Answered step by step

Verified Expert Solution

Question

1 Approved Answer

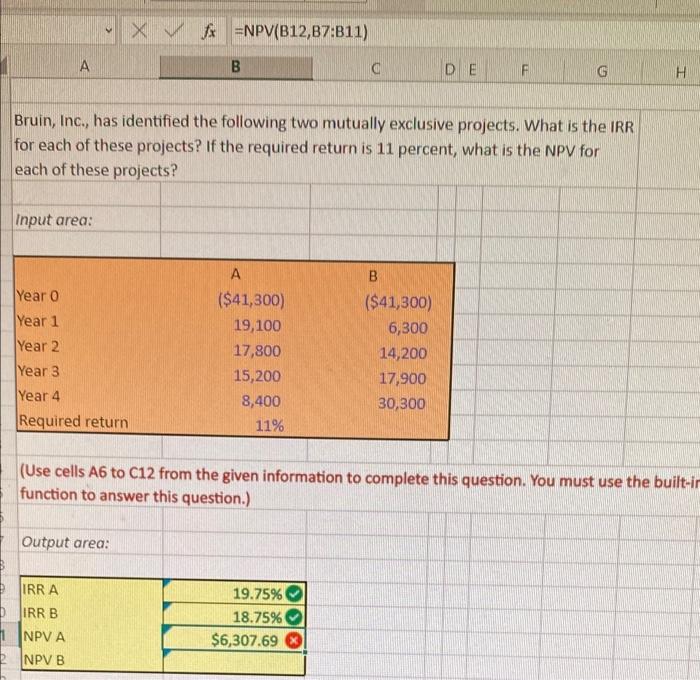

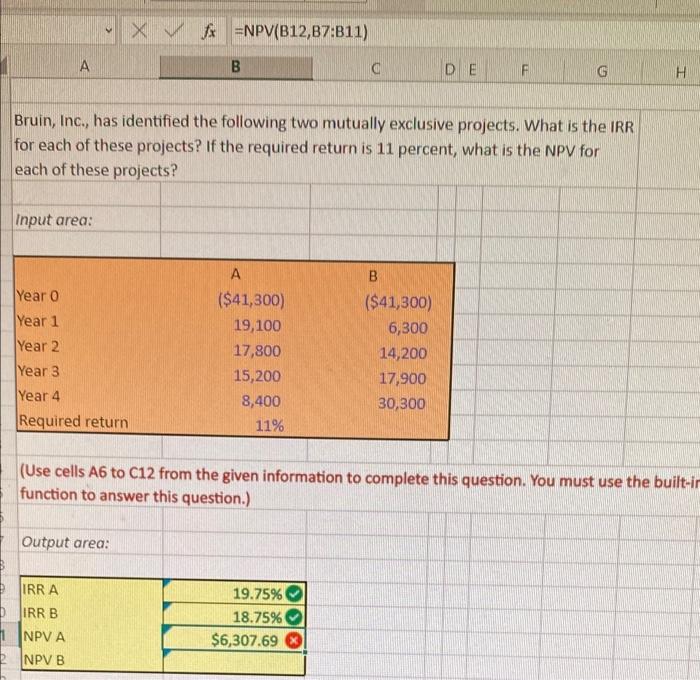

im not sure what im doing wrong for the NPV. can someone help Xfx=NPV(B12,87:B11) A B C DE F G H Bruin, Inc., has identified

im not sure what im doing wrong for the NPV. can someone help

Xfx=NPV(B12,87:B11) A B C DE F G H Bruin, Inc., has identified the following two mutually exclusive projects. What is the IRR for each of these projects? If the required return is 11 percent, what is the NPV for each of these projects? Input area: A B Year 0 ($41,300) ($41,300) Year 1 19,100 6,300 Year 2 17,800 14,200 Year 3 15,200 17,900 Year 4 8,400 30,300 Required return 11% (Use cells A6 to C12 from the given information to complete this question. You must use the built-in function to answer this question.) Output area: IRR A 19.75% IRR B 18.75% 1NPV A $6,307.69 2 NPV B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started