Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I'm practice this for my suplementary exam I like to compare if my answer are correct. Question 5 Total 22 marks Waterhouse Ltd commenced business

I'm practice this for my suplementary exam

I like to compare if my answer are correct.

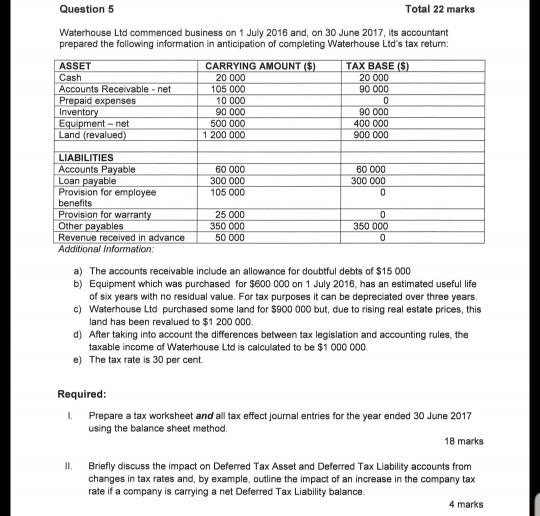

Question 5 Total 22 marks Waterhouse Ltd commenced business on 1 July 2016 and, on 30 June 2017, its accountant prepared the following information in anticipation of completing Waterhouse Ltd's tax return: ASSET CARRYING AMOUNT ($) TAX BASE (S) 20 000 90 000 0 Cash 20 000 Accounts Receivable - net Prepaid expenses Inventory Equipment-net Land (revalued) 105 000 10 000 90 000 500 000 1 200 000 90 000 400 000 900 000 LIABILITIES Accounts Payable Loan payable Provision for employee benefits Provision for warranty Other payables 60 000 60 000 300 000 300 000 0 105 000 25 000 350 000 50 000 0 350 000 Revenue received in advance 0 Additional Information: a) The accounts receivable include an allowance for doubtful debts of $15 000 b) Equipment which was purchased for $600 000 on 1 July 2016, has an estimated useful life of six years with no residual value. For tax purposes it can be depreciated over three years. c) Waterhouse Ltd purchased some land for $900 000 but, due to rising real estate prices, this land has been revalued to $1 200 000. d) After taking into account the differences between tax legislation and accounting rules, the taxable income of Waterhouse Ltd is calculated to be $1 000 000. e) The tax rate is 30 per cent. Required: Prepare a tax worksheet and all tax effect journal entries for the year ended 30 June 2017 using the balance sheet method. 18 marks Briefly discuss the impact on Deferred Tax Asset and Deferred Tax Liability accounts from changes in tax rates and, by example, outline the impact of an increase in the company tax rate if a company is carrying a net Deferred Tax Liability balance. 4 marks Question 5 Total 22 marks Waterhouse Ltd commenced business on 1 July 2016 and, on 30 June 2017, its accountant prepared the following information in anticipation of completing Waterhouse Ltd's tax return: ASSET CARRYING AMOUNT ($) TAX BASE (S) 20 000 90 000 0 Cash 20 000 Accounts Receivable - net Prepaid expenses Inventory Equipment-net Land (revalued) 105 000 10 000 90 000 500 000 1 200 000 90 000 400 000 900 000 LIABILITIES Accounts Payable Loan payable Provision for employee benefits Provision for warranty Other payables 60 000 60 000 300 000 300 000 0 105 000 25 000 350 000 50 000 0 350 000 Revenue received in advance 0 Additional Information: a) The accounts receivable include an allowance for doubtful debts of $15 000 b) Equipment which was purchased for $600 000 on 1 July 2016, has an estimated useful life of six years with no residual value. For tax purposes it can be depreciated over three years. c) Waterhouse Ltd purchased some land for $900 000 but, due to rising real estate prices, this land has been revalued to $1 200 000. d) After taking into account the differences between tax legislation and accounting rules, the taxable income of Waterhouse Ltd is calculated to be $1 000 000. e) The tax rate is 30 per cent. Required: Prepare a tax worksheet and all tax effect journal entries for the year ended 30 June 2017 using the balance sheet method. 18 marks Briefly discuss the impact on Deferred Tax Asset and Deferred Tax Liability accounts from changes in tax rates and, by example, outline the impact of an increase in the company tax rate if a company is carrying a net Deferred Tax Liability balance. 4 marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started