Answered step by step

Verified Expert Solution

Question

1 Approved Answer

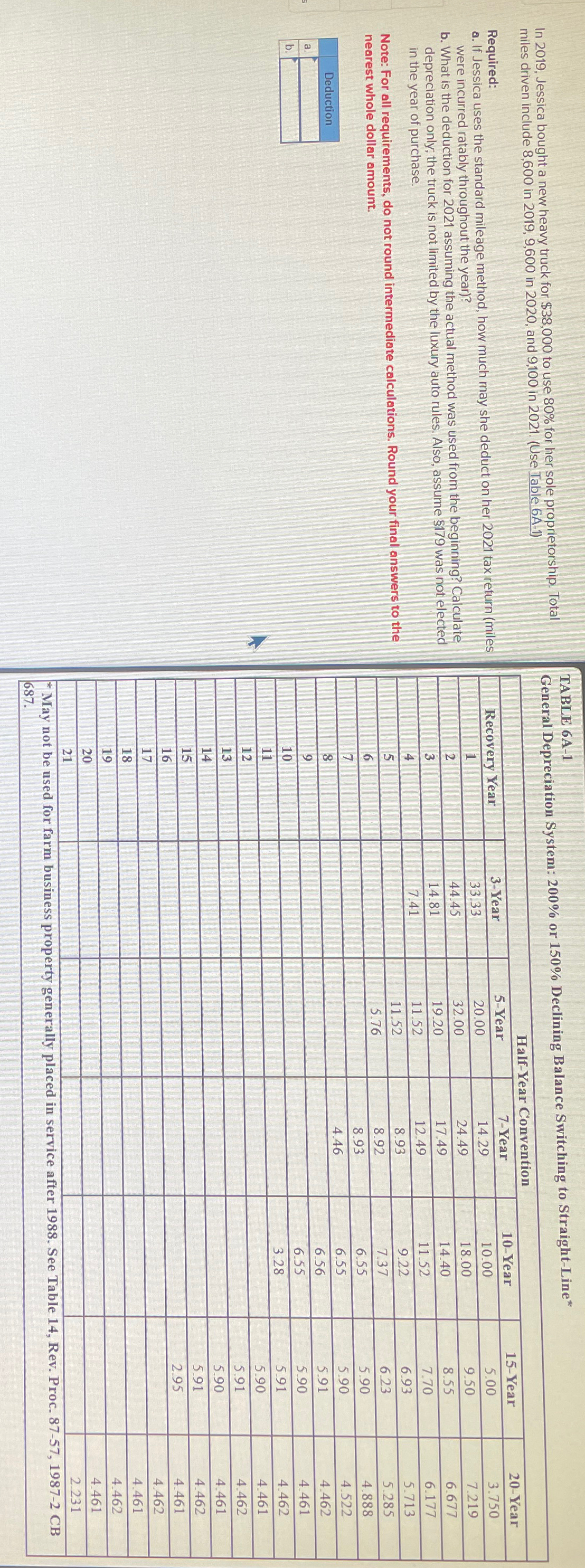

In 2 0 1 9 Jessica bought a new heavy truck for $ 3 8 , 0 0 0 to use 8 0 % for

In Jessica bought a new heavy truck for $ to use for her sole proprietorship. Total miles driven include in in and in Use Table A

Required:

a If Jessica uses the standard mileage method, how much may she deduct on her tax return miles were incurred ratably throughout the year

b What is the deduction for assuming the actual method was used from the beginning? Calculate depreciation only, the truck is not limited by the luxury auto rules. Also, assume $ was not elected in the year of purchase.

Note: For all requirements, do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.

Deduction

a

b

TABLE A

General Depreciation System: or Declining Balance Switching to StraightLine

tableConvent,,, VearRecovery Year,Year,Year,Year,Year,Year,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started