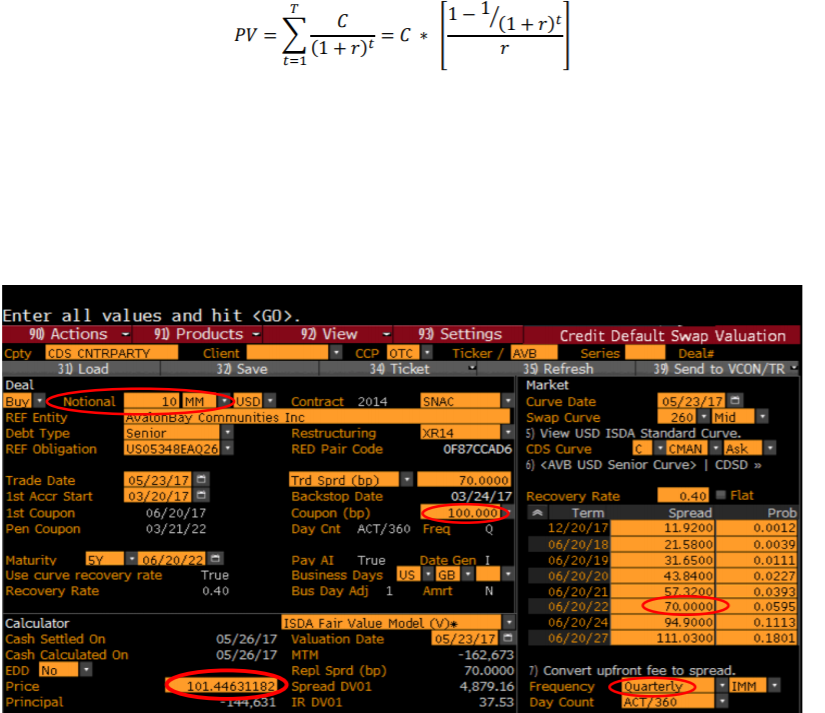

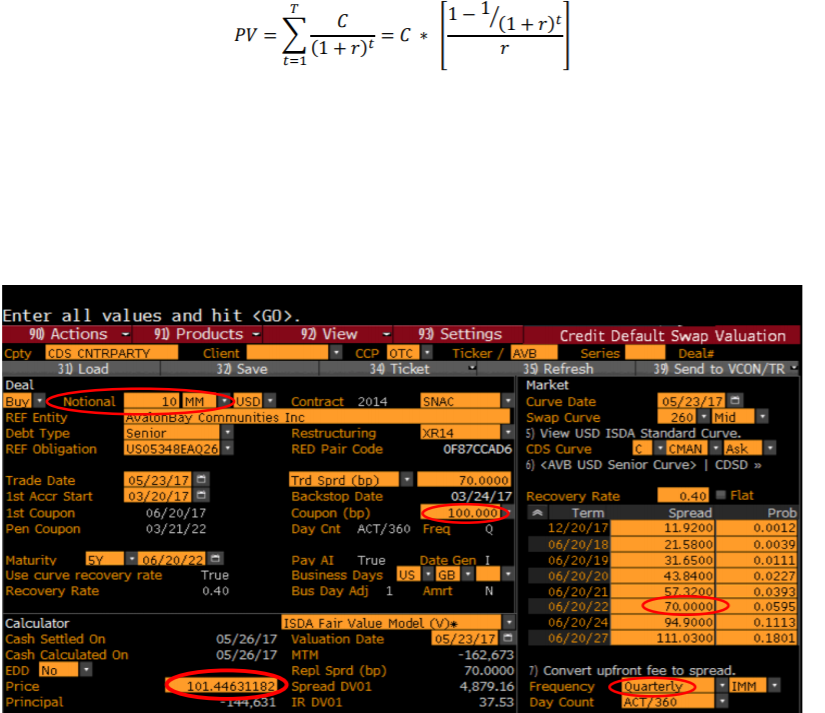

In 2017, you purchased a 5-year 100 bp semi-annual coupon bond from AvalonBay Communities Inc at the price of 101.4463 which YTM = 35.742 bp. At that time, you also purchased CDS on that bond whose premium was 70 bp (APR) of the bonds principal (quarterly settlement, annuity due). Calculate the market value of default risk on AvalonBays bond when you purchased the CDS. It is the amount of money the market is willing to pay to remove any default risk. (Assume that there is no default in your calculation. Use the YTM as your discount rate. You may use the following annuity formula)

