Answered step by step

Verified Expert Solution

Question

1 Approved Answer

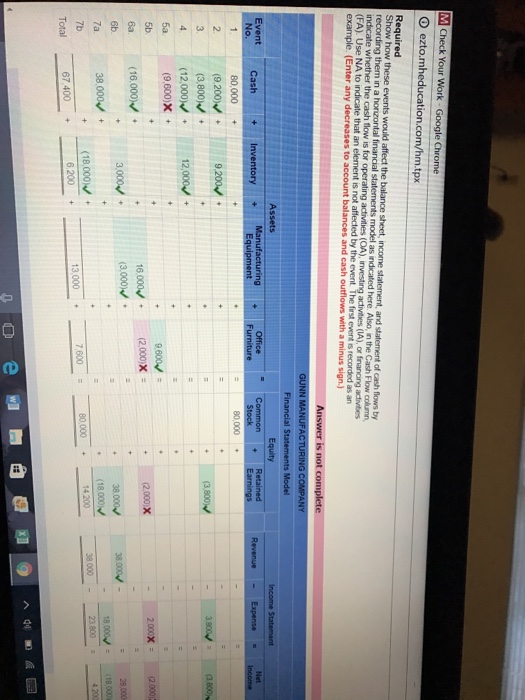

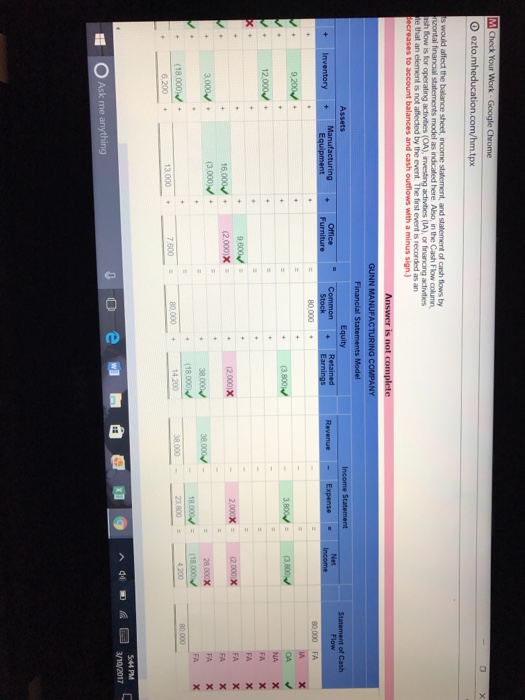

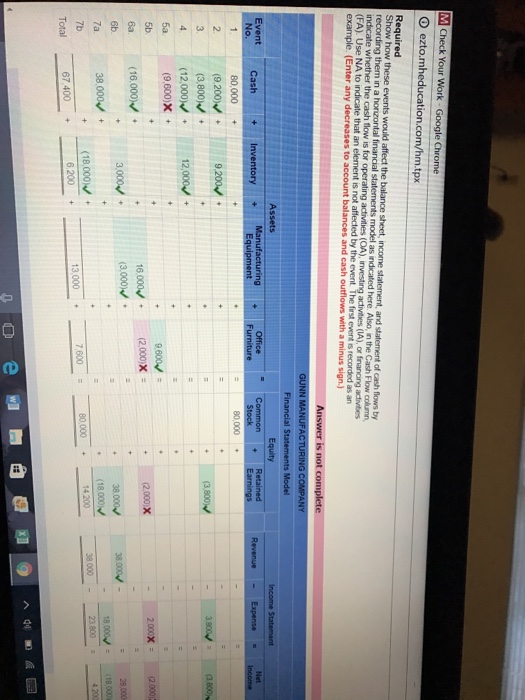

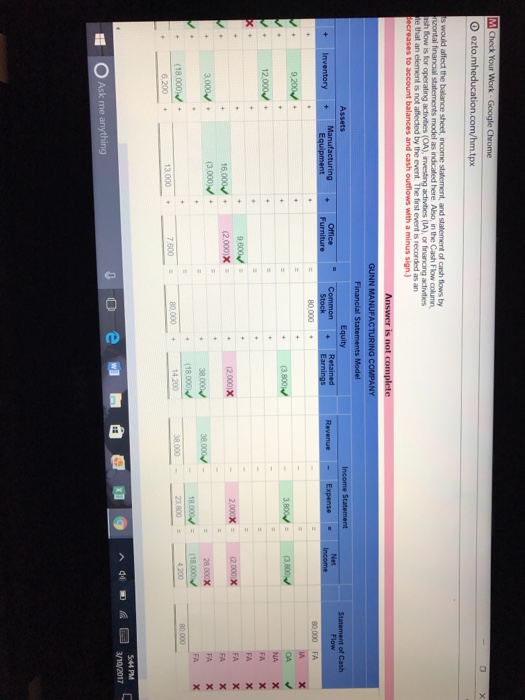

I'm sending the problem. Then a picture of what I got wrong. Please help and explain how you got the correct answer. Gunn Manufacturing Company

I'm sending the problem. Then a picture of what I got wrong. Please help and explain how you got the correct answer.

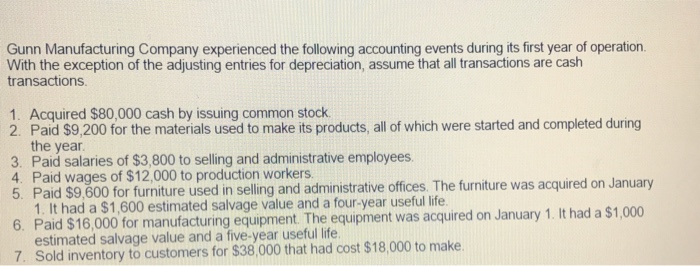

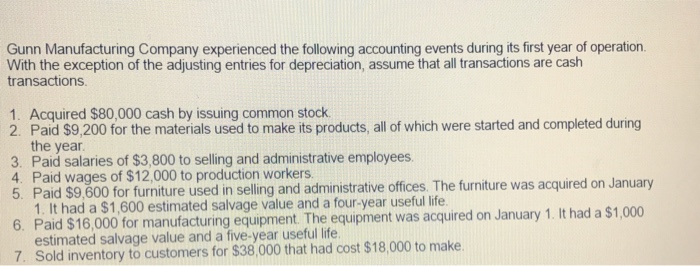

Gunn Manufacturing Company experienced the following accounting events during its first year of operation. With the exception of the adjusting entries for depreciation, assume that all transactions are cash transactions. 1. Acquired $80,000 cash by issuing common stock. 2. Paid $9,200 for the materials used to make its products, all of which were started and completed during the year 3. Paid salaries of $3,800 to selling and administrative employees. 4. Paid wages of $12,000 to production workers. offices. The furniture was acquired on January 5. Paid 9,600 for furniture used in selling and administrative useful 6. had a salvage value and acquired 1. It had a $1,000 Paid $16,000 for manufacturing equipment The equipment was on January estimated salvage value and a five-year useful life $18,000 to make. 7. Sold inventory to customers for $38,000 that had cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started