costs remained the same. Turnover for the years before the fire was as follows: 2019R959,591 2020R1,165,775 2021R1,088,819 Financial details for the year ending 31 December 2021: Sales Finance commission Income from concession Turnover Opening stock Production wages Purchases Closing stock Cost of sales Gross profit Wages and salaries Rent Rates Delivery charges Utilities Cleaning Utilities Cleaning Waste disposal Repairs and maintenance Communication Advertising Bad debts Credit card charges Depreciation Total overheads Net profit Question Calculate the loss of gross profit amount for 2021 O a. R442 853,00 O b. - R71 862,05 c. 413596,39 R1,088,819 R678,538 R410,281 R336,848 R73.433 O d. R71862,05 Q21 \begin{tabular}{|l|} \hline Question 21 \\ Not yet \\ answered \\ Marked out of \\ 1.00 \\ P Elag \\ guestion \\ \hline \end{tabular} The difference between traditional insurance and holistic risk management is... a. Holistic risk management provides mono-line policies while traditional risk management provide multiline policies. b. holistic risk management protects industrial risks while traditional risk management protects industrial risks and financial exposures. c. holistic risk management provides the protection to the balance sheet while traditional risk management cannot provide this cover. d. holistic risk management manages operational risk only while traditional risk management manages all risk categories that have an impact on the balance sheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started