(1+rt * Enfo - 100 PV = C * tsy (1+r) Enter all values and hit

90 Actions - 91 Products - 92 View - 93) Settings Credit Default Swap Valuation Cpty CDS CNTRPARTY Client : Ticker / AVB Series Deal: 31 Load 32 Save 34 Ticket 35 Refresh 39 Send to VCON/TR Deal Market Buy Notional 10 MM - USD Contract 2014 SNAC Curve Date 05/23/17 - REF Entity Avalombay Communities Inc Swap Curve 260 Mid Debt Type Senior Restructuring XR14 5) View USD ISDA Standard Curve. REF Obligation US05348EA026 RED Pair Code OF87CCAD6 CDS Curve C CMAN. Ask 6) CAVB USD Senior Curve) | CDSD >> Trade Date 05/23/17 - Trd Sprd (b) 70.0000 1st Accr Start 03/20/170 Backstop Date 03/24/17 Recovery Rate 0.40 Flat 1st Coupon 06/20/17 Coupon (bp) 100.000 Term Spread Prob Pen Coupon 03/21/22 Day Cnt ACT/360 Freq 12/20/17 11.9200 0.0012 06/20/18 21.5800 0.0039 Maturity Sy . 06/20/22 - Pay AI True Date Gen I 06/20/19 31.6500 0.0111 Use curve recovery rate True Business Days US. GB 06/20/20 43.84001 0.0227 Recovery Rate 0.40 Bus Day Adji Amrt N 06/20/21 57 3200 0.0393 06/20/22 70.0000D 0.0595 Calculator ISDA Fair Value Model V* 06/20/24 94.9000 0.1113 Cash Settled On 05/26/17 Valuation Date 05/23/17 O 06/20/27 111.03001 0.1801 Cash Calculated On 05/26/17 MTM -162,673 EDD No Repl Sprd (bp) 70.0000 7) Convert upfront fee to spread. Price 101.44631182 Spread DVO1 4,879.16 Frequency Quarterly IMM Principal -144,031 IR DVO1 37.53 Day Count ACT360 (1+rt * Enfo - 100 PV = C * tsy (1+r) Enter all values and hit 90 Actions - 91 Products - 92 View - 93) Settings Credit Default Swap Valuation Cpty CDS CNTRPARTY Client : Ticker / AVB Series Deal: 31 Load 32 Save 34 Ticket 35 Refresh 39 Send to VCON/TR Deal Market Buy Notional 10 MM - USD Contract 2014 SNAC Curve Date 05/23/17 - REF Entity Avalombay Communities Inc Swap Curve 260 Mid Debt Type Senior Restructuring XR14 5) View USD ISDA Standard Curve. REF Obligation US05348EA026 RED Pair Code OF87CCAD6 CDS Curve C CMAN. Ask 6) CAVB USD Senior Curve) | CDSD >> Trade Date 05/23/17 - Trd Sprd (b) 70.0000 1st Accr Start 03/20/170 Backstop Date 03/24/17 Recovery Rate 0.40 Flat 1st Coupon 06/20/17 Coupon (bp) 100.000 Term Spread Prob Pen Coupon 03/21/22 Day Cnt ACT/360 Freq 12/20/17 11.9200 0.0012 06/20/18 21.5800 0.0039 Maturity Sy . 06/20/22 - Pay AI True Date Gen I 06/20/19 31.6500 0.0111 Use curve recovery rate True Business Days US. GB 06/20/20 43.84001 0.0227 Recovery Rate 0.40 Bus Day Adji Amrt N 06/20/21 57 3200 0.0393 06/20/22 70.0000D 0.0595 Calculator ISDA Fair Value Model V* 06/20/24 94.9000 0.1113 Cash Settled On 05/26/17 Valuation Date 05/23/17 O 06/20/27 111.03001 0.1801 Cash Calculated On 05/26/17 MTM -162,673 EDD No Repl Sprd (bp) 70.0000 7) Convert upfront fee to spread. Price 101.44631182 Spread DVO1 4,879.16 Frequency Quarterly IMM Principal -144,031 IR DVO1 37.53 Day Count ACT